Dollar is reversing much of yesterday’s gain as both headline and core PCE price indexes showed more than expected moderation. Meanwhile, Yen is also reversing earlier gains around BoJ policy decisions. On the other hand, European majors are making a notable comeback, with Sterling outperforming Euro and Swiss Franc. Commodity currencies however, are staying as the worst performers, except that Loonie is just mixed.

In Europe, at the time of writing, FTSE is up 0.14%. DAX is up 0.22%. CAC is up 0.01%. Germany 10-year yield is flat at 2.473. Earlier in Asia, Nikkei dropped -0.40%. Hong Kong HSI rose 1.41%. China Shanghai SSE rose 1.84%. Singapore Strait Times rose 1.01%. Japan 10-year JGB yield rose 0.1094 to 0.550.

US PCE slows to 3.0% yoy, core PCE down to 4.1% yoy, below expectations

US personal income rose 0.3% mom or USD 69.5B in June, below expectation of 0.5% mom. Spending rose 0.5% mom or USD 100.4B, above expectation of 0.4% mom.

PCE price index rose 0.2% mom, above expectation of -0.1% mom. Core PCE price index (excluding food and energy) also rose 0.2% mom, matched expectations. Prices for goods decreased -0.1% mom and prices for services increased 0.3% mom. Food prices decreased -0.1% mom and energy prices increased 0.6% mom.

From the same month one year ago, PCE price index slowed from 3.8% yoy to 3.0% yoy, below expectation of 3.1% yoy. Core PCE price index slowed from 4.6% yoy to 4.1% yoy, below expectation of 4.2% yoy. Goods prices were down -0.6% yoy while services prices were up 4.9% yoy. Food prices increased 4.6% yoy and energy prices decreased -18.9% yoy.

Canada GDP grew 0.3% mom in May, but down -0.2% mom in Jun

Canada GDP grew 0.3% mom in May, matched expectations. Services-producing industries were up 0.5%, while goods-producing industries partially offset the increase with -0.3% decline. Overall, 12 of 20 industrial sectors posted increases.

Advance information indicates that GDP decreased -0.2% mom in June. The decrease was driven by the wholesale trade and manufacturing sectors. These decreases were partially offset by increases in oil and gas extraction as well as in the real estate and rental and leasing sector.

ECB policymakers weigh in on rates

Several top ECB policymakers have today voiced their thoughts on the future of the bank’s interest rate hikes, highlighting a variety of perspectives.

Yannis Stournaras, Chief of Greek Central Bank, hinted towards the nearing end of interest rate increases, stating, “It looks like we are very close to the end of interest rate rises.” While he doesn’t completely rule out another possible hike in September, he noted, “if there is one further – I see it difficult – in September, I believe we will stop there.”

However, Slovakia’s Central Bank Head Peter Kazimir suggested a less definitive stance, indicating a pause rather than an outright end to the cycle of rate increases. “Even if we were to take a break in September, it would be premature to consider it automatically…the end of the cycle,” Kazimir opined, further adding, “We are looking for the right place to stay for a large part of next year…And you will recognize that it has to be a place where we all must like it a little.”

Adding a nuanced perspective to the discourse, Francois Villeroy de Galhau, head of French Central Bank, expressed the ECB’s growing confidence that it will achieve its 2% inflation target by 2025, attributing this confidence to the effective transmission of rate hikes to the broader economy.

Villeroy emphasized the need for continued perseverance and pragmatism, stating, “Given the time needed for this full transmission, perseverance is now the prime key virtue. Pragmatism is second – decisions at our next meetings will be open and entirely data driven.”

French GDP grew strongly by 0.5% qoq, bolstered by foreign trade

France’s GDP surpassed expectations in Q2, growing by 0.5% qoq, significantly better than anticipated 0.1% qoq growth. French economy managed to outperform due to robust rebound in foreign trade activities.

According to the data, the main driver of this better-than-expected performance was the positive contribution from foreign trade, which added 0.7 points to GDP growth. Exports in particular saw a rebound this quarter, rising 2.6% after -0.8% contraction in the previous period. Meanwhile, imports also saw an increase, though less pronounced, rising by 0.4% after falling -2.0% in the prior period.

On the other hand, final domestic demand, excluding inventories, weighed on GDP growth once again, contributing a negative -0.1%, consistent with the previous quarter. This is largely attributed to a decrease in household consumption, which dropped by -0.4%. However, Gross Fixed Capital Formation (GFCF) noted a slight increase of 0.1%.

Contribution of inventory changes to GDP growth was minimally negative in Q2, at -0.1%.

Swiss KOF rose slightly to 92.2, economic environment remains difficult

Swiss KOF Economic Barometer rose from 90.7 to 92.2 in July, above expectation of 90.0. KOF said: “The economic environment remains difficult for the Swiss economy.”

It added: “All indicator bundles except those for consumption continue to point to a rather below-average development, but they moved in different directions in July.

“The outlook for services, financial and insurance services as well as for foreign demand and domestic consumption has brightened somewhat. On the other hand, the outlook for construction activity and for manufacturing, whose outlook is particularly gloomy, have clouded over.”

BoJ imposes minor tweak in YCC

On the surface, BoJ kept monetary policy unchanged today. Short term policy rate is held at -0.10% and 10-year JGB yield target is kept at around 0%, by unanimous vote. The band for 10-year JGB yield fluctuation is also kept at plus and minus 0.50% from the target level, by 8-1 majority vote.

However, there were key alterations including decision to buy 10-year JGB yields at 1% in fixed-rate operations, up from previous rate of 0.5%, caught investors’ attention. Additionally, BoJ’s pledge to conduct yield curve control with “greater flexibility” and to “nimbly respond” to both upside and downside risks was noted.

At the post-meeting press conference, BoJ Governor Kazuo Ueda explained the details of the changes. “We will not tolerate an increase in the 10-year bond yield above 1% and will step in if it does,” Ueda emphasized.

While yield moves between 0.5% and 1%, BoJ will monitor the yield level, pace of change, and speed, and conduct various market operations to counter any excessive upward pressure on long-term interest rates. He added, “We don’t expect the yield to move up to 1%, but have set this cap as a pre-emptive measure.”

In the new economic forecasts, BoJ upgraded CPI core and CPI core-core forecasts for fiscal 2023, but other projections are kept largely unchanged.

- Real GDP growth at 1.3% in fiscal 2023, downgraded from 1.4% as made in April.

- Real GDP growth at 1.2% in fiscal 2024, unchanged.

- Real GDP growth at 1.0% in fiscal 2025, unchanged.

- CPI core at 2.5% in fiscal 2023, upgraded from 1.8%.

- CPI core at 1.9% in fiscal 2024, downgraded from 2.0%.

- CPI core at 1.6% in fiscal 2025, unchanged.

- CPI core-core at 3.2% in fiscal 2023, upgrade from 2.5%.

- CPI core-core at 1.7% in fiscal 2024, unchanged.

- CPI core-core at 1.8% in fiscal 2025, unchanged.

Australia retail sales down -0.8% mom in Jun, cost-of-living pressures weigh

Australia retail sales turnover fell -0.8% mom in June, much worse than expectation of 0% mom. Sales turnover rose 2.3% yoy compared with June 2022.

Ben Dorber, ABS head of retail statistics, said: “Retail turnover fell sharply in June due to weaker than usual spending on end of financial year sales. This comes as cost-of-living pressures continued to weigh on consumer spending.

“There was extra discounting and promotional activity in May, leading up to mid-year sales events. This delivered a boost in turnover for retailers, but that proved to be temporary as consumers pulled back on spending in June.”

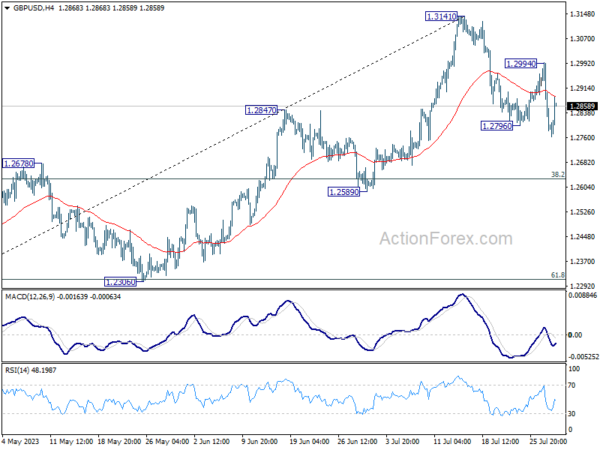

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2720; (P) 1.2858; (R1) 1.2934; More…

GBP/USD recovers notably after dipping to 1.2761 earlier today. But for now, further decline is in favor as long as 1.2994 resistance holds. Fall from 1.3141 would target 55 D EMA (now at 1.2718) and possibly below. On the upside, break of 1.2994 resistance will argue that the pull back has completed, and bring retest of 1.3141 high.

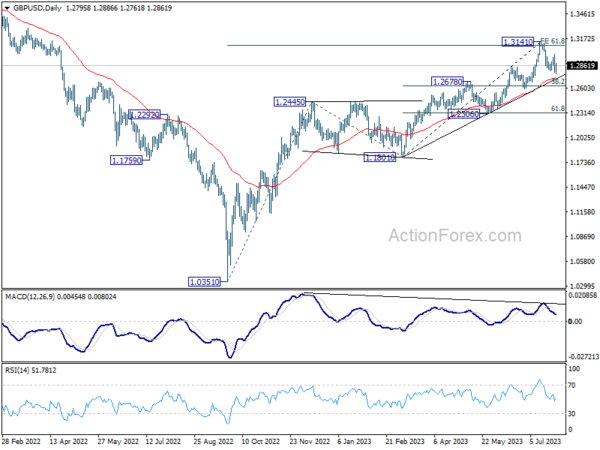

In the bigger picture, as long as 1.2678 resistance turned support holds, rise from 1.0351 (2022 low) is expected to continue. Next target is 100% projection of 1.0351 to 1.2445 from 1.1801 at 1.3895. However, sustained break of 1.2678 will argue that it’s at least correcting this rally, with risk of bearish reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jul | 3.20% | 2.80% | 3.10% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Jul | 3.00% | 2.90% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Jul | 4.00% | 3.80% | ||

| 01:30 | AUD | Retail Sales M/M Jun | -0.80% | 0.00% | 0.70% | 0.80% |

| 01:30 | AUD | PPI Q/Q Q1 | 0.50% | 0.90% | 1.00% | |

| 01:30 | AUD | PPI Y/Y Q1 | 3.90% | 3.90% | 5.20% | |

| 03:28 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:30 | EUR | France GDP Q/Q Q2 | 0.50% | 0.10% | 0.20% | 0.10% |

| 07:00 | CHF | KOF Economic Barometer Jul | 92.2 | 90 | 90.8 | 90.7 |

| 09:00 | EUR | Germany GDP Q/Q Q2 | 0.00% | 0.10% | -0.30% | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jul | 94.5 | 95 | 95.3 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jul | -9.4 | -7.5 | -7.2 | -7.3 |

| 09:00 | EUR | Eurozone Services Sentiment Jul | 5.7 | 5.3 | 5.7 | 5.9 |

| 09:00 | EUR | Eurozone Consumer Confidence Jul F | -15.1 | -15.1 | -15.1 | |

| 12:00 | EUR | Germany CPI M/M Jul P | 0.30% | 0.30% | 0.30% | |

| 12:00 | EUR | Germany CPI Y/Y Jul P | 6.20% | 6.20% | 6.40% | |

| 12:30 | CAD | GDP M/M May | 0.30% | 0.30% | 0.00% | 0.10% |

| 12:30 | USD | Personal Income M/M Jun | 0.30% | 0.50% | 0.40% | 0.50% |

| 12:30 | USD | Personal Spending M/M Jun | 0.50% | 0.40% | 0.10% | 0.20% |

| 12:30 | USD | PCE Price Index M/M Jun | 0.20% | -0.10% | 0.10% | |

| 12:30 | USD | PCE Price Index Y/Y Jun | 3.00% | 3.10% | 3.80% | |

| 12:30 | USD | Core PCE Price Index M/M Jun | 0.20% | 0.20% | 0.30% | |

| 12:30 | USD | Core PCE Price Index Y/Y Jun | 4.10% | 4.20% | 4.60% | |

| 12:30 | USD | Employment Cost Index Q1 | 1.00% | 1.10% | 1.20% | |

| 13:45 | USD | Chicago PMI Jul | 72.6 | 41.5 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul F | 72.6 | 72.6 |