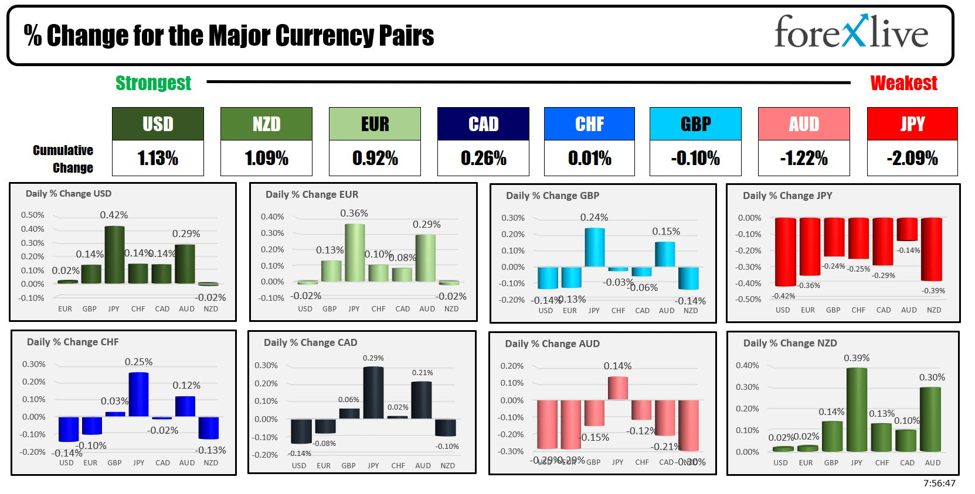

As the North American session begins, the USD is the strongest and the JPY is the weakest. Having said that the pairs are fairly scrunched together with the USD, CAD and EUR fighting for the strongest. The JPY is the most weakest followed by the AUD which is lower after their interest rate decision as the decision was thought to be somewhat less hawkish then expectations.

The Reserve Bank of Australia (RBA) maintained the cash rate at 4.35% for May 2024, a move that was expected. In the statement, the RBA said that despite inflation showing signs of moderation, it is decreasing at a slower pace than expected. The RBA highlighted several uncertainties affecting the economic outlook, including persistent services inflation and weak household consumption growth. Additionally, uncertainties in the global economic environment continue to pose challenges. The RBA emphasized that the journey to bringing inflation back within the target range would be complex and extended, asserting a vigilant stance towards potential upside risks to inflation. They also remained non-committal about future monetary policy decisions.

In her press conference following the decision , RBA’s Michelle Bullock stated that the current interest rates are appropriately set to bring inflation back to the target level, although she acknowledged that recent economic data has been variable. Bullock emphasized the importance of a long-term perspective and the need for vigilance regarding inflation risks. She mentioned that while an additional tightening of rates might not be necessary, it cannot be entirely ruled out if required by future economic conditions. Bullock affirmed that the current policy stance is to maintain rates and closely monitor the economic developments. She noted that there had been discussions about possibly raising rates, particularly if inflation’s decline is significantly delayed, but clarified that this is not the expected scenario at present. The market’s current pricing is seen as relatively balanced, but she highlighted the importance of remaining alert, as the costs of higher inflation would outweigh those of lower inflation.

In Japan, BoJ Governor Ueda had a routine discussion with Japanese Prime Minister Kishida, focusing on foreign exchange issues and the broader economic impacts. During their conversation, Ueda confirmed that the Bank of Japan (BoJ) would consider the significant potential impacts of economic fluctuations and price changes in their policy decisions. He emphasized the central bank’s readiness to closely monitor the effects of the Japanese Yen’s movements on trend inflation and outlined the BoJ’s commitment to guide its monetary policy from the perspective of sustainably achieving the inflation goal.

Meanwhile in the EU, ECBs de Cos reiterated that rates can be cut from June if the price path holds and that the ECB is dependent and cannot commit to a specific rate path. Nothing new there.

The BOE will be the next central bank to meet, and will announce their rate decision on Thursday at 7 AM ET.

This morning, earnings from Disney and others were reported. Disney beat on EPS but was shy of expectations on revenues. Disney shares are trading down -5.3% in pre-market trading. US stocks are mixed with Dow up modestly. S&P near unchanged and the Nasdaq down modestly. Below are a list of some of the releases this morning.

-

TransDigm Group Inc (TDG):

- EPS: $7.99 (expected $7.42) – BEAT

- Revenue: $1.92 billion (expected $1.88 billion) – BEAT

-

GlobalFoundries (GFS):

- EPS: $0.31 (expected $0.23) – BEAT

- Revenue: $1.549 billion (expected $1.52 billion) – BEAT

-

Kenvue Inc (KVUE):

- EPS: $0.28 (expected $0.26) – BEAT

- Revenue: $3.89 billion (expected $3.79 billion) – BEAT

-

Ferrari (RACE IM):

- Revenue: €1.59 billion (expected €1.57 billion) – BEAT

- Adj. EBITDA: €605 million (expected €605 million) – MET

- Adj. Net Income: €352 million (expected €342 million) – BEAT

-

Walt Disney Co (DIS):

- EPS: $1.21 (expected $1.10) – BEAT

- Revenue: $22.08 billion (expected $22.11 billion) – MISSED

-

Duke Energy Corp (DUK):

- EPS: $1.44 (expected $1.38) – BEAT

- Revenue: $7.67 billion (expected $7.24 billion) – BEAT

There are no major US economic data scheduled to be released today. The Ivey PMI index in Canada will be released at 10 AM. Last month the index came in at 57.5 seasonally adjusted.

A snapshot of the other markets as the North American session begins currently shows.:

- Crude oil is trading down $0.20 or -0.25% at $78.28. At this time yesterday, the price was at $79.02.

- Gold is trading down $12.20 or -0.53% at $2313.32. At this time yesterday, the price was higher at $2318.48

- Silver is trading down $0.17 or -0.62% at $27.26. At this time yesterday, the price was at $27.10

- Bitcoin currently trades at $63,811. At this time yesterday, the price was trading at $64,260

In the premarket, the US major indices are trading mixed:

- Dow Industrial Average futures are implying a gain of 29.53 points. Yesterday, the index rose 176.59 points or 0.46% at 38852.28.

- S&P futures are implying a gain of one point. Yesterday, the S&P index rose 52.93 points or 1.03% at 5180.73.

- Nasdaq futures are implying a decline of -24.32 points. Yesterday the index rose 192.92 points or 1.19% at 16349.25.

European stock indices are trading higher:

- German DAX, +0.50%

- France CAC , +0.21%

- UK FTSE 100, +1.03%

- Spain’s Ibex, +0.85%.

- Italy’s FTSE MIB, +0.28% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mixed/higher:

- Japan’s Nikkei 225, +1.57%

- China’s Shanghai Composite Index, +0.22%

- Hong Kong’s Hang Seng index, -0.53%

- Australia S&P/ASX index, +1.44%

Looking at the US debt market, yields are lower. Today the U.S. Treasury will auction off 3-year notes. Tomorrow they will auction off 10- year note and on Thursday they will auction off 30-year bonds:

- 2-year yield 4.822%, unchanged. At this time yesterday, the yield was at 4.799%

- 5-year yield 4.476%, -0.7 basis points. At this time yesterday, the yield was at 4.472%

- 10-year yield 4.473%, -1.6 basis points. At this time yesterday, the yield was at 4.489%

- 30-year yield 4.619%, -2.2 basis points. At this time yesterday, the yield was at 4.694%

Looking at the treasury yield curve spreads the yield curve is steeper (but still negative):

- The 2-10 year spread is at -34.9 basis points. At this time yesterday, the spread was at -31.2 basis points

- The 2-30 year spread is at -19.8 basis points. At this time yesterday, the spread was at -15.3 basis points

European benchmark 10-year yields are lower.