Dollar remains firm in Asian session after the strong post-CPI rally. US stocks were deeply sold off as a June Fed rate cut is further priced out by the markets. Market attention is now keenly focused on the upcoming PPI for March, as well as University of Michigan’s consumer survey results. Should today’s PPI data reveal strong figures, followed by heightened consumer inflation expectations tomorrow, it could further delay the Fed’s anticipated rate reduction timeline, thereby reinforcing the Dollar’s strength.

In Europe, the financial markets are braced for ECB rate decision, with broad consensus anticipating the main refinancing rate to hold steady at 4.50%. ECB has communicated clearly its conditional plan to initiate rate cuts by June, dependent on the first-quarter wage data due in May. By then, new economic projections will be available too to guide monetary policy decision. It’s unlikely that ECB will depart from its cautious stance at this juncture. President Christine Lagarde would continue to emphasize a data-dependent approach and reaffirm the meeting-by-meeting decisions. Today’s announcement and subsequent press conference are anticipated to have minimal impact on the markets.

Throughout this week, Dollar is currently the dominant currency, outpacing its counterparts with no significant competition. Swiss Franc has underperformed the most, followed by Australian Dollar, Euro, Yen, Sterling, Canadian Dollar, and New Zealand Dollar in order. Yen, in particular, finds itself in the middle position following Japan’s hesitancy to signal an imminent intervention in currency markets. Notably, all non-Dollar currencies are currently trading within the previous week’s range, indicating a lack of definitive strength or weakness among them.

Technically, AUD/NZD is worth a watch in the coming days. This week’s retreat raises the chance that rebound from 1.0567 has completed at 1.0952, ahead of medium trend line resistance. Firm break of 1.0836 support will argue that the sideway pattern from 1.1085 is starting another falling leg back to 55 D EMA (now at 1.0800) first, and then towards 1.0567 support.

In Asia, at the time of writing, Nikkei is down -0.41%. Hong Kong HSI is down -0.76%. China Shanghai SSE is up 0.37%. Singapore Strait Times is down -0.37%. Japan 10-year JGB yield surges sharply by 0.0611 to 0.860. Overnight, DOW fell -1.09%. S&P 500 fell -0.95%. NASDAQ fell -0.84%. 10-year yield rose 0.069 to 4.378.

DOW takes a dive and Dollar leaps, as traders start to dismiss June Fed cut

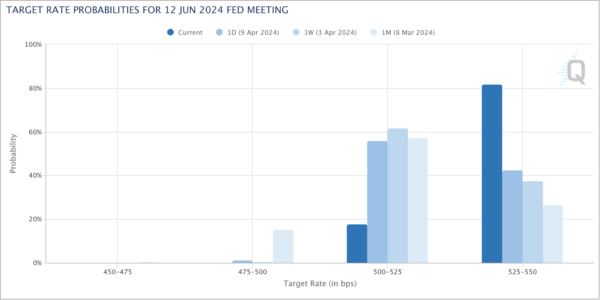

Bets on a Fed rate cut in June receded sharply following yesterday’s stronger than expected US CPI report. The drastic shift in sentiment led to steep decline in DOW and strong rally in Dollar index. FOMC minutes further cemented this outlook, revealing Fed’s cautious stance on interest policy easing and its desire for more evidence of disinflation progress before considering rate cuts.

The March FOMC minutes highlighted a consensus among members regarding the “uncertainty” surrounding the “persistence of high inflation”. Recent economic data did little to assuage these concerns, failing to increase the Committee’s confidence that inflation was on a steady decline toward 2% target.

The minutes further detailed concerns over the “relatively broad based” nature of recent inflation increases, cautioning against dismissing these trends as mere statistical outliers. This characteristic led to a consensus that these developments should not be hastily dismissed as “merely statistical aberrations.”

Fed fund futures are now pricing in just 18% chance of a Fed rate cut in June, comparing to 58% a day ago.

DOW closed down -422 pts or -1.09% at 38461.51. Technically, the break of 38483.25 support and 55 D EMA suggest that rise from 32327.20 has completed at 39899.05, on bearish divergence conditions in D MACD. Deeper correction is in favor to 38.2% retracement of 32327.20 to 39899.05 at 37000.42.

Dollar Index surged sharply to close at 105.24. Break of 150.10 resistance indicates resumption of whole rally from 100.61. Also, the strong support from 55 D EMA is a clear near term bullish sign. Further rally is now expected as long as 103.93 support holds. Next target is 100% projection of 100.61 to 104.97 from 102.35 at 106.71.

Japan’s Suzuki and Kanda: No predetermined Yen levels for currency intervention

Japanese Yen’s steep decline through 152 mark against Dollar overnight has put attention on potential currency intervention. However, responses from key officials today suggest a more measured approach is being considered at this point. In particular, Finance Minister Shunichi Suzuki acknowledged the mixed implications of a weakening Yen, with pros and cons. Its looks like Japan is not gearing up for direct intervention at the current level.

Suzuki highlighted the government is looking at the currency markets “with a high sense of urgency”. But he also emphasized that Japan is “not just looking at levels” such as 152 or 153, but also the underlying factors driving Yen’s depreciation.

Suzuki reiterated the government’s preference for currency stability, emphasizing that exchange rates should reflect economic fundamentals rather than short-term volatilities.

Masato Kanda, Japan’s top currency diplomat, echoed this sentiment by highlighting the recent pace of Yen’s movements as “rapid.” While not dismissing interventions, Kanda pointed out the absence of a fixed level that would trigger such actions. “I don’t have any particular level in mind,” he noted.

China’s CPI falls back to 0.1%, PPI negative for 18th month

China’s CPI slowed significantly from 0.7% yoy to 0.1% yoy in March, coming in below expectation of 0.4% yoy. Core CPI, which strips out food and energy prices, also decelerated from 1.2% yoy to 0.6% yoy. This shift was largely influenced by a notable -2.7% decrease in food prices, while non-food prices edged up rose 0.7%. Month-on-month, CPI declined -1.0% mom.

NBS attributed this March dip in CPI to a “seasonal decline in consumer demand following the holidays and the overall sufficient market supply.”

In parallel, PPI, a measure of factory-gate prices, edged down further to -2.8% yoy from February’s -2.7% yoy, aligning with market expectations. This continuation of downward trend for the 18th consecutive month emphasizes persistent deflationary pressures within the manufacturing sector. On a month-on-month basis, PPI contracted by -0.1%.

Looking ahead

ECB rate deicsion in the main focus in Euroepan session while Italy will release industria output. Later in the day, US will publish PPI and jobless claims.

EUR/USD Daily Outlook

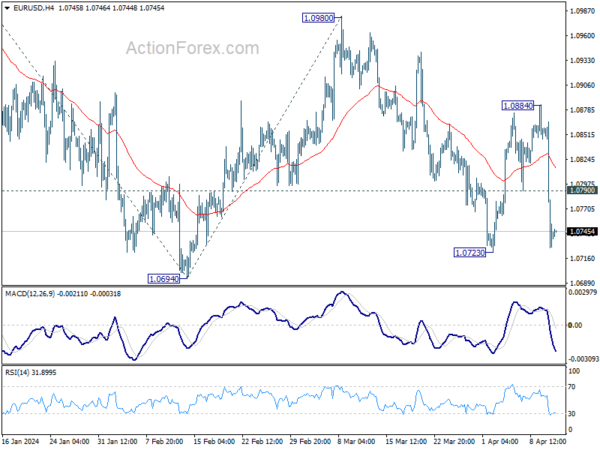

Daily Pivots: (S1) 1.0692; (P) 1.0779; (R1) 1.0830; More…

Intraday bias in EUR/USD remains on the downside for 1.0694/0723 support zone. Decisive break there will resume whole fall from 1.1138. Next target is 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536. On the upside, above 1.0790 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.0884 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Mar | -4% | -6% | -10% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Mar | 2.50% | 2.40% | 2.50% | 2.40% |

| 01:00 | AUD | Consumer Inflation Expectations Apr | 4.60% | 4.30% | ||

| 01:30 | CNY | CPI Y/Y Mar | 0.10% | 0.40% | 0.70% | |

| 01:30 | CNY | PPI Y/Y Mar | -2.80% | -2.80% | -2.70% | |

| 08:00 | EUR | Italy Industrial Output M/M Feb | 0.50% | -1.20% | ||

| 12:15 | EUR | ECB Main Refinancing Operations Rate | 4.50% | 4.50% | ||

| 12:15 | EUR | ECB Rate On Deposit Facility | 4.00% | 4.00% | ||

| 12:30 | USD | PPI M/M Mar | 0.30% | 0.60% | ||

| 12:30 | USD | PPI Y/Y Mar | 2.30% | 1.60% | ||

| 12:30 | USD | PPI Core M/M Mar | 0.20% | 0.30% | ||

| 12:30 | USD | PPI Core Y/Y Mar | 2.30% | 2.00% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 5) | 215K | 221K | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | 14B | -37B |