Gold today rose as high as $2199 but failed to break back above $2200. That’s a level it first crossed on March 20 before it fell back the next day.

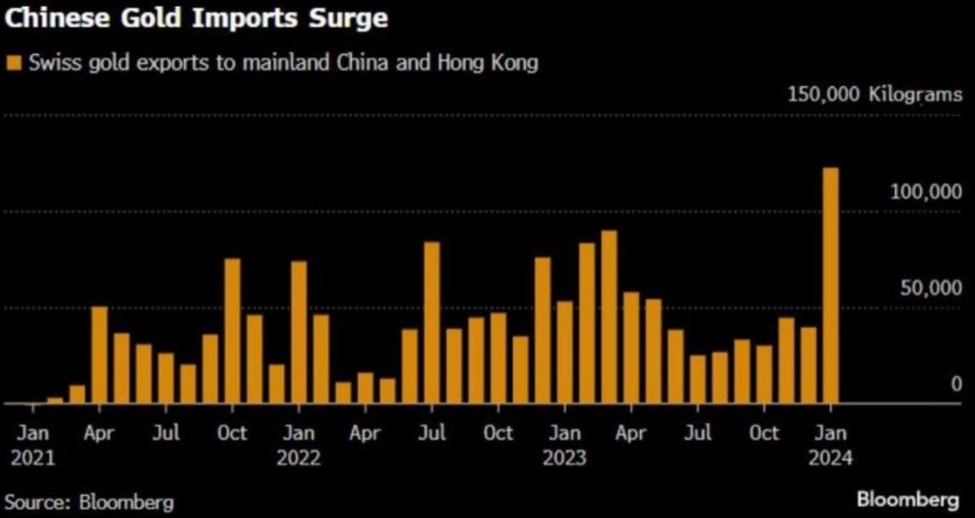

Today’s rally came in Europe and Asia but has given it all back in US trading. It’s another hint that all the buying is coming from Asia.

Technically, I wonder if we’re starting to see a head-and-shoulders pattern unfolding on the four-hour chart.

gold 4 hour

I expect a heavy weighting on economic data for gold in the coming months. A turn in the US dollar would supercharge it but if the Fed is forced back into a neutral stance, there could be a reckoning.

For now, I suspect that gold miners hedging is a big part of the flows. Despite the high gold prices, many of those companies aren’t in good places and their stock price are struggling, in part because of high costs. There’s a big temptation to hedge future production.