Bank of America shares fell more than 2% in premarketing trading on Friday after the firm reported declining fourth-quarter earnings.

Here’s what the company reported compared with what Wall Street analysts surveyed by LSEG, formerly known as Refinitiv, were expecting:

- Earnings per share: 70 cents vs. 68 cents per share, expected

Bank of America’s net income fell to $3.1 billion in the fourth quarter, down more than 50% from $7.1 billion from a year ago.

The bank, based in Charlotte, North Carolina, said its net interest income decreased 5% to $13.9 billion due to higher deposit costs and lower deposit balances, which more than offset higher asset yields.

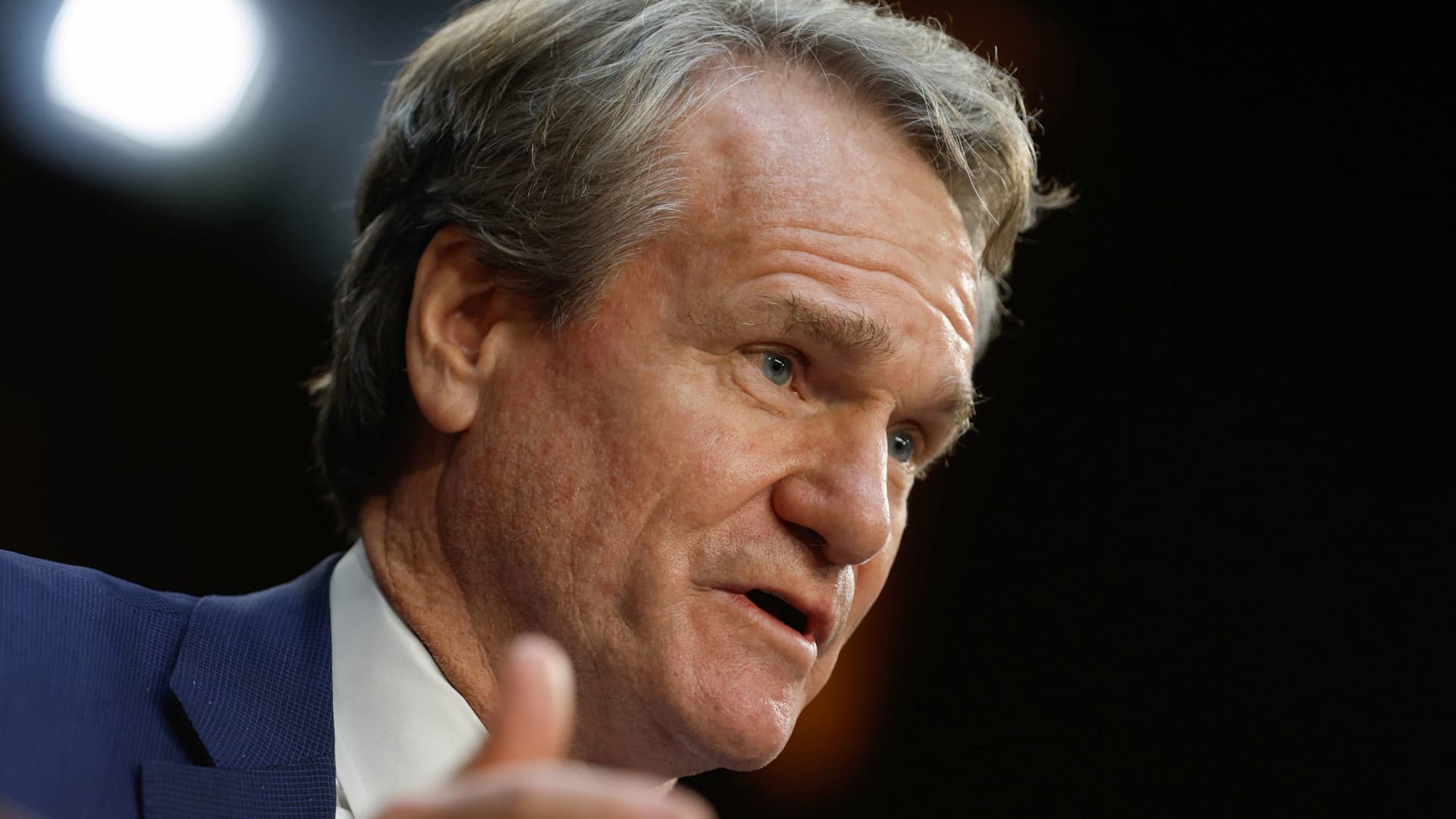

“We reported solid fourth quarter and full-year results as all our businesses achieved strong organic growth, with record client activity and digital engagement,” CEO Brian Moynihan said in a statement. “Our expense discipline allowed us to continue investing in growth initiatives. Strong capital and liquidity levels position us well to continue to deliver responsible growth in 2024.”

Bank of America stock is down more than 1% this year after a mere 1.7% gain in 2023. The S&P 500 financial sector gained 10% last year.

The bank was supposed to be one of the biggest beneficiaries of higher interest rates last year, but it underperformed its peers because the lender had piled into low-yielding, long-dated securities during the Covid pandemic. Those securities lost value as interest rates climbed.

This story is developing. Please check back for updates.