The day started with the Dow industrial average and S&P index lower on the day. At session lows, the S&P was down -10.58 points and the Dow industrial average always down -69.15 point). That lower open threatened the 7-day consecutive up day streak. However, at the close, the losses have been reversed and each of those indices are closing higher for the 7th day in a row. The S&P string is the longest since 2021.

Meanwhile, the NASDAQ index opened higher and although it moved briefly into negative territory (-2.22 point at session lows), the index remained mostly higher and now has an 8 day winning streak.

The final numbers are showing:

- Dow industrial average rose 56.94 points or 0.17% at 34152.81

- S&P index rose 12.38 points or 0.28% at 4378.37

- NASDAQ index rose 121.07 points or 0.90% at 13639.85

Technically, the NASDAQ is closing just above its 100-day moving average at 13616.97. Back on October 11, the price closed above that moving average for one day before failing and starting the move to the October low.

The S&P index remains below its 100-day moving average of 4402.73. The Dow industrial average is also below its 100-day moving average at 34266.33

In the US the debt market today, yields are lower. The U.S. Treasury auctioned off $48 billion of 3 your notes with marginally higher than average demand. They will auction off 10 and 30-year bonds over the next 2 trading days.

- 2-year yield 4.911%, -3.3 basis points

- 5-year yield 4.534% -7.4 basis points

- 10-year yield 4.572% -8.9 basis points

- 30-year yield 4.736% -9.4 basis points

In other markets,

- Crude oil is sharply lower. The price is trading down $-3.34 or -4.13% at $77.48. The low price reached $77.17. The high price was at $81.05

- Spot gold is lower by -$8.82 or -0.45% at $1968.71

- Bitcoin traded as low as $34,530, but is trading near highs at $35,706. The high price for the day reached $35,891

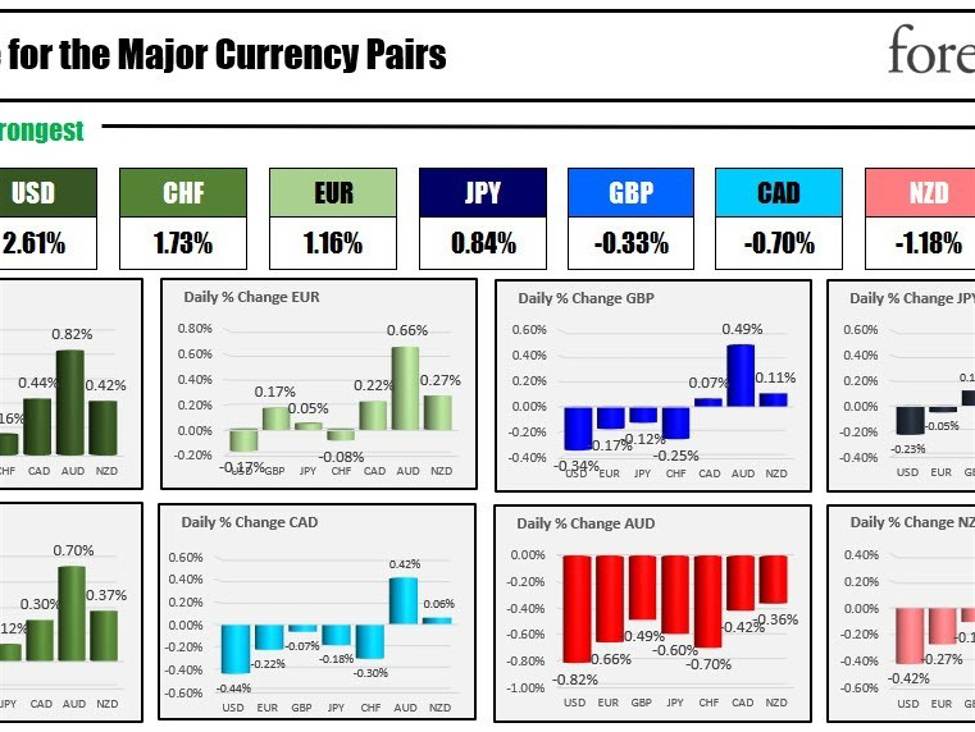

In the Forex market, the US dollar is closing is the strongest of the major currencies despite the decline in yield. Lower industrial production in Germany, and mixed data in China gave the nod to the greenback ahead of other countries.

In after-hours earnings:

Rivian Automotive Inc (RIVN):

- Q3 2023 Adj. EPS: -1.19 (Beat expectations of -1.32)

- Q3 2023 Revenue: $1.34 billion (Beat expectations of $1.33 billion)

Viatris Inc (VTRS):

- Q3 2023 Revenue: $3.93 billion (Missed expectations of $4.01 billion)

- Q3 2023 Adj. EBITDA: $1.36 billion (Beat expectations of $1.3 billion)

Gilead Sciences Inc (GILD):

- Q3 2023 EPS: $2.29 (Beat expectations of $1.92)

- Q3 2023 Revenue: $7.05 billion (Beat expectations of $6.8 billion)

- FY EPS view: $6.65-$6.85 (Beat expectations of $6.62; previously $6.45)

- FY Revenue view: $26.7-$26.9 billion (Missed expectations of $26.87 billion; previously $26.3-$26.7 billion)

Akamai Technologies Inc (AKAM):

- Q3 2023 Adj. EPS: $1.63 (Beat expectations of $1.50)

- Q3 2023 Revenue: $965.5 million (Beat expectations of $944.1 million)

Lucid Group Inc (LCID):

- Q3 2023 EPS: -$0.28 (Beat expectations of -$0.35)

- Q3 2023 Revenue: $138 million (Missed expectations of $180 million)

eBay Inc (EBAY):

- Q3 2023 EPS: Not provided (Expectations were $1.00)

- Q3 2023 Revenue: $2.5 billion (Met expectations of $2.5 billion)