As the week draws to a close, the Japanese Yen is exhibiting signs of a tentative comeback, with USD/JPY retreating back below the significant 150 mark. Dollar’s response to the latest US personal income and outlays data was relatively subdued. Although the monthly headline PCE price index ticked slightly above forecasts, other inflation indicators aligned closely with market expectations. Notably, robust spending growth highlights the resilience of US consumers.

However, it appears Dollar traders are cautiously adjusting their positions in anticipation of next week’s pivotal FOMC meeting and the upcoming non-farm payroll report. Similarly, Yen traders are vigilant, preparing for potential shifts stemming from BoJ’s upcoming policy meeting.

Looking at the week in review, Australian and New Zealand Dollars have emerged among the top performers, sharing the stage with Dollar. On the flip side, Swiss Franc, Euro, and Canadian Dollar lagged behind. British Pound and Yen showcased a mixed performance.

In Europe, at the time of writing, FTSE is down -0.18%. DAX is up 0.25%. CAC is down -0.60%. Germany 10-year yield is down -0.023 at 2.845. Earlier in Asia, Nikkei rose 1.27%. Hong Kong HSI rose 2.08%. China Shanghai SSE rose 0.99%. Japan 10-year JGB yield dropped -0.0090 to 0.876.

US PCE inflation unchanged at 3.4% yoy, core slowed to 3.7% yoy

US personal income rose 0.3% mom or USD 77.8B in September, below expectation of 0.4%. Personal spending rose 0.7% mom or USD 138.7B, well above expectation of 0.4% mom.

PCE price index rose 0.4% mom, above expectation of 0.3% mom. Core PCE price index (excluding food and energy) rose 0.3% mom, matched expectations. Prices for goods increased 0.2% mom and prices for services increased 0.5% mom. Food prices increased 0.3% mom and energy prices increased 1.7% mom.

Annually, PCE price index was unchanged at 3.4% yoy, matched expectations. Core PCE price index slowed from 3.8% yoy to 3.7% yoy, matched expectations. Prices for goods increased 0.9% yoy and prices for services increased 4.7% yoy. Food prices increased 2.7% yoy and energy prices decreased by less than -0.1% yoy.

ECB survey indicates modest adjustments to growth and inflation forecasts

ECB’s latest Survey of Professional Forecasters for Q4 presents marginal adjustments to economic outlook for the 2023-2025 period. Also, headline inflation expectations underwent minimal changes for these years.

Regarding the HICP, inflation forecast for 2023 has been adjusted upwards to 5.6% from its earlier 5.5% estimation. The projections for 2024 remain steady at 2.7%, whereas for 2025, it was slightly dialed back to 2.1% from the prior 2.2% prediction.

On the core inflation front, 2023 remains unchanged at 5.1%. However, the following years see a minor downward revision, with 2024 expectations set at 2.9% (down from earlier 3.1%) and 2025 set at 2.2% (down from 2.3%).

Turning to Real GDP growth, 2023 projections are adjusted downwards to 0.5% an prior 0.6%. 2024 now stands at 0.9%, a reduction from 1.1% previously forecasted. Growth projection for 2025 remains steady at 1.5%.

Tokyo CPI signals rising inflation; BoJ likely to upgrade forecasts

In Japan, Tokyo’s headline CPI unexpectedly accelerated from 2.8% yoy to 3.3% yoy in October. CPI core, which excludes the volatile prices of fresh food, also witnessed an acceleration, moving from 2.5% yoy to 2.7% yoy. On the other hand, CPI core-core, which strips out impact of both food and energy prices, marginally slowed from 3.9% yoy to 3.8% yoy, but remained elevated.

An important metric to note is acceleration in services prices, which went from 1.9% yoy 2.1% yoy. The continued uptick in services inflation indicates a more entrenched and broad-based price pressure scenario, suggesting that it could be a prolonged period before inflation retraces its steps back below BoJ’s 2% target.

Considering that consumer inflation in Tokyo often sets the tone for national trends, the data bolsters the anticipation that BoJ might have to upgrade its inflation forecasts. Market participants are now keenly awaiting the fresh quarterly projections that are expected to be unveiled at BoJ’s policy meeting next week.

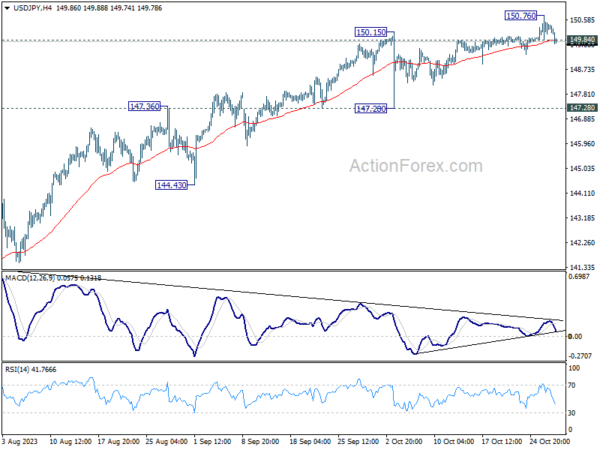

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 149.91; (P) 150.34; (R1) 150.85; More…

Intraday bias in USD/JPY is turned neutral with break of 149.84 minor support. Some consolidations would be seen first. But near term outlook will stay bullish as long as 147.28 support holds, even in case of deep retreat. On the upside, above 150.76 will resume larger rally to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Oct | 3.30% | 2.80% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Oct | 2.70% | 2.50% | 2.50% | |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y Oct | 3.80% | 3.80% | 3.90% | |

| 00:30 | AUD | PPI Q/Q Q3 | 1.80% | 0.70% | 0.50% | |

| 00:30 | AUD | PPI Y/Y Q3 | 3.80% | 3.90% | ||

| 12:30 | USD | Personal Income M/M Sep | 0.30% | 0.40% | 0.40% | |

| 12:30 | USD | Personal Spending Sep | 0.70% | 0.40% | 0.40% | |

| 12:30 | USD | PCE Price Index M/M Sep | 0.40% | 0.30% | 0.40% | |

| 12:30 | USD | PCE Price Index Y/Y Sep | 3.40% | 3.40% | 3.50% | 3.40% |

| 12:30 | USD | Core PCE Price Index M/M Sep | 0.30% | 0.30% | 0.10% | |

| 12:30 | USD | Core PCE Price Index Y/Y Sep | 3.70% | 3.70% | 3.90% | 3.80% |

| 14:00 | USD | Michigan Consumer Sentiment Index Oct F | 63 | 63 |