Dollar experienced a broad upsurge overnight, propelled by a robust rebound in benchmark treasury yields and a general mood of risk aversion. This strength continued into the Asian trading session, particularly notable in the greenback’s gains against Japanese Yen, which have now extended past the significant 150 mark. Despite verbal interventions from Japan, Yen has received no notable support, leaving Dollar to dominate.

Attention now turns to the US Q3 GDP data release, which could be pivotal in determining Dollar’s short-term momentum. Additionally, the global forex markets are keenly awaiting today’s ECB rate decision. While a hold on rates is widely anticipated, investors and analysts are eager to gauge ECB’s perspective on the resurgence of inflation risks, economic slowdown, and escalating geopolitical tensions.

Australian Dollar is the weakest currency for the day so far, feeling pressure from RBA Governor Michele Bullock’s cautious remarks about the recent stronger-than-projected CPI data and the chance of a rate hike in November. Sterling and Kiwi Dollar trail behind as subsequent underperformers. In contrast, Canadian Dollar, presently positioned as the second strongest after US Dollar, is attempting to recuperate from the post-BoC dip witnessed yesterday. Swiss Franc holds its ground as the third strongest, engaging in consolidations against both Euro and Sterling.

From a technical standpoint, NASDAQ resumed the decline from 14446.55 overnight to close at 12821.22. Immediate focus is on 38.2% retracement of 10088.82 to 14446.55 at 12781.89 could prompt downside acceleration through near term channel support. In that case, next target will be 12269.55 resistance turned support.It will be interesting to monitor how the NASDAQ responds to the upcoming GDP data and the subsequent impacts on currencies.

In Asia, at the time of writing, Nikkei is down -2.16%. Hong Kong HSI is down -0.82%. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.41%. Japan 10-year JGB yield is up 0.0251 at 0.886. Overnight, DOW dropped -0.32%. S&P 500 dropped -1.43%. NASDAQ dropped sharply by -2.43%. 10-year yield rose 0.113 to 4.953.

RBA’s Bullock undecided on rate hike following CPI surprise

In the Senate Economics Committee session today, RBA Governor Michele Bullock indicated that the bank was not entirely caught off guard by the stronger than expected CPI data released yesterday. She refrained from offering a definitive direction for the bank’s next steps

The Q3 and September CPI data, which Bullock admitted “came out a little higher” than the projections in the August Statement on Monetary Policy, still aligned with the bank’s expectations. She clarified, “The numbers were pretty much where we thought it would come out”.

When queried on the prospect of another rate hike in the forthcoming meeting, Bullock responded, “We’re still analyzing the numbers at the moment. I wouldn’t like to say more or less likely, we’re still looking at it.”

Bullock reiterated the bank’s position, stating, “We’ve always said we have a low tolerance” on inflation surprises. She added, “We are wary and we don’t know if the job has been done yet.”

Looking forward, Bullock hinted at imminent changes to their economic projections, announcing, “We will be releasing a new set of forecasts after the board meeting.” Moreover, she alluded to the significance of these revisions by stating, “There is going to be a change to our forecasts. We have to look at whether or not it’s material enough to change our views on monetary policy.”

As USD/JPY breaks 150, Japan faces intervention and YCC decision

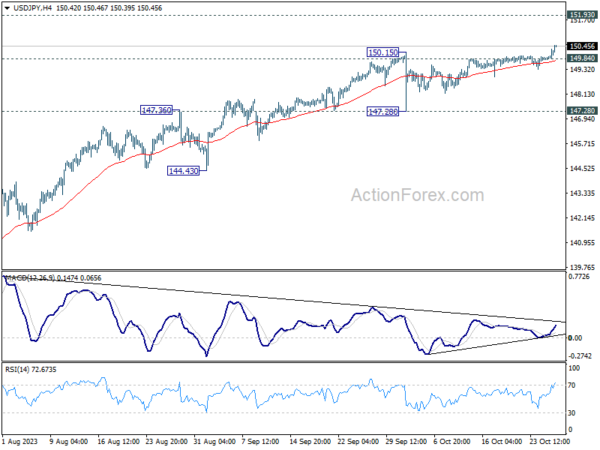

In a significant move, USD/JPY surpasses the key psychological level of 150 today, marking its highest point in a year. This uptick has reignited concerns among investors regarding market interventions by Japan, given that the 150 mark is widely regarded as a trigger point for such actions.

Japanese finance minister Shunichi Suzuki addressed the market developments, reiterating, “I’m watching market moves with a sense of urgency, as before.” Notably, despite the heightened speculation, he refrained from commenting on any immediate intervention measures. This silence has led to further ambiguity, especially considering the suspected actions by Japan on October 3 to buy Yen, actions that have yet to be officially confirmed.

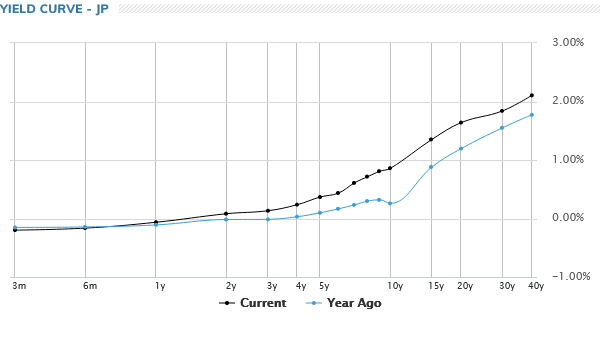

A primary reason for the sustained pressure on Yen can be attributed to increasing yield gap between Japan and other major economies. This disparity intensifies the debate on the necessity for BoJ to revise its yield curve control, especially in light of rising global interest rates. There are rumblings about a possible adjustment to the 10-year yield cap, even though it was adjusted only three months prior, especially with a policy meeting on the horizon.

Nevertheless, BoJ has consistently asserted that previous adjustments to the yield curve control were primarily to rectify any irregularities in the bond market’s operations. The current yield curve appears more natural, especially when contrasted against the noticeable dip in 10-year yield in the curve from a year ago. It remains uncertain whether BoJ feels the immediacy to modify its YCC in the near term.

ECB to finally pause, EUR/USD looking soft

Today, ECB is broadly anticipated to maintain its main refinancing rate at 4.50% and the deposit rate at 4.00%. Having increased rates consistently during its previous ten meetings to tackle surging inflation, ECB hinted at a pause last month, reflective of the policy’s apparent efficacy, as evidenced by deceleration in the Eurozone economy.

President Christine Lagarde, along with other top officials, has been keen to redirect discussions toward the duration for which the interest rates might need to remain at these current restrictive thresholds.

Amid this backdrop, there’s also been speculation regarding ECB’s potential move for an early reduction in bond holdings within its colossal EUR 1.7T euro Pandemic Emergency Purchase Programme. However, given the prevailing climate of heightened macroeconomic, geopolitical, and financial ambiguities, it’s probable that the ECB will resist any hasty decisions to expedite quantitative tightening.

Some previews on ECB:

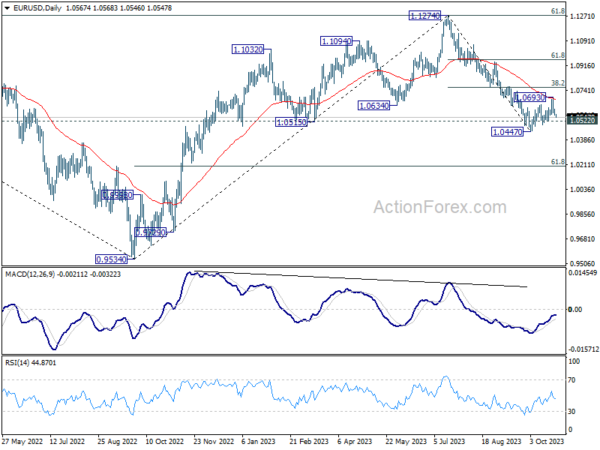

Technically, it’s possible that EUR/USD’s recovery from 1.0447 has completed at 1.0693, after rejection by 55 D EMA. Immediate focus for today is 1.0522 minor support. Firm break there should strengthen this bearish case. Further break of 1.0447 will resume whole fall from 1.1274, and target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next.

Elsehwere

US GDP is another major focus today. Durable goods orders, goods trade balance and jobless claims will also be featured.

USD/JPY Daily Outlook

Daily Pivots: (S1) 149.91; (P) 150.12; (R1) 150.43; More…

USD/JPY’s rally from 127.20 resumed by breaking through 150.15 resistance. Intraday bias is back on the upside for 151.93 high medium term resistance next. On the downside, below 149.84 minor support will turn intraday bias neutral first, and bring consolidations. But near term outlook will now stay bullish as long as 147.28 support holds, even in case of deep retreat.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Sep | 2.10% | 2.00% | 2.10% | |

| 00:30 | AUD | Import Price Index Q/Q Q3 | 0.80% | 0.20% | -0.80% | |

| 12:15 | EUR | ECB Main Refinancing Rate | 4.50% | 4.50% | ||

| 12:30 | USD | Initial Jobless Claims (Oct 20) | 202K | 198K | ||

| 12:30 | USD | GDP Annualized Q3 P | 4.30% | 2.10% | ||

| 12:30 | USD | GDP Price Index Q3 P | 2.50% | 1.70% | ||

| 12:30 | USD | Goods Trade Balance (USD) Sep P | -85.5B | -84.6B | ||

| 12:30 | USD | Wholesale Inventories Sep P | 0.10% | -0.10% | ||

| 12:30 | USD | Durable Goods Orders Sep | 1.00% | 0.10% | ||

| 12:30 | USD | Durable Goods Orders ex TransportSep | 0.20% | 0.40% | ||

| 14:00 | USD | Pending Home Sales M/M Sep | 1.10% | -7.10% | ||

| 14:30 | USD | Natural Gas Storage | 82B | 97B |