As Middle East tensions escalate again ahead of the weekend, global financial markets are exhibiting a pronounced shift towards risk aversion. The news of Israel urging all civilians in Gaza City to evacuate, in anticipation of a ground invasion following a severe attack by Hamas, has sent shockwaves through the markets. Both Oil and Gold Prices are rising, with Gold edging closer to the significant 1900 mark.

Remarkably, the bullish momentum in gold hasn’t undermined Dollar; the US currency remains generally robust. However, Swiss Franc, a traditional safe-haven asset, has outperformed the greenback amidst the current geopolitical unrest. The Canadian Dollar also maintains its ground, buoyed by rising oil prices.

A weekly assessment suggests Swiss Franc is on track to be the week’s top performer, with Dollar and Canadian Dollar following suit. On the other end, New Zealand Dollar trails as the weakest, with Australian Dollar and Euro not faring much better. British Pound has displayed some softness too, whereas Japanese Yen remains relatively neutral.

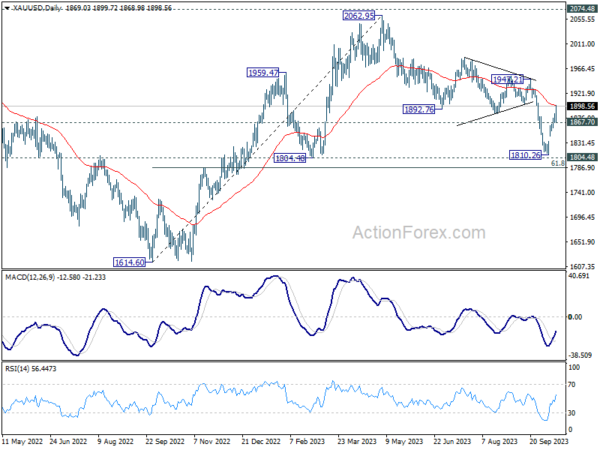

On the technical front, immediate focus in Gold is now on 55 D EMA (now at 1899.03), or simply put 1900 handle. Sustained break there will argue that fall from 2062.95 has completed with three waves down to 1810.26, just ahead of 1804.48 support. The corrective structure argues that larger rally from 1614.60 might be ready to resume. In this case, 1947.21 resistance will be the next target. Decisive break there will add to this bullish case and set up another bullish run towards 2062.95 high.

In Europe, at the time of writing, FTSE is down -0.38%. DAX is down -0.86%. CAC is down -0.83%. Germany 10-year yield is down -0.0635 at 2.727. Earlier in Asia, Nikkei dropped -0.55%. Hong Kong HSI dropped -2.33%. China Shanghai SSE dropped -0.64%. Singapore Strait Times dropped -1.02%. Japan 10-year yield rose 0.0036 to 0.759.

BoE’s Bailey: Monetary decisions to go on to be tight

During his recent speech at IMF’s annual meeting in Marrakech, BoE Governor Andrew Bailey reflected on previous month’s decision to maintain interest rates at 5.25%. He characterized the decision as “a tight one”, added that “they’re going to go on being tight ones”.

The MPC’s narrow 5-4 vote to pause its series of consecutive rate hikes in September underscores the divided opinions within the bank regarding the best path forward.

Highlighting the bank’s recent efforts, Bailey commented, “We have made, I think, particularly in the last few months, solid progress in terms of showing signs that inflation is being tackled.”

However, he cautioned against overconfidence, adding, “let’s not get carried away because there’s an awful lot still to do.”

The “last mile” of inflation management, according to Bailey, will considerably depend on “restrictive policy.”

Industrial production in Eurozone and EU up 0.6% mom in Aug

Eurozone industrial production rose 0.6% mom in August, well above expectation of 0.1% mom. Production of durable consumer goods grew by 1.2% mom, non-durable consumer goods by 0.5% mom and capital goods by 0.3% mom, while production of intermediate goods fell by -0.3% mom and energy by 0.9% mom.

EU industrial production rose 0.6% mom. Among Member States for which data are available, the highest monthly increases were registered in Ireland (+6.1%), Slovakia (+4.5%) and Lithuania (+3.7%). The largest decreases were observed in Hungary (-2.4%), Croatia (-2.2%) and Belgium (-1.8%).

New Zealand BNZ PMI falls to 45.3, entrenched manufacturing downturn deepens

New Zealand manufacturing sector has further sunk into troubled waters, as evidenced by the continued and deepening contraction observed in recent data.

BusinessNZ Performance of Manufacturing Index for September highlighted this slowdown by dropping to 45.3, down from 46.1 the previous month. This marks its most dismal performance for a month unaffected by COVID-19 since May 2009 and sits notably below the long-term average activity rate of 52.9.

Delving into the specifics, there’s a discernible decline across most metrics. While production saw a slight uptick, moving from 43.8 to 44.6, other areas weren’t as fortunate. Employment indicators slid from 47.7 to 45.2, and new orders also receded from 46.6 to 44.9. Meanwhile, finished stocks dwindled, albeit marginally, from 52.0 to 51.6, and deliveries plunged from 47.8 to 44.3.

Catherine Beard, BusinessNZ’s Director of Advocacy, highlighted the sustained downturn, pointing out that the sector “has now been in contraction for seven consecutive months, with little sign it is showing any improvement.”

On the economic front, BNZ Senior Economist Doug Steel provided a bleak perspective, remarking, “the trend remains firmly downward.” He also touched upon the challenges in discerning the exact causes of any PMI result but cited “falling sales, rising costs, and election uncertainty” as significant factors currently impacting the sector..

China’s export slump persists but softens; imports shrink further as CPI stalls

China’s trade figures for September revealed a continued, albeit moderating, decline in exports, marking the fifth consecutive month of contraction. Exports dropped by -6.2% yoy to USD 229.1B, an improvement from the -8.8% yoy decline recorded in the previous month. Despite this easing contraction, prolonged declines in shipments to major trade partners underscore the persisting challenges in the external sector.

A breakdown of the data shows exports to ASEAN countries contracted by -15.8% yoy, hitting USD 55B. The US, amidst a 14-month streak of declines, saw a -9.3% yoy contraction in goods from China, totaling USD 46B. European Union imports from China also fell by -11.6% yoy. In contrast, Russia exhibited a robust appetite for Chinese goods, with exports soaring by 20.6% yoy.

On the import front, China’s inbound shipments contracted by -6.2% yoy to USD 221.4B, marking the seventh consecutive monthly decline but showing a slower pace compared to August’s -7.3% yoy contraction. Consequently, trade surplus widened to USD 77.7B, outperforming market expectations.

Inflation dynamics within the country presented another layer of economic intricacies. China’s CPI stagnated at 0.0% yoy in September, pulled down by a -3.2% yoy decline in food prices, and falling short of the anticipated 0.2% yoy increase. The National Bureau of Statistics cited a high base of comparison with last year and abundant food supply ahead of the Golden Week holiday as key factors behind the subdued inflation.

Simultaneously, PPI showed a -2.5% yoy decline, extending the 12-month streak of contraction yet revealing an easing trend from August’s -3.0% yoy drop.

GBP/USD Mid-Day Outlook

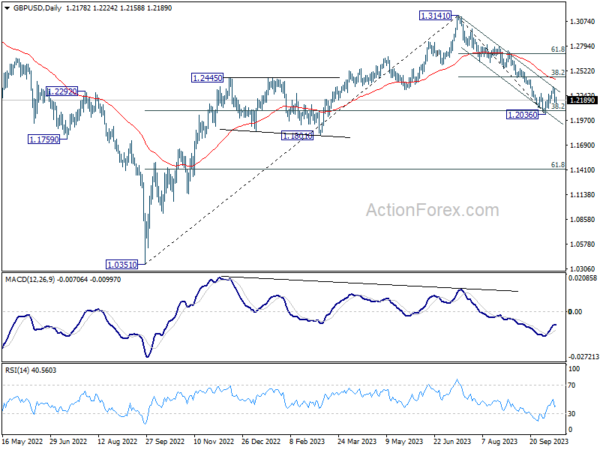

Daily Pivots: (S1) 1.2121; (P) 1.2226; (R1) 1.2281; More

Intraday bias in GBP/USD remains mildly on the downside at this point. Recovery from 1.2035 should have completed at 1.2336, after hitting falling channel resistance. Deeper decline would be seen to retest 1.2036 low. Decisive break there will resume larger fall from 1.3141. On the upside, above 1.2336 minor resistance will resume the rebound instead.

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2420) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Sep | 45.3 | 46.1 | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Sep | 2.40% | 2.40% | 2.50% | |

| 01:30 | CNY | CPI Y/Y Sep | 0.00% | 0.20% | 0.10% | |

| 01:30 | CNY | PPI Y/Y Sep | -2.50% | -2.40% | -3.00% | |

| 03:00 | CNY | Trade Balance (USD) Sep | 77.7B | 73.7B | 68.4B | |

| 06:30 | CHF | Producer and Import Prices M/M Sep | -0.10% | 0.20% | -0.20% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Sep | -1.00% | -0.80% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Aug | 0.60% | 0.10% | -1.10% | -1.30% |

| 12:30 | USD | Import Price Index M/M Sep | 0.10% | 0.60% | 0.50% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Oct P | 68 | 68.1 |