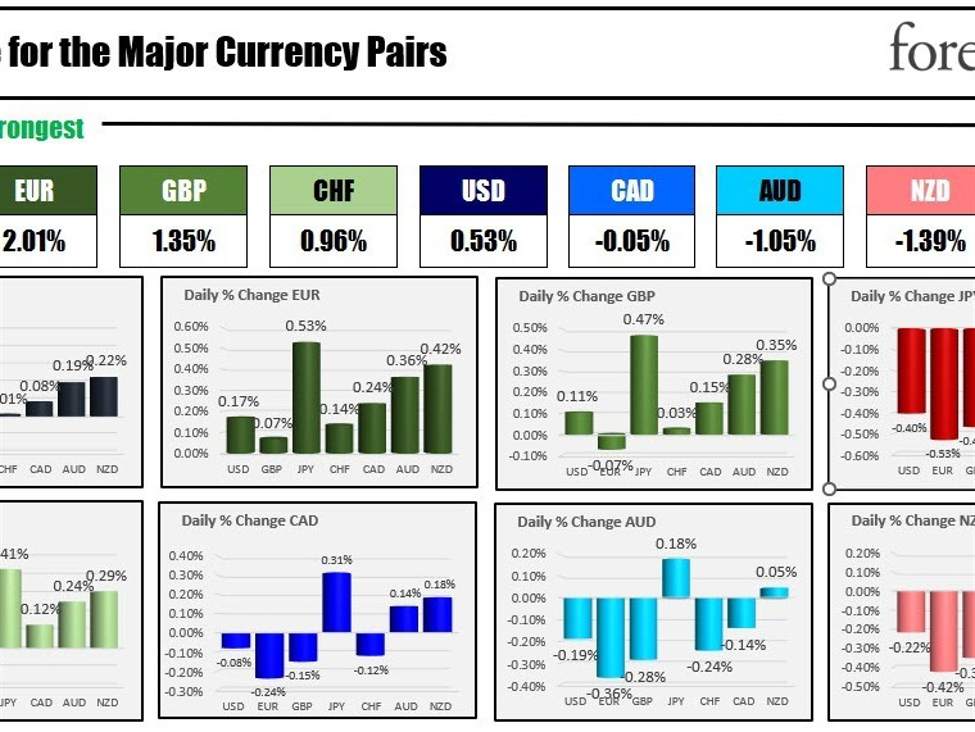

The strongest to the weakest of the major currencies

The EUR is the strongest and the JPY is the weakest as the North American session begins. The USD is mixed with the USDJPY the biggest mover vs the greenback (+0.40%). The USD is lower vs the EUR and the GBP to start the US trading day.

U.S. Treasury yields mostly decreased as traders returned from the Columbus Day holiday and moved into the safety of American debt due to escalating conflicts in Gaza. In addition, comments by two high-ranking Federal Reserve officials’ yesterday also eased concerns about further monetary policy tightening, leading to a decrease in yields. The sharp rise in 10-year Treasury yields since the Fed’s last meeting in September has prompted a reassessment of whether this is due to a stronger economic outlook or investors seeking higher returns for interest rate risk. Dallas Fed President Lorie Logan suggested that higher yields might reduce the need to increase the key Fed funds rate. Fed Vice Chair Philip Jefferson emphasized caution due to the surge in long-term yields. Market participants are awaiting other Fed officials’ views. Also, the key consumer price data will be released on Thursday. The 10-year Treasury note yield fell to a low of 4.63% during Asian trading but has moved back to 4.70% near the start of US trading. The 2-year yield dropped to a low of 4.932%, and the 30-year yield to 4.804%, but are back up at 5.01% and 4.876% respectively. Fed’s Waller and Kashkari are expected to speak today.

Oil prices are fairly steady in trading today as investors ponder the impact of the Israel-Hamas conflict on supply. U.S. crude futures are down modestly after a 4.34% surge on Monday, following Hamas’s significant assault on Israel and subsequent Israeli air strikes on Gaza. There are concerns that the conflict could escalate and affect the already strained supply in the Middle East. The Israeli defense forces have taken back areas taken by Hamas terrorists over the weekends. Meanwhile, Hamas threatens to execute hostages the reaction to Israeli strikes.

In China overnight, Country Garden’s shares plummeted over 10% after the Chinese property developer missed a repayment on an international loan, indicating potential default. The company admitted facing significant sales pressure, with contracted sales dropping 80.7% YoY in September. Yesterday, Fed official comments indicated a concern for the China economy. This is certainly a concern.

A snapshot of the markets as the NA session gets underway shows:

- Crude oil is trading down $-0.50 or -0.58% at $85.88. At this time yesterday, the price was at $86.07.

- Spot gold is trading down -$4.64 or -0.25% at $1856.67. At this time yesterday, the price is trading at $1848.88.

- Spot silver is trading down $0.18 or -0.86% at $21.66. At this time yesterday the price is trading at $21.62.

- Bitcoin is trading at $27,576. At this time yesterday the price is trading at $27,460.

In the US premarket for US stocks, futures are implying a modestly higher open

- Dow Industrial Average futures are implying a gain of 59 points. Yesterday the index rose 197.07 points

- S&P index futures are implying a gain of 4.5 points. Yesterday the index rose 27.16 points

- NASDAQ futures are implying a gain of 20.5 points. Yesterday the index rose 52.90 points

In the European equity markets, the major indices are rebounding to the upside with solid gains:

- German DAX, up 1.62%

- France’s CAC, up 1.49% %

- UK’s FTSE 100, up 1.64%

- Spain’s Ibex, up 1.82%

- Italy’s FTSE MIB, up 1.82% (10 minute delay)

In the US debt market, markets are reopened after yesterday’s Columbus Day holiday

- 2-year yield, 5.013% -6.5 basis points

- 5-year yield, 4.660% -8.8 basis points

- 10-year yield, 4.700% -8.1 basis points

- 30-year yield, 4.876% -6.6 basis points

- The 2 – 10 year spread is trading at -31.1 basis points basis points. Last week the high reached -26.4 basis points

In the European debt market, benchmark 10-year yields are trading higher:

European benchmark 10 year yields