Forex markets have found a moment of stability in today’s Asian trading session, with Dollar taking a breather as it looks for fresh catalysts to continue this week’s rally. All eyes are now on the upcoming ISM Services data, which could prove pivotal for Dollar’s trajectory.

Services sector has emerged as the main engine of growth for US economy this year, overshadowing the manufacturing sector that has slipped into contraction. Whether we’re discussing jobs growth, inflation, or consumer spending, the services sector remains the cornerstone of economic resilience. A strong showing in ISM Services data could extend Dollar’s rally, underpinning the narrative of a resilient US economy amid global uncertainties.

Conversely, a surprising downturn in services could put the brakes on the Dollar, aligning it more closely with slowing economic trends observed in Eurozone and UK.

As of now, Dollar reigns as this week’s strongest performer, followed by the Sterling and Swiss Franc. On the flip side, Australian Dollar has emerged as the weakest, with New Zealand Dollar not far behind. Yen’s decline has decelerated after Japan’s verbal intervention but still ranks as the third weakest performer this week. Meanwhile, Euro and Canadian Dollar are trading mixed, with traders keenly watching today’s BoC rate decision where a hold on interest rates is widely expected.

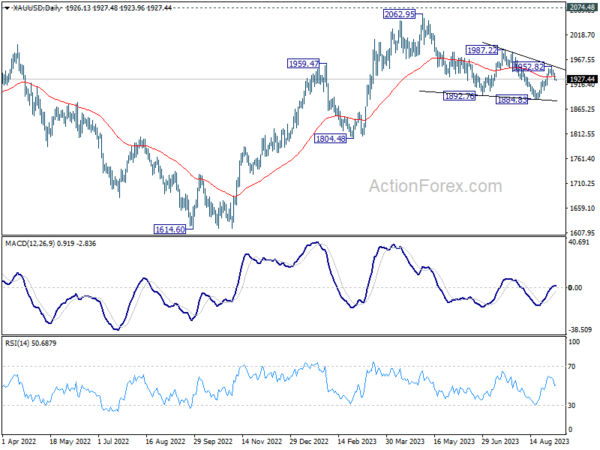

Technically speaking, both Gold and Silver have experienced significant declines this week, largely due to Dollar’s strength. Gold appears to have completed its rebound at 1952.82 from 1844.83. Corrective pattern from 2062.95 is likely extending with another falling leg towards 1884.83 support again in the near term.

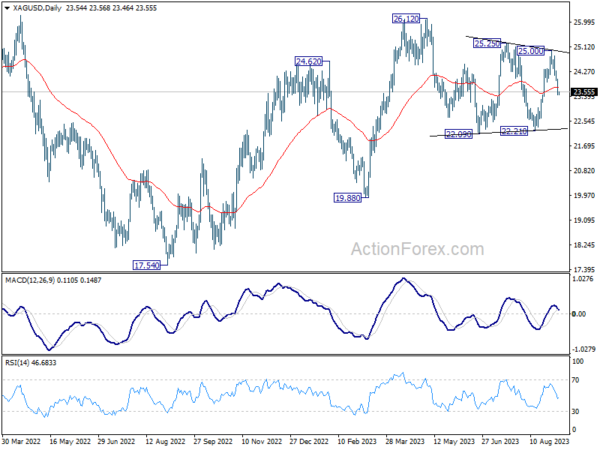

Silver’s scenario echoes Gold’s, having completed its rebound at 25.00 from 22.21. Further fall towards 22.21 seems imminent. Both Gold and Silver are likely to remain under pressure as long as their respective resistance levels at 1952.82 and 25.00 hold.

Overnight, DOW dropped -0.56%. S&P 500 dropped -0.42%. NASDAQ dropped -0.08%. 10-year yield rose 0.091 to 4.376. In Asia, at the time of writing, Nikkei is up 0.41%. Hong Kong HSI is down -0.78%. China Shanghai SSE is down -0.32%. Singapore Strait Times is down -0.21%. Japan 10-year JGB yield is up 0.0012 at 0.659.

Japan’s Kanda flags “high urgency” as Dollar bears 148 Yen

Japan’s Vice Minister of Finance for International Affairs, Masato Kanda, issued a strong warning as Dollar approaches 148 yen, marking a high for this year.

Kanda stated, “We are closely monitoring the situation, with a high sense of urgency. If such moves continue, the government will take appropriate measures, and all options are on the table.”

These remarks are the first significant warning since the Ten dropped below the 145-per-dollar mark in mid-August. Since then, Japanese authorities had been relatively silent.

With the declared “high sense of urgency”, Japan has effectively put currency traders on alert for potential intervention or other policy moves. The “all options are on the table” comment raises the possibility of multiple policy actions, ranging from more verbal warnings to more market interventions to curb yen’s fall.

BoJ’s Takata signals new dawn in wage-price cycle

BoJ board member Hajime Takata highlighted in a speech today the significant shifts in firms’ behavior on price-setting and wages, leading to a budding “virtuous cycle between wages and prices” in Japan.

The existence of the virtuous wage-price cycle, if it sustains, could give BoJ more room to navigate its monetary policy and prompt an exit from the ultra-loose monetary policy, particularly if it’s accompanied by “proactive and forward-looking efforts by firms” and appropriate “policy responses by the government.”

“My understanding is that, on the whole, firms’ price-setting behavior has changed from that observed during the deflation period,” Takata said. This shift in behavior indicates that Japanese firms, traditionally cautious in raising prices, are beginning to pass on increased costs to consumers.

The significant point here is not merely the change but also the why of the change. According to Takata, firms’ new willingness to adjust selling prices upwards is “likely because consumption has been solid even when prices have been rising, underpinned by standby funds that accumulated during the pandemic and by pent-up demand.”

Another key takeaway is the substantial change in firms’ wage-setting behavior. “As reflected in the results of the annual spring labor-management wage negotiations this year, firms’ wage-setting behavior has changed, leading to wage increases and moves to pass on higher wage costs to selling prices,” Takata highlighted. This wage growth has, in turn, boosted consumer sentiment, potentially setting the stage for a self-sustaining cycle of growth and inflation.

What financial markets should keep an eye on are the upcoming annual spring labor-management wage negotiations. Takata expects a “relatively high wage growth rate,” given that labor shortages and high inflation rates are likely to continue.

Australia GDP grew 0.4% qoq on capital investment and services exports

Australia’s GDP saw 0.4% qoq growth in Q2, aligning perfectly with market expectations. This marks the seventh consecutive quarter of economic growth for the nation. The economy exhibited resilience with a 3.4% annual growth rate for 2022-23 financial year, comfortably surpassing 10-year pre-pandemic average of 2.6%.

However, it wasn’t all good news: nominal GDP dropped by -1.2% qoq in the June quarter. GDP implicit price deflator also fell -1.5%, primarily due to -7.9% decline in terms of trade. Export prices fell by -8.2%, exceeding -0.3% fall in import prices. Despite this, domestic price growth remained stable at 1.2%, buoyed by increases in household rents, food prices, and the cost of capital goods, which escalated due to Australian Dollar’s depreciation.

The positive quarterly GDP numbers were largely driven by two key factors: capital investment and the exports of services. Total gross fixed capital formation surged by 2.4%, reflecting growth in both public and private investment sectors.

Services exports soared 12.1%, with a significant push coming from 18.5% uptick in travel services.

Net trade in goods added 0.5% to GDP, with 2.5% rise in goods exports led mainly by mining commodities.

Household spending, on the other hand, remained rather muted, contributing just 0.1T to the GDP growth with modest 0.1% increase.

BoC to pause today after surprised Q2 GDP contraction

BoC is widely anticipated to maintain its current interest rate of 5.00% today. This expected pause in rate adjustments comes on the heels of surprising economic contraction in Canada, with the GDP shrinking at an annualized rate of -0.2% in Q2. The contraction signals the onset of economic slowdown, a stark contrast to the relatively robust performance seen in previous quarters.

Although July’s inflation rate of 3.3% remains well above BoC’s target, weakening economic backdrop is likely to bolster policymakers’ confidence that inflation will gradually fall back to target over time. The slower economy could apply downward pressure on prices, providing the central bank with some breathing room to keep rates unchanged for now.

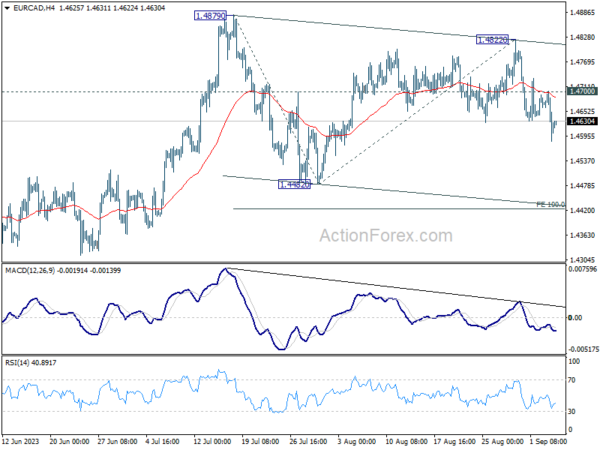

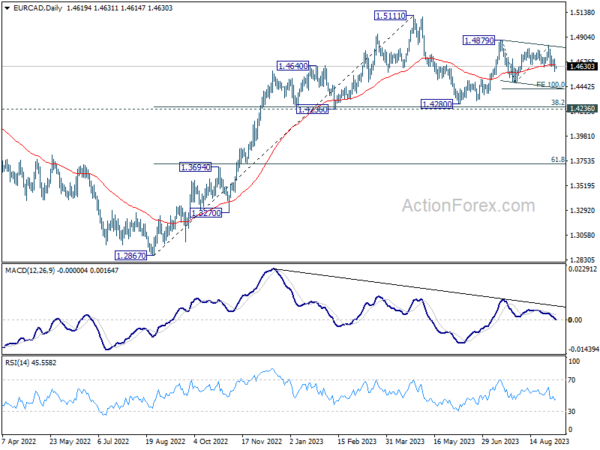

EUR/CAD’s decline since last week suggests that recovery from 1.4482 has completed at 1.4822 already, ahead of 1.4879 resistance. For now, price actions from 1.4879 are seen as a consolidation pattern only, and thus, rise from 1.4280 should resume after this pattern completes. Hence, while deeper fall is in favor in the near term as long as 1.4700 resistance holds, downside should be contained by 100% projection of 1.4879 to 1.4482 from 1.4822 at 1.4425.

On a broader scale, price actions from 1.5111 are seen as a corrective pattern only and the up trend from 1.2867 is not over. The lingering question is whether the rise from 1.4280 constitutes the second leg of a medium-term pattern or signifies a resumption of the upward trend. More clarity on this could emerge once the current consolidation phase from 1.4879 completes.

Looking ahead

Germany factory orders, UK PMI construction and Eurozone retail sales will be released in European session. US ISM services will be the main event later in the day, together with BoC rate decisions. Both US and Canada will also publish trade balance. Fed will also release Beige Book economic report.

USD/JPY Daily Outlook

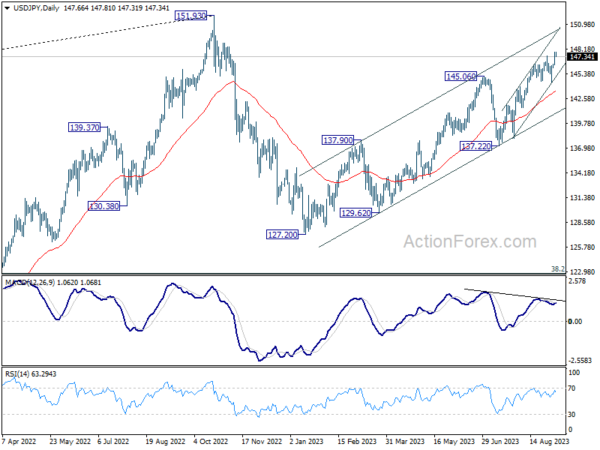

Daily Pivots: (S1) 146.82; (P) 147.31; (R1) 148.22; More…

Intraday bias in USD/JPY remains on the upside at this point. Current rally is part of the whole rise from 127.20, and should target a test on 151.93 high. On the downside, below 146.40 minor support will turn intraday bias neutral first. But near term outlook will stay bullish as long as 144.43 support holds, in case of retreat.

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | GDP Q/Q Q2 | 0.40% | 0.40% | 0.20% | |

| 06:00 | EUR | Germany Factory Orders M/M Jul | -4.30% | 7.00% | ||

| 08:30 | GBP | Construction PMI Aug | 49.8 | 51.7 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Jul | -0.20% | -0.30% | ||

| 12:30 | CAD | Labor Productivity Q/Q Q2 | -0.10% | -0.60% | ||

| 12:30 | CAD | Trade Balance (CAD) Jul | -3.5B | -3.7B | ||

| 12:30 | USD | Trade Balance (USD) Jul | -67.9B | -65.5B | ||

| 12:30 | USD | Goods Trade Balance Jul | $-91.2B | |||

| 13:45 | USD | Services PMI Aug F | 51 | 51 | ||

| 14:00 | USD | ISM Services PMI Aug | 52.6 | 52.7 | ||

| 14:00 | CAD | BoC Interest Rate Decision | 5.00% | 5.00% | ||

| 18:00 | USD | Fed’s Beige Book |