Earlier preview is here:

July non-farm payrolls preview: ADP vs ISM edition

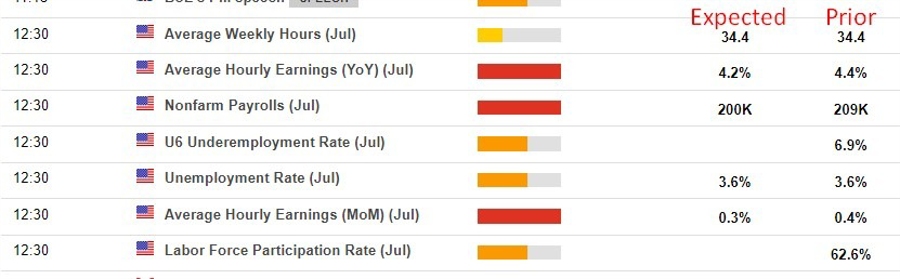

The data is due at 1230 GMT, which is 0830 US Eastern time.

Deutsche Bank:

- While our economists expect some payback from state and local government education hiring for the headline print (+175k forecast, consensus at +200k vs. +209k previously), they expect a slight pick up in private (+175k vs. +149k) payrolls inline with consensus. This would be below the three-month averages for headline (+244k) and private (+196k) payrolls gains.

- Watch out for average hourly earnings and hours worked as well.

CIBC:

- Initial jobless claims eased over the July survey reference period, suggesting that a healthy 185K jobs could have been created in the US. That’s in line with the climb in participation seen lately in the prime-age working group, which coincides with a drawdown of excess savings. Still strong demand for workers, as evidenced by elevated job openings, suggests that new labor force entrants are being absorbed quickly into vacant positions.

- The unemployment rate could have remained steady at 3.6%, while a rise in participation also would have left more room for hiring without putting additional upwards pressure on wages, which likely slowed to 0.3% MoM. We’re slightly lower than the consensus on hiring which could result in bond yields falling.

Scotia:

- Federal Reserve Chair Powell made it very clear that the FOMC is extremely data-dependent as it plots the long path ahead toward the next decision on September 20th. … Key will be Friday’s nonfarm payrolls report and wages for the month of July. I’ve gone with a guesstimated gain of 250k and an unchanged unemployment rate of 3.6% with wage growth pegged at another 0.4% m/m SA nonannualized gain. That should keep trend wage growth running at a healthy clip that is expected to remain above the rate of inflation and drive real wage gains

This article was originally published by Forexlive.com. Read the original article here.