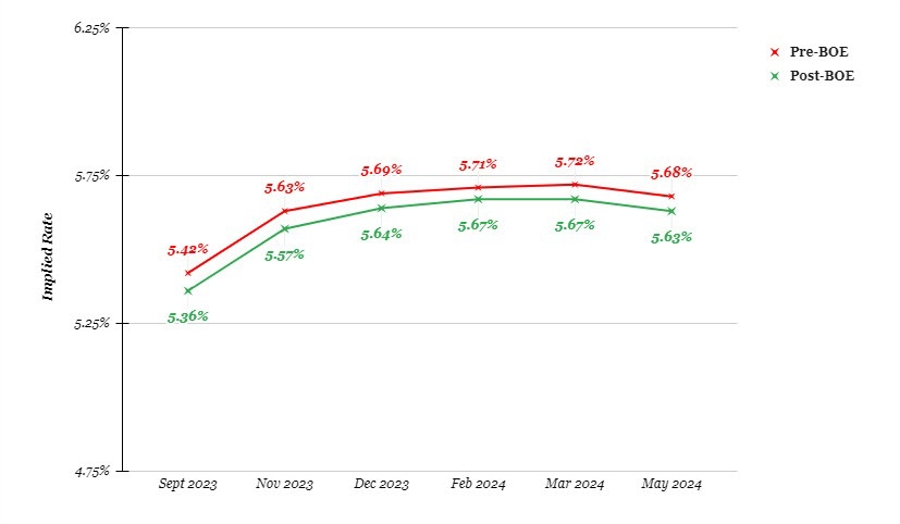

Here’s a look at how the OIS curve has shifted before and after the BOE policy decision today:

It’s not much of a change in general as the BOE continues to allude to the fact that they are going to keep tightening policy further so long as the data suggests so. That is regardless of the fact that they have acknowledged that rates are now in restrictive territory.

So, yes there might be some backlash against the fact that traders have priced in roughly 32% odds of a 50 bps move today. However, it is not to say that the trajectory of where rates will end up is wrong or anything in that ballpark. There’s still a strong likelihood of two more rate hikes to come (which was what is priced in before) and that hasn’t changed.

For the pound, that means traders have some things to work out. On the one hand, there will be those “disappointed” by a 25 bps move instead of a 50 bps move. But when you drill down to the overall pricing picture, it’s not to say that whatever that was priced in previously is being invalidated. Instead, I would argue that it is being reaffirmed instead.

Now, over to Bailey to see how he will follow through on this.