Yen extended its late last week’s slide in Asian session today, a downward trajectory that prevailed despite a notable ascent in 10-year JGB yields above the 0.6% mark. Market watchers seemed to have absorbed BoJ’s recent communication effectively — that the added flexibility to its yield curve control doesn’t suggest an impending tightening cycle. As a result, Yen might stay under selling pressure in the short-term, especially if the ongoing investor enthusiasm about Japan’s economic prospects, mirrored in the resilient Nikkei index, holds.

Elsewhere in the currency markets, Swiss Franc and Euro trail Yen as the next weakest currencies, with Euro likely to react to today’s release of Eurozone’s CPI flash data. New Zealand and Australian Dollar are gaining strength, tracking a broad risk appetite in the market despite the continued sluggish economic momentum in China as indicated by PMI data. The picture for Sterling, Canadian and Dollar is more mixed at present, with these currencies awaiting potentially market-moving events including BoC rate decision and job data from both Canada and the US.

Technically, EUR/CHF is worth some attention today. While a short term bottom could be in place at 0.9520, on bullish convergence condition in 4H MACD, it’s way to early to call for trend reversal. Upside surprise in today’s Eurozone CPI flash could prompt further recovery in the cross towards 0.9670 support turned resistance. But as long as this level holds, larger fall from 1.0095 is expected to resume through 0.9520 at a later stage.

In Asia, at the time of writing, Nikkei closed up 126%. Hong Kong HSI is up 1.38%. China Shanghai SSE is up 0.36%. Singapore Strait Times is up 0.16%. Japan 10-year JGB yield is up 0.0594 at 0.610.

ECB Lagarde: A September pause not necessarily definitive

In an interview published in Le Figaro on Sunday, ECB President Christine Lagarde said , “At the next meeting in September, there could be a further hike of the policy rate or perhaps a pause.”

But, she further clarified that “a pause, whenever it occurs, in September or later, would not necessarily be definitive.” This suggests that the ECB remains flexible in its approach to policy adjustments, committed to assessing the economic landscape on a meeting-by-meeting basis.

Elucidating on ECB’s mandate, Lagarde said, “We are committed to returning inflation to our target in a timely manner and for this we need a sufficiently restrictive policy in terms of level and length.”

On a more positive note, Lagarde pointed out that recent Q2 GDP figures for France, Germany, and Spain were “quite encouraging.” These data points, she suggested, lend support to their projection of a 0.9% GDP growth in Eurozone this year.

Fed Kashkari: If we need to hike from here, we will do so

Minneapolis Fed President Neel Kashkari has indicated Fed’s willingness to raise rates if necessary but maintains that the approach will be dictated by incoming data, as he said on CBS’s Face the Nation on Sunday

Kashkari called that a “good progress as core inflation moved from 5.5% a year ago to 4.1%. However, he was quick to caution against complacency, adding, “But it’s still double our 2 percent rate. And so we don’t want to declare victory.”

His emphasis on a flexible, data-driven strategy was further evident in his comments, “If we need to hike — raise rates further from here, we will do so. But we’re going to let the data guide us and not prejudge the outcome.”

On the topic of future rate decisions, Kashkari kept all options open: “September and beyond. You know, we may or may not raise in September, but we also will continue to watch all the data, the inflation data, the wage data, as well as the unemployment data to make those assessments.”

Despite recent uncertainties, Kashkari expressed optimism about the economy’s resilience: “The economy continues to surprise how resilient it is. The base case scenario seems to be that we’ll have a slowing economy, but that we would avoid a recession.”

Japan’s industrial production rose 2.0% mom in Jun, moderately picking up

Japan’s Ministry of Economy, Trade and Industry reported 2.0% mom increase in industrial production in June, below expected 2.4%. This places the seasonally adjusted index of production at factories and mines at 105.3, with 2020 as the base of 100.

Motor vehicles led industrial production growth, surging 6.1% thanks to robust demand in both domestic and overseas markets. Out of 15 industrial sectors covered , 10 sectors saw increased output, while production in five dropped.

Despite the production growth coming in lower than expected, the Ministry maintained its basic assessment, noting that industrial production was “showing signs of moderately picking up.”

Looking ahead, the Ministry’s forecast based on a poll of manufacturers anticipates slight output decline of -0.2% in July, followed by climb of 1.1% in August.

Also released, retail sales rose 5.9% yoy in June, above expectation of 5.4% yoy, picked up from prior month’s 5.7% yoy.

China’s PMI manufacturing ticked up to 49.3, but marked 4th month of contraction

China’s official Manufacturing PMI rose from 49.0 in June to 49.3 in July, slightly above anticipated 49.2. However, it marked the fourth consecutive month that this indicator remained below the 50-point mark separating expansion from contraction on a monthly basis.

Zhao Qinghe, a senior NBS official, indicated that while there was a slight rebound, many enterprises reported experiencing a “complicated and severe” external environment. In his statement, Zhao stated, “overseas orders have decreased, and insufficient demand is still the main difficulty faced by enterprises.”

Meanwhile, Non-Manufacturing PMI, which measures activity in both services and construction sectors, dropped from 53.32 to 51.5, missing the expected 53.1, marking its fourth straight monthly decline. The services subindex fell from 52.8 to 51.5, while the construction subindex saw a significant drop from 55.7 to 51.2.

Composite PMI, which provides a broader picture of the economy, also declined from 52.3 in June to 51.1 in July, reflecting the challenges faced by both the manufacturing and non-manufacturing sectors.

NZ ANZ business confidence rose to -13.1, highest since Sep 2021

New Zealand’s business confidence has reached its highest point since September 2021, with ANZ Business Confidence Index improved from -18.0 to -13.1. Although this remains in the negative territory, it shows a relative boost in optimism.

Looking at the details, Own Activity Outlook, a measure of businesses’ expectations of their own activity, experienced a slight drop from 2.7 to 0.8. However, various components of the index witnessed improvements. Export intentions increased from -1.8 to 1.5, indicating a renewed confidence in overseas markets. Both investment and employment intentions showed minor improvements.

Inflation indicators were mixed, with cost expectations climbing from 76.0 to 80.6, while inflation expectations saw a slight ease from 5.29% to 5.14%. At the same time, profit expectations and pricing intentions edged slightly lower.

Despite expecting a recession and rising unemployment, ANZ’s view on the current economic environment is that it’s “patchy rather than capitulating,” suggesting that although there are definite challenges ahead, New Zealand’s economy might show more resilience than expected.

RBA and BoE, US NFP and ISM, EZ CPI, China PMIs, and much more…

As anticipation builds for the imminent policy meetings of RBA and BoE, and a slew of significant economic data, the global financial markets are poised for more volatility. The only question is which event is more impactful.

Opinions are split regarding policy action of RBA, following Q2 inflation data that indicated more rapid cooling than anticipated. According to a Reuters poll, a slender majority of 55% surveyed economists expect another 25bps increase to 4.35%, while the remaining experts forecast a pause. Regardless, a strong consensus points towards an eventual peak rate of 4.35% by the end of September, suggesting that the debate centers around the timing of the next hike – this week or the next month. Market participants are equally, if not more, interested in RBA’s new economic projections.

Across the globe, BoE is widely anticipated to increase rates, with the consensus veering towards a 25bps hike to 5.25%. However, given the surprise 50bps rise in June, a similar move can’t be entirely discounted. The MPC could opt for a bolder stance to underscore their commitment to combating inflation. Irrespective of the decision this week, it is generally accepted that the current tightening cycle is not nearing its conclusion, with peak rates projected to hit 5.75% or potentially even higher. An added layer of intrigue will be the voting behavior of new MPC member Megan Greene, who has stepped into the shoes of known dove Silvana Tenreyro. Alongside the rate decision, BoE will also release its latest economic forecasts.

In addition to these central bank decisions, a host of critical economic data is poised to shape market trends this week. In US, spotlights will be on non-farm payroll report and ISM indexes. However, these are not the sole determinants of market sentiment. Equally significant would be Eurozone’s CPI and GDP figures. Furthermore, indicators such as China’s PMIs, Canadian employment statistics, Swiss CPI, and New Zealand’s employment data will also command close attention from investors.

Here are some highlights for the week:

- Monday: Japan industrial production, retail sales, consumer confidence; New Zealand ANZ business confidence; China official PMIs; Germany import prices, retail sales; Swiss retail sales; UK M4 money supply, mortgage approvals; Eurozone CPI, GDP; US Chicago PMI.

- Tuesday: New Zealand building permits; Japan unemployment rate, PMI final; Australia RBA rate decision; China Caixin PMI manufacturing; Eurozone PMI manufacturing final, unemployment rate; Germany unemployment; UK PMI manufacturing final; Canada PMI manufacturing; US ISM manufacturing, construction spending.

- Wednesday: New Zealand employment; Japan monetary base, BoJ minutes; Swiss SECO consumer climate, PMI manufacturing; US ADP employment.

- Thursday: Australia trade balance; China Caixin PMI services; Germany trade balance; Swiss CPI; Eurozone PMI services final, PPI; UK PMI services final, BoE rate decision; US jobless claims, nonfarm productivity; ISM services, factory orders.

- Friday: RBA monetary policy statement; Germany factory orders; France industrial production; UK PMI construction; Eurozone retail sales; Canada employment, Ivey PMI; US non-farm payroll.

GBP/JPY Daily Outlook

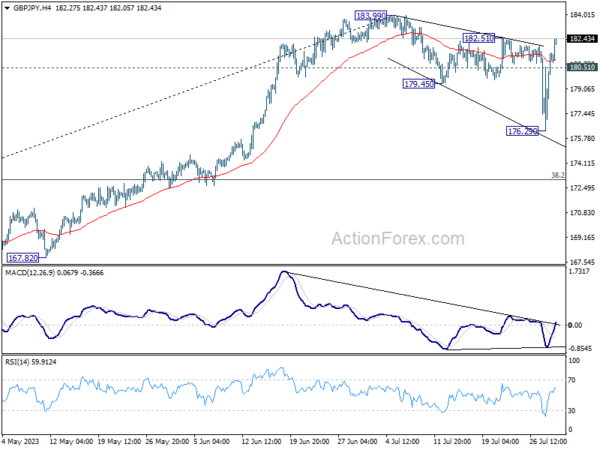

Daily Pivots: (S1) 178.01; (P) 179.75; (R1) 183.18; More…

Immediate focus is now on 182.51 resistance in GBP/JPY. Firm break there should confirm that whole corrective pattern from 183.99 has completed with three waves down to 176.29. Further rally should be seen through 183.99 to resume larger up trend. Break of 180.51 minor support will argue that the corrective pattern is extending with another falling leg. But overall, outlook will stay bullish as long as 38.2% retracement of 155.33 to 183.99 at 173.04holds, in case of another dip.

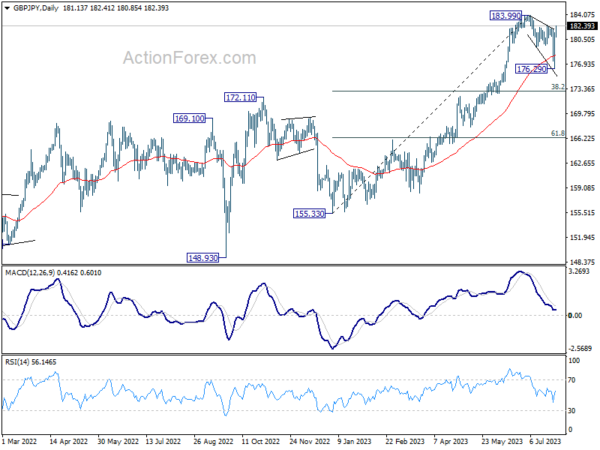

In the bigger picture, as long as 172.11 resistance turned support holds, up trend from 123.94 (2020 low) is expected to continue through 183.99 at a later stage, towards 195.86 (2015 high). Nevertheless, firm break of 172.11 will argue that larger correction is already underway.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jun P | 2.00% | 2.40% | -2.20% | |

| 23:50 | JPY | Retail Trade Y/Y Jun | 5.90% | 5.40% | 5.70% | |

| 01:00 | CNY | NBS Manufacturing PMI Jul | 49.3 | 49.2 | 49 | |

| 01:00 | CNY | Non-Manufacturing PMI Jul | 51.5 | 53.1 | 53.2 | |

| 01:00 | NZD | ANZ Business Confidence Jul | -13.1 | -18 | ||

| 01:00 | AUD | TD Securities Inflation M/M Jul | 0.80% | 0.10% | ||

| 01:30 | AUD | Private Sector Credit M/M Jun | 0.20% | 0.40% | 0.40% | |

| 05:00 | JPY | Housing Starts Y/Y Jun | -4.80% | -0.20% | 3.50% | |

| 05:00 | JPY | Consumer Confidence Index Jul | 37.1 | 37 | 36.2 | |

| 06:00 | EUR | Germany Import Price Index M/M Jun | -0.80% | -1.40% | ||

| 06:00 | EUR | Germany Retail Sales M/M Jun | -0.20% | 0.40% | ||

| 08:00 | EUR | Italy GDP Q/Q Q2 P | 0.00% | 0.60% | ||

| 08:30 | GBP | Mortgage Approvals Jun | 49K | 51K | ||

| 08:30 | GBP | M4 Money Supply M/M Jun | 0.50% | 0.20% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.20% | -0.10% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Jul P | 5.30% | 5.50% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul P | 5.40% | 5.50% | ||

| 13:45 | USD | Chicago PMI Jul | 43.5 | 41.5 |