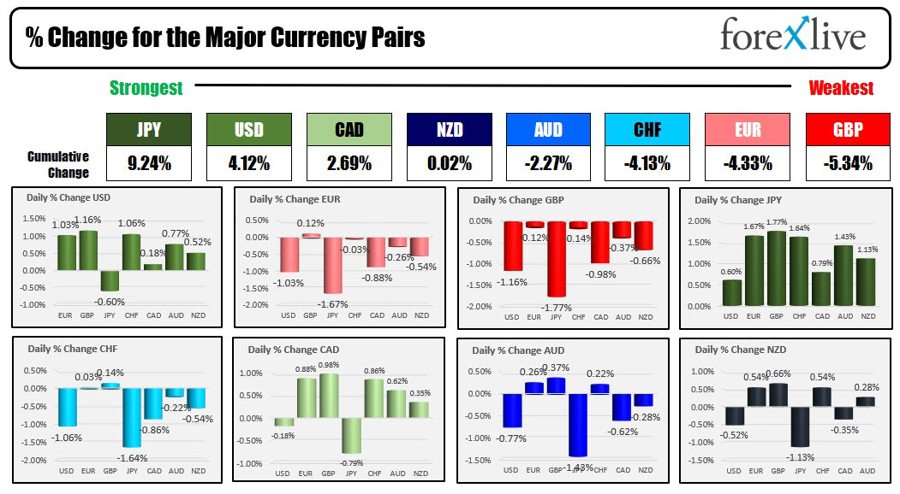

The JPY is the strongest and the GBP is the weakest of the major currencies.

The strongest to weakest of the major currencies

The day started with the ECB hiking rates by 25 basis points as expected. Shortly thereafter, a slew of economic data the US was released with all showing better than expected data. Initial jobless claims came in at 221K versus estimated 235K. Durable goods orders were much stronger than expected at 4.7% versus 1.0%. Second-quarter GDP in the US was also higher at 2.4% versus 1.8%.

The data sent the US dollar higher, yields higher, and also advanced US stocks. The Dow Industrial Average was coming off its 13th consecutive day to the upside yesterday. A close higher today would be the longest streak since 1897 (when earnings rose for 14 consecutive days).

ECB’s Lagarde presser was next, and her comments were more dovish and help to push the dollar even higher (and the EUR lower).

The USDJPY was also extended to the upside and traded above its 100-hour movie average at 140.888. However, around the time the U.S. Treasury auctioned off seven-year notes with tepid demand, a report from a Nikkei came out saying that the Bank of Japan was discussing tweaking the yield curve controls. Recall from last week comments to the contrary were released sending the JPY lower.

The USDJPY quickly turned around and fell sharply. The low price extended to 138.76 before bouncing toward 139.40 currently. JPY crosses also fell sharply with the:

- GBPJPY -1.77%

- EURJPY, -1.67%

- CHFJPY, -1.64%

- AUDJPY, -1.43%

- NZDUSD, -1.13%

The USDJPY is ending the day down -0.60% after trading higher earlier in the day. The EURJPY was up 83 pips at session highs today. It is currently trading down -237 pips.

Stocks reversed lower and the Dow string of up days was snapped at 13.

- Dow Industrial Average fell -237.40 points or -0.67% at 35282.73

- S&P index fell -29.34 points or -0.64% at 4537.40

- NASDAQ index fell -77.18 points or -0.55% at 14050.10

The earnings releases after the close, showed the BEATs continue to outpace the MISSes. Tomorrow we will see if the declines today will see gains again tomorrow.

Skechers U S A Inc (SKX): BEAT

- EPS: $0.98, expected: $0.54

- Revenue: $2.01bn, expected: $1.93bn

Dexcom Inc (DXCM): BEAT

- Adj. EPS: $0.34, expected: $0.23

- Revenue: $876m, expected: $840m

First Solar Inc (FSLR): BEAT

- EPS: $1.59, expected: $0.96

- Revenue: $811m, expected: $720m

Live Nation Entertainment Inc (LYV): BEAT

- EPS: $1.02, expected: $0.63

- Revenue: $5.63bn, expected: $4.95bn

KLA Corp (KLAC): BEAT

- EPS: $4.97, expected: $4.85

- Revenue: $2.355bn, expected: $2.26bn

Roku Inc (ROKU): BEAT

- EPS: -$0.76, expected: -$1.27

- Revenue: $815m, expected: $770m

Mondelez International Inc (MDLZ): BEAT

- Adj. EPS: $0.76, expected: $0.69

Ford Motor Co (F): BEAT

- Adj. EPS: $0.72, expected: $0.55

- Revenue: $45bn, expected: $40.38bn

T-Mobile US Inc (TMUS): MISS

- EPS: $1.86, expected: $1.69

- Revenue: $19.2bn, expected: $19.31bn

Intel Corp (INTC): BEAT

- Adj. EPS: $0.13, expected: -$0.03

- Revenue: $12.90bn, expected: $12.13bn

Looking at other markets as the day comes to a close:

- Crude oil is trading at $1.08 or 1.37% at $79.86

- Gold is trading down $26 or -1.35% at $1944.73

- Silver is trading down $0.78 or 3.17% at $24.11

- Bitcoin is trading lower at $29,159 after trading around $29,500 at the start of this training session today

In the US a debt market, yields moved higher today after the better expected data (remember the Fed is a data dependent):

- 2 year yield 4.96%, +9.9 basis points

- 5 year yield 4.233%, +14.7 basis points

- 10 year yield 4.022%, +15.1 basis points

- 30-year-yield 4.039 per percent +11.2 basis points

Bank of Japan on tap next.

Thanks for your support. Good fortune with you trading.