Sterling continues its descent, which was spurred on by the fallout from UK CPI data, in early US session. The odds of a 50 bps rate hike from BoE in August are being reassessed, now standing at a mere 50% probability. Furthermore, expectations of a peak rate have also dipped, falling below the 6% threshold.

Australian Dollar is taking a hit as well, assuming the position of the second weakest currency for the day. This downturn is occurring concurrently with the Chinese Yuan and Copper prices. Yen, while the third weakest, is likely to face limited selling, at least until release of Japan’s inflation data on Friday.

Conversely, Dollar, along with Swiss Franc and Euro, is showing signs of strength. The greenback’s decline started slowing earlier in the week and there is prospect of a stronger recovery. However, the momentum of Dollar is more likely to be influenced by developments in other major currencies rather than its own intrinsic factors.

Technically, Copper’s fall from 3.942 is currently seen as the third leg of the pattern from 3.9501 only. While deeper decline cannot be ruled out, downside should be contained above 3.6706 support. Indeed, break above 3.843 minor resistance will bring stronger rebound back to retest 3.9420/9501 resistance zone. In case of a rebound, AUD/USD would likely follow higher, even if there is slight downside surprises in Australia employment data tomorrow.

In Europe, at the time of writing, FTSE is up 1.68%. DAX is down -0.16%. CAC is up 0.12%. Germany 10-year yield is down -0.0054 at 2.383. Earlier in Asia, Nikkei rose 1.24%. Hong Kong HSI dropped -0.33%. China Shanghai SSE rose 0.03%. Singapore Strait Times rose 0.64%. Japan 10-year JGB yield dropped -0.0195 to 0.467.

Eurozone CPI finalized at 5.5% in Jun, core CPI at 5.5%

Eurozone CPI was finalized at 5.5% yoy in June, down from May’s 6.1% yoy. Core CPI (excluding energy, food, alcohol & tobacco) was finalized at 5.5% yoy, up from May’s 5.3% yoy.

The highest contribution to annual Eurozone inflation rate came from food, alcohol & tobacco (+2.35%), followed by services (+2.31%), non-energy industrial goods (+1.42%) and energy (-0.57%).

EU CPI was finalized at 6.4% yoy, down from May’s 7.1% yoy. The lowest annual rates were registered in Luxembourg (1.0%), Belgium and Spain (both 1.6%). The highest annual rates were recorded in Hungary (19.9%), Slovakia (11.3%) and Czechia (11.2%). Compared with May, annual inflation fell in twenty-five Member States, remained stable in one and rose in one.

UK CPI eased to 7.9% in Jun, core CPI down to 6.9%, both below expectations

UK CPI slowed from 8.7% yoy to 7.9% yoy in June, below expectation of 8.2% yoy. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 7.1% yoy to 6.9% yoy, below expectation of staying unchanged at 7.1% yoy.

CPI goods slowed from 9.7% yoy to 8.5% yoy. CPI services also eased from 7.4% yoy to 7.2% yoy.

On a monthly basis, CPI rose just 0.1% mom, down from May’s 0.7% mom. Falling prices for motor fuel led to the largest downward contribution to the monthly change.

Also released, RPI came in at 0.3% mom, 10.7% yoy, versus expectation of 0.3% mom, 10.9% yoy. PPI input was at -1.3% mom, 2.7% yoy. PPI output was at -0.3% mom, 0.1% yoy. PPI core output was at -0.20% mom, 3.00% yoy.

New Zealand’s Q2 CPI beats expectations despite slowdown

New Zealand’s CPI experienced a slightly slowed but stronger-than-expected rise in Q2, registering 1.1% qoq increase compared to Q1’s 1.2% qoq. This exceeded the anticipated 0.9% qoq rise for the quarter. Year-on-year inflation also surpassed expectations, with 6.0% yoy rise as opposed to expected 5.9% yoy, despite slowdown from 6.7% yoy in the previous quarter.

StatsNZ, New Zealand’s pointed out that food prices, which rose 2.2% qoq and 12.3% yoy, were the primary drivers of Q2 annual inflation rate. Rising prices for vegetables, ready-to-eat food, and dairy products like milk, cheese, and eggs played a significant role. Housing and household utilities, another crucial sector, experienced quarterly increase of 1.2% qoq and 6.0% yoy increase annually.

On analyzing the CPI data further, it was found that excluding food, inflation increased by 4.6% yoy. Excluding housing and household utilities, it increased by 6.1% yoy. When excluding alcoholic beverages and tobacco, the annual increase stood at 5.9% yoy. CPI increased by 6.1% yoy when food, household energy, and vehicle fuels were excluded.

Australia leading index records 11th consecutive negative month

Australia’s Westpac Leading Index rose to -0.51% in June from -1.01% in May, marking the eleventh consecutive negative print. This trend indicates that the Australian economy is likely to operate below its potential trend over the six to nine months outlook.

In light of these results, Westpac maintains a modest forecast for Australian economic growth. It expects modest expansion of 0.3% over the year to June 2024, with contraction in consumer spending of -0.2%.

Commenting on the upcoming RBA meeting on August 1, Westpac anticipates a 25 bps hike in interest rate. It noted, “By the August meeting we expect that the Board will be dealing with an inflation read still above 6%; an unemployment rate registering nearly 1ppt below the Board’s current estimate of full employment; and the recent report from the national accounts showing unit labour costs growing at 7.9% over the year.”

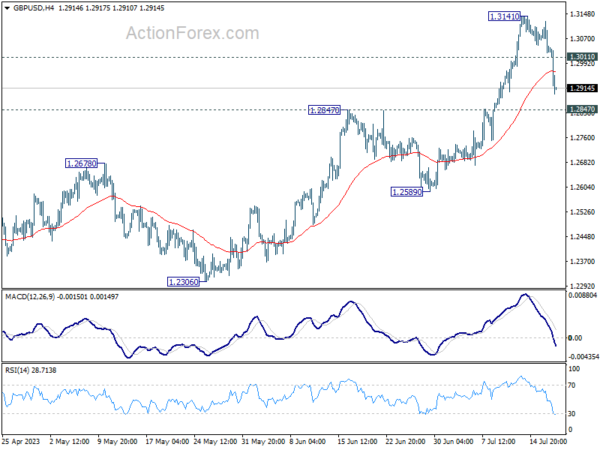

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3000; (P) 1.3063; (R1) 1.3098; More…

GBP/USD’s correction from 1.3141 is still in progress and deeper decline could be seen. But near term outlook will stay bullish as long as 1.2847 resistance turned support holds. On the upside, above 1.3011 minor resistance will turn bias back to the upside for retesting 1.3141 high. Nevertheless, decisive break of 1.2847 will argue that larger correction is underway and target 1.2589 support next.

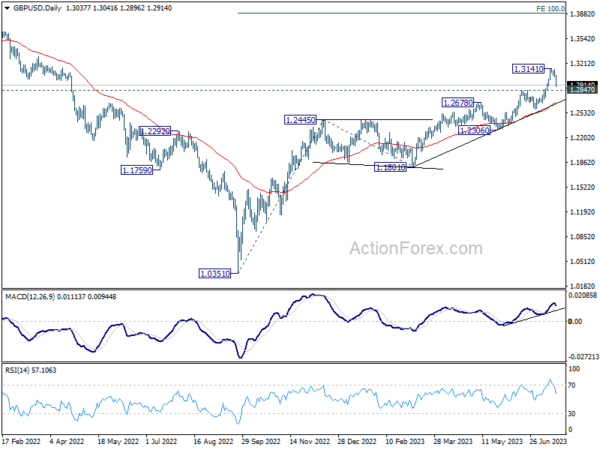

In the bigger picture, rise from 1.0351 medium term bottom (2022 low) is in progress. Next target is 100% projection of 1.0351 to 1.2445 from 1.1801 at 1.3895. Break there will target 1.4248 key long term resistance (2021 high) next. This will now remain the favored case as long as 1.2678 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q2 | 1.10% | 0.90% | 1.20% | |

| 22:45 | NZD | CPI Y/Y Q2 | 6.00% | 5.90% | 6.70% | |

| 00:30 | AUD | Westpac Leading Index M/M Jun | 0.10% | -0.30% | ||

| 06:00 | GBP | CPI M/M Jun | 0.10% | 0.40% | 0.70% | |

| 06:00 | GBP | CPI Y/Y Jun | 7.90% | 8.20% | 8.70% | |

| 06:00 | GBP | Core CPI Y/Y Jun | 6.90% | 7.10% | 7.10% | |

| 06:00 | GBP | RPI M/M Jun | 0.30% | 0.30% | 0.70% | |

| 06:00 | GBP | RPI Y/Y Jun | 10.70% | 10.90% | 11.30% | |

| 06:00 | GBP | PPI Input M/M Jun | -1.30% | -0.20% | -1.50% | -1.20% |

| 06:00 | GBP | PPI Input Y/Y Jun | -2.70% | -3.30% | 0.50% | |

| 06:00 | GBP | PPI Output M/M Jun | -0.30% | -0.30% | -0.50% | |

| 06:00 | GBP | PPI Output Y/Y Jun | 0.10% | 1.60% | 2.90% | 2.70% |

| 06:00 | GBP | PPI Core Output M/M Jun | -0.20% | -0.20% | -0.30% | -0.50% |

| 06:00 | GBP | PPI Core Output Y/Y Jun | 3.00% | 2.80% | 4.10% | 3.90% |

| 09:00 | EUR | Eurozone CPI Y/Y Jun F | 5.50% | 5.50% | 5.50% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun F | 5.50% | 5.40% | 5.40% | |

| 12:30 | USD | Building Permits Jun | 1.44M | 1.48M | 1.49M | |

| 12:30 | USD | Housing Starts Jun | 1.43M | 1.47M | 1.63M | |

| 14:30 | USD | Crude Oil Inventories | -2.0M | 5.9M |