Asian markets presented a subdued trading environment today, despite overnight rallies in their US counterparts. A notable exception is that Hong Kong’s stock market underwent a significant tumble, taking a step back after a day off. Elsewhere, indices generally hovered around flat levels within a tight range. In the realm of currencies, most major pairs and crosses stayed confined within Monday’s narrow range. While Dollar, Yen, and Canadian dollar found themselves on the weaker side, Aussie and Kiwi are in stronger positions. European currencies showed mixed performance.

Particular attention is directed towards USD/CAD today, with release of Canada’s CPI and US retail sales data on the horizon. Canada’s headline inflation is anticipated to dip further to the top of BoC’s 2-3% target range in June. However, BoC may be more interested in the monthly rise in core inflation, in order to gauge its persistent undercurrent. Other consumer spending and economic activity data will also carry substantial weight as the economy needs to cool off sufficiently to reduce core inflation. Today’s data could evoke a complex response from Loonie.

From a technical standpoint, USD/CAD’s price actions from 1.3976 appear to be merely corrective. Ideally, the pair should bottom around the current level to round off the five-wave decline from 1.3860, as well as the three-wave pattern from 1.3976. Break of 1.3386 resistance would reinforce this outlook and retain medium-term bullishness. Conversely, decisive break of 61.8% projection of 1.3653 to 1.3115 from 1.3386 at 1.3054 might spark a faster descent and increase the probability of a larger bearish trend reversal. The next move, regardless of whether it is triggered by today’s data or not, will be critical.

In Asia, at the time of writing, Nikkei is up 0.02%. Hong Kong HSI is down -2.17%. China Shanghai SSE is down -0.35%. Singapore Strait Times is down -0.17%. Japan 10-year JGB yield is down -0.0009 at 0.479. Overnight, DOW rose 0.22%. S&P 500 rose 0.39%. NASDAQ rose 0.93%. 10-year yield dropped -0.022 to 3.797.

Bundesbank Nagel: We have to be a little bit more patient

Bundesbank President and ECB Governing Council member, Joachim Nagel expects a 25 bps increase for the upcoming July meeting of ECB. As for the meeting in September, Nagel stated on Monday, “we will see what the data will tell us.”

Unlike previous financial cycles, core inflation rates in developed nations are not declining as swiftly, implying a more drawn-out recovery process. Despite this, Nagel dismissed the notion of an over-tightened policy risking a hard landing for Europe as interest rates rise. “It’s too early to really declare a certain kind of victory when it comes to our inflation fight,” Nagel remarked.

Notably, the Bundesbank chief advised patience in the face of these challenges, acknowledging a potentially slower pace in transmission of monetary policy. “This time maybe we have to be a little bit more patient. The pace of the transmission channel is maybe not as fast as it was in the past,” he added.

RBA Jul minutes: Hike considered, hold to reassess in Aug

Minutes from RBA’s July 4th meeting reveal that two options were considered: raising cash rate by additional 25 bps, or keeping it unchanged. RBA eventually chose the latter, acknowledging the “uncertainty around the outlook and the significant increase in interest rates to date.” Members agreed to “reassess the situation at the August meeting.”

Despite maintaining status quo, RBA members acknowledged the possibility of future policy tightening. “Members agreed that some further tightening of monetary policy may be required to bring inflation back to target within a reasonable timeframe, but that this depended on how the economy and inflation evolve,” the minutes read.

RBA’s decision underscores the central bank’s caution amid shifting economic conditions. With August meeting on the horizon, the Board anticipates additional data on inflation, the global economy, labor market, and household spending. This incoming information, combined with updated staff forecasts and a revised risk assessment, will guide the next policy decision.

Looking ahead

Canada CPI is a major focus today while IPPI and RMPI, as well as housing starts will be released. US retail sales will also be published, and industrial production, business inventories and NAHB housing index.

USD/CHF Daily Outlook

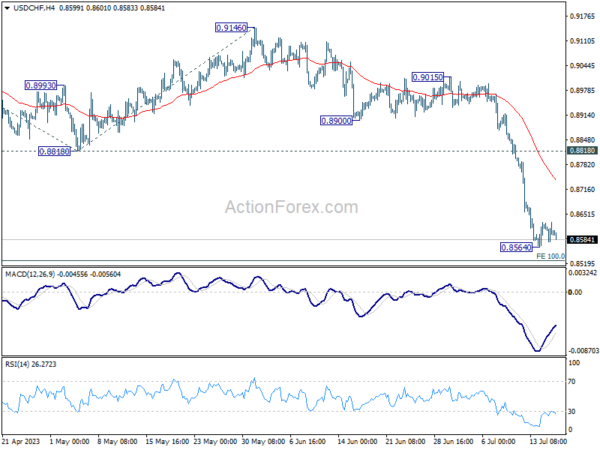

Daily Pivots: (S1) 0.8578; (P) 0.8604; (R1) 0.8629; More…

Intraday bias in USD/CHF remains neutral for the moment. Consolidation from 0.8564 could extend, but upside of recovery should be limited below 0.8818 support turned resistance to bring another fall. On the downside, break of 0.8564 will resume larger down trend from 1.0146 and target 100% projection of 0.9439 to 0.8818 from 0.9146 at 0.8525 next.

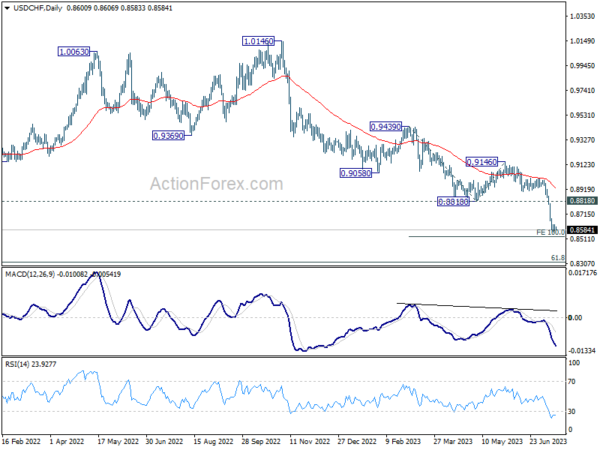

In the bigger picture, the break of 0.8756 (2021 low) indicates break out from the long term range pattern. For now, medium term outlook will stay bearish as long as 0.9146 resistance holds. Further fall would be seen to 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 04:30 | JPY | Tertiary Industry Index M/M May | 1.2% | 0.40% | 1.20% | |

| 12:15 | CAD | Housing Starts Jun | 215K | 202K | ||

| 12:30 | CAD | CPI M/M Jun | 0.30% | 0.40% | ||

| 12:30 | CAD | CPI Y/Y Jun | 3.00% | 3.40% | ||

| 12:30 | CAD | CPI Core M/M Jun | 0.20% | |||

| 12:30 | CAD | CPI Median Y/Y Jun | 3.70% | 3.90% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Jun | 3.60% | 3.80% | ||

| 12:30 | CAD | CPI Common Y/Y Jun | 5.00% | 5.20% | ||

| 12:30 | CAD | Industrial Product Price M/M Jun | -0.10% | -1% | ||

| 12:30 | CAD | Raw Material Price Index Jun | -0.20% | -4.90% | ||

| 12:30 | USD | Retail Sales M/M Jun | 0.50% | 0.30% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Jun | 0.30% | 0.10% | ||

| 13:15 | USD | Industrial Production M/M Jun | 0.00% | -0.20% | ||

| 13:15 | USD | Capacity Utilization Jun | 79.50% | 79.60% | ||

| 14:00 | USD | Business Inventories May | 0.20% | 0.20% | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 55 | 55 |