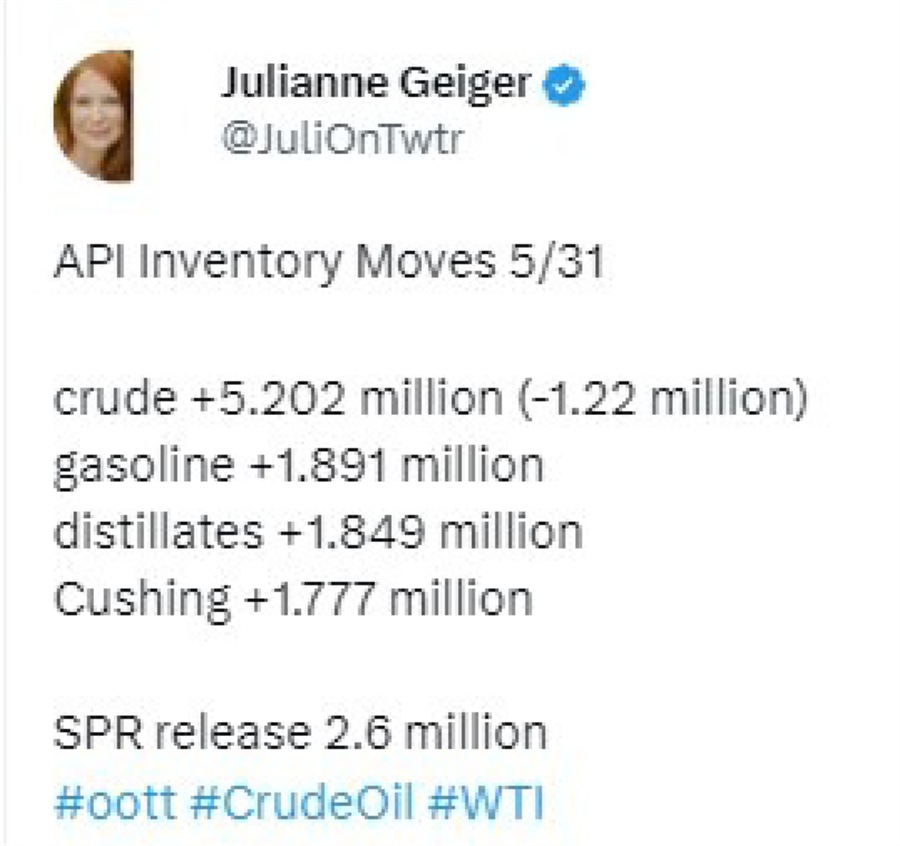

The inventory data from the private survey is out now, official data follows Wed. morning (US time).

The numbers via Twitter:

The headline crude result was expected to be a draw of 1.22 million barrels.

Expectations I had seen centred on:

- Headline crude -1.2 mn barrels

- Distillates +0.9 mn bbls

- Gasoline -0.5 mn

This data point is from a privately-conducted survey by the American Petroleum Institute (API):

- It’s a survey of oil storage facilities and companies

The official report is due Wednesday morning US time. The two reports are quite different. The official government data comes from the US Energy Information Administration (EIA):

- Its based on data from the Department of Energy and other government agencies

- Whereas information on total crude oil storage levels and variations from the previous week’s levels are both provided by the API report, the EIA report also provides statistics on inputs and outputs from refineries, as well as other significant indicators of the status of the oil market, and storage levels for various grades of crude oil, such as light, medium, and heavy.

- the EIA report is held to be more accurate and comprehensive than the survey from the API

This article was originally published by Forexlive.com. Read the original article here.