Markets:

- Gold down $10 to $1970

- WTI crude oil up $1.14 to $75.51

- US 10-year yields down 1 bps to 3.48%

- S&P 500 up 58 points to 4110

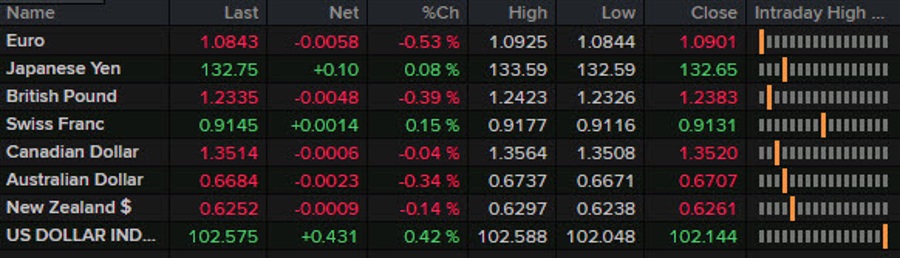

- CAD leads, EUR lags

When I think about this market, we came into January and everyone was worried about recession. By January, it was fears of inflation and in March there was a bank panic. Add it all up and it’s +7% in the S&P 500 and 16% in the Nasdaq. They say that bull markets climb a wall of worry and that’s a powerful example.

On Friday, the flows were a big factor but the bias towards risk trades was evident and helped out by a more-benign PCE report.

Despite that, the US dollar was broadly strong, trailing only the loonie as the top performer. The ECB’s Villeray downplayed the outlook for significantly more hikes and that may have weighed on the euro but flow-driven trade was perhaps the larger factor. Dollar buying was particularly strong into the London fix.

EUR/USD fell to 1.0840 from a high of 1.0900 in early North American trade. That was despite falling US Treasury yields and a positive risk trade.

Cable was equally soft, falling 52 bps to 1.2330 with nearly all of that coming in the latter part of the day.

The commodity currencies couldn’t sustain a bid despite risk appetite with the exception of the loonie, which made some modest headway with the help of higher oil prices.

The comments late in the day from Fed officials were largely ignored, with the market content to wait for the same data as the FOMC. Pricing suggests a hike in May is 50/50 but there’s no longer much scope for hiking beyond that.