It’s jobs Friday. Both the US and Canada employment reports will be released at 8:30 AM ET. In the US the expectations are for nonfarm payroll to rise by 200K. The unemployment rate is expected to remain steady at 3.7%. Average hourly earnings are expected to rise by 0.4% versus 0.6% last month and by 5.0% year on year versus 5.1%.

In Canada the employment change is expected at 8.0K versus 10.1K last month with a unemployment rate of 5.2% versus 5.1% last month. As a guide, the mix from last month was strong with full-time employment increasing by 50.7K last month while part-time employment falling by 40.6K.

Later at 10 AM, ISM services PMI and US factory orders will be released. At 11:15 AM FOMC member Cook will be speaking. At 12:15 PM, feds bargain is scheduled to speak. At 1 PM, Feds George will speak. Finally, Feds Bostic is scheduled to speak at 3:30 PM.

The U.S. House of Representatives will begin day four loading on a new Speaker the House

In Europe this morning, German factory orders were much weaker than expected -5.3% month on month. Retail sales in Germany, France and Switzerland were also weaker than expectations. However overall EU retail sales came in at 0.8% versus 0.5% expected.

UK construction PMI fell back below the 50 level at 48.8.

The EU CPI flash estimate will also weaker on the headline at 9.2% versus 9.6% expected (and 10.1% last month), but the core CPI ticked up to 5.2% from 5.0% last month. Nevertheless it is good news on the inflation in Europe as the worst may be over

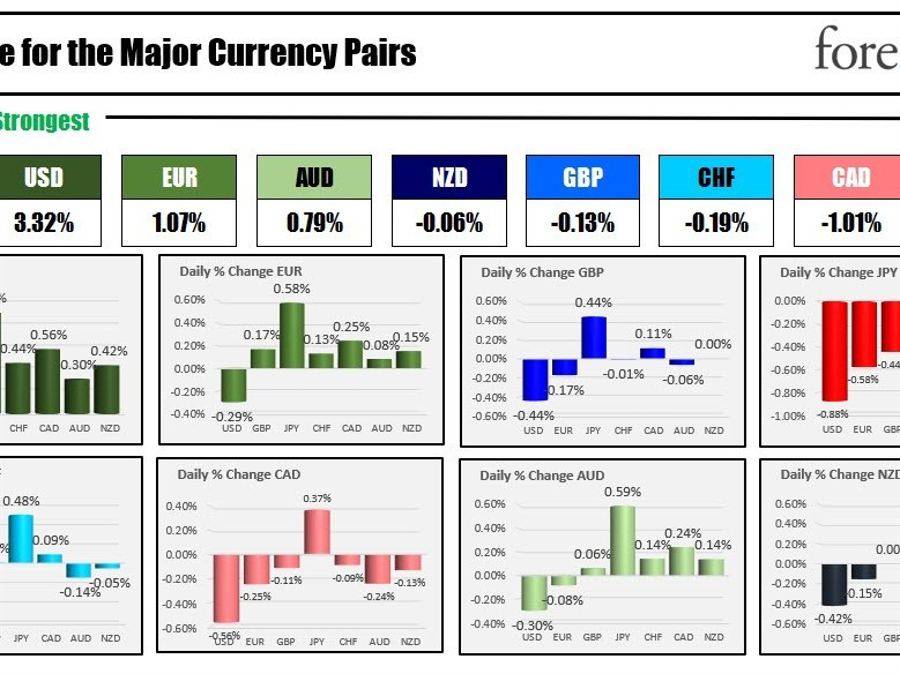

Ahead of the data this morning, the USD is the strongest of the majors, while the NZD is the weakest. The USD was also the strongest yesterday after the better than expected ADP and weekly claims data. Fed officials also expressed the need to continue the restrictive tightenings and get to a plateau where rates would stay “well into 2024” (as per Fed’s George).

In other markets a snapshot currently shows:

- spot gold is trading up $3.40 or 0.19% at $1835.90

- spot silver is trading up $0.14 or 0.61% at $23.37

- WTI crude oil is trading down -$0.16 at $73.52

- Bitcoin remains fairly steady at $16,700. At 5 PM yesterday the digital currency was trading at $16,840

In the premarket for US stocks, the major indices are trading their own changed (giving up some earlier gains in premarket trading)

- Dow Industrial Average is down -6 points after yesterday’s -339.69 point decline

- S&P index is down 4-5 points after yesterday’s -44.89 point decline

- NASDAQ index is trading down -37 points after yesterday’s -153.52 point decline

Tesla shares are down sharply in premarket trading at $103.33 after closing yesterday $110.34.. The company announced cuts between 6% and 13% of its Model 3 and Model Y prices.

In the European equity markets:

- German DAX -0.1%

- Francis CAC +0.32%

- UK’s FTSE 100 +0.3%

- Spain’s Ibex +0.35%

- Italy’s FTSE MIB +0.5%

in the Asian-Pacific markets:

- Japan Nikkei rose 0.59%

- Hang Seng composite index -0.29%

- New Zealand 50 -0.22%

- Australia’s S&P/ASX +0.65%

- Shanghai composite +0.08%

The US yields are mixed with the long end outperforming the short end by a few basis points:

in the European debt market, the benchmark tenure yields are trading mixed with modest changes: