Blackrock, the world’s largest money manager, from their “2023 Global Outlook”.

It builds on views expressed here:

It’s a long piece, I’ve pulled out this snippet.

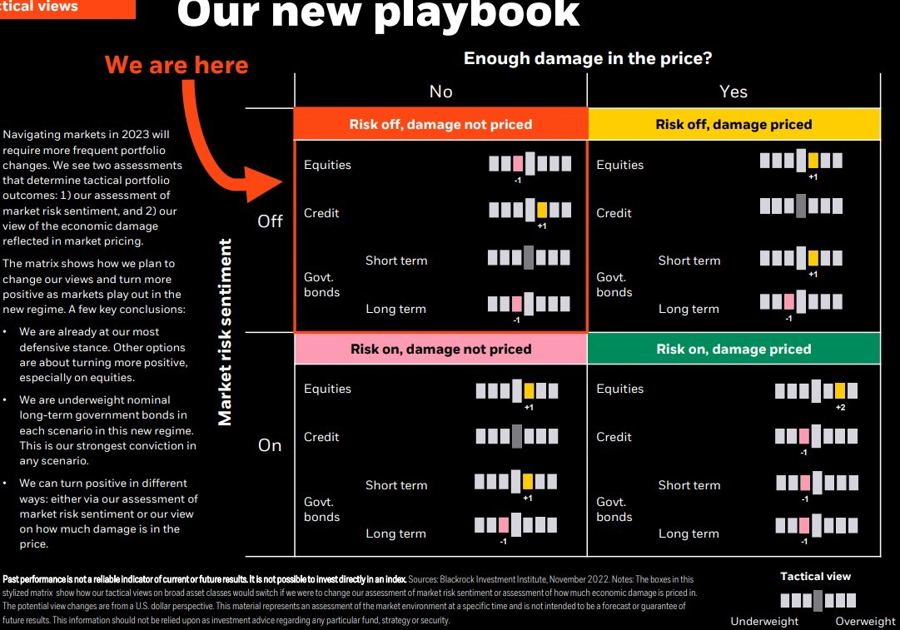

- We expect to turn more positive on risk assets at some point in 2023 – but we are not there yet.

- What matters most, we think, is how much of the economic damage is already reflected in market pricing. This is why pricing the damage is our first 2023 investment theme. Case in point: Equity valuations don’t yet reflect the damage ahead, in our view. We will turn positive on equities when we think the damage is priced or our view of market risk sentiment changes. Yet we won’t see this as a prelude to another decade-long bull market in stocks and bonds.

This article was originally published by Forexlive.com. Read the original article here.