The price of crude oil futures settled at $79.98. That is down -$1.24 or -1.53%.

- The OPEC+ meeting will take place virtually on Sunday. No change in production is expected.

- The price cap looks to be set at $60 for Russian oil

- The Russian sanctions will also go into effect cutting off all imports of Russian imports. Those will stop on Monday.

So there are a lot of balls in the air that could have impact on supply. On the demand side, China and its Covid policy remains a wild card for global demand.

For the week, the price is up 4.79% from last Friday’s closing level.

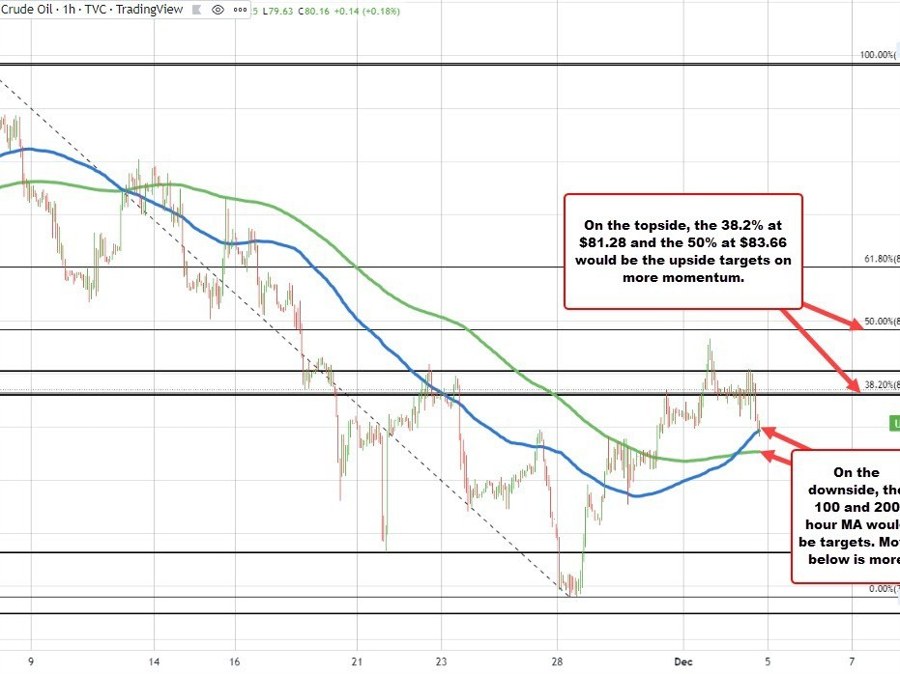

Technically, looking at the hourly chart, the price low today tested the rising 100 hour MA at $79.85. The price dipped below that level but has rebounded back above.

Next week, a move below the 100 hour MA would have traders targeting the 200 hour MA at $79.05. On the topside, the close levels in play would be the 38.2% of the move down from the November high at $81.28 followed by the 50% midpoint at $83.66.

This article was originally published by Forexlive.com. Read the original article here.