The USD moved higher in trading today as focus shifted from the lower inflation seen this week in the US to the troubles in other nations. German’s Rhine River, moved below a critical navigational level which could impact energy (coal travels the river), hydro power, trade, slow growth and increase inflation. That is not good new for the EU. The GBP was impacted as well as it too is suffering from higher energy costs with higher temperatures.

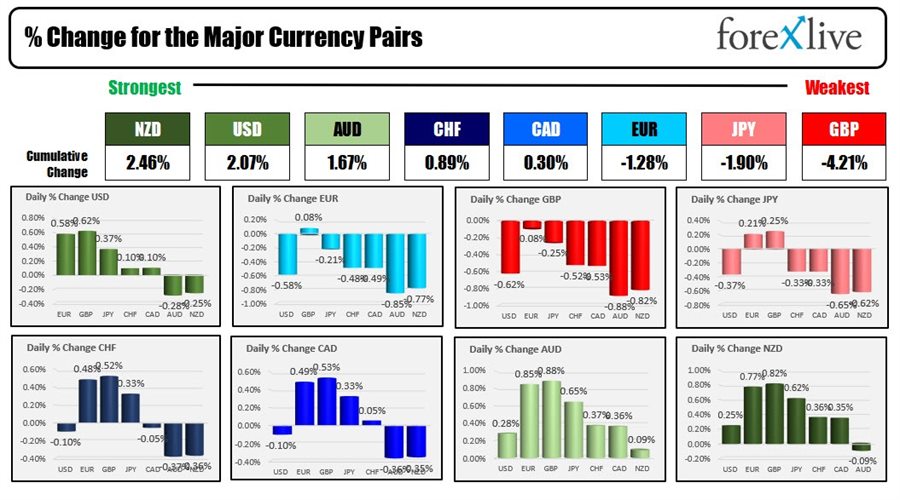

The GBP, JPY and the EUR are ending the day as the weakest of the major currencies, while the NZD and the USD are the strongest.

Next week the RBNZ is expected to continue their tightening program with another 50 basis point hike. The US Fed will release the minutes of the last FOMC rate meeting where the Fed tightened by 75 basis points and moved the target rate to “neutral” at 2.5%.

Today, Richmond Fed’s Barkin reiterated a number of Fed officials sentiments, by saying he wants to see inflation remain lower for an extended time period and until the rate reaches their target level of 2%, the Fed would continue to tighten policy. He did not commit to 50 or 75 basis points citing the number of inflation and employment reports yet to be released.

The Michigan preliminary consumer sentiment index came out better than expected, but was mixed in the details. Although expectations saw a bump up to 54.9 from 47.3, the current conditions moved to 55.5 from 58.1 last month. Inflation expectations were also mixed with the 1 year expectations moving lower to 5.0% from 5.2%, the 5 year expectations ticked up to 3.0% from 2.9% last month.

In other markets heading into the weekend:

- Spot gold is trading at $1801.44 that’s up $12.06 or 0.67% today. For the week, the precious metal is up 1.54%, and is up 7.16% from its July 21 low.

- Spot silver is up $0.51 or 2.46% at $20.80. For the trading week the price is up 4.61%

- WTI crude oil is trading down $2.45 at $91.89. For the week, the price is still up 3.77%

- Bitcoin is trading at $24,254. From the close last Friday the price is up 4%.

In the US debt market, yields are mixed in trading today:

- 2 year 3.246%, +2.3 basis points

- 5 year 2.960%, -3.0 basis points

- 10 year 2.838% -5.1 basis point

- 30 year 3.114%, -6.5 basis points

For the trading week the:

- 2 year yield move down -2.8 basis points

- 5 year yield is flat

- 10 year yield is flat

- 30 year yield is up 4.3 basis points

In the US stock market today, the week ended with solid gains led by the Nasdaq which rose over 2%. For the week, the major indices notched their 4th consecutive gain. The gains for the week showed:

- Dow, +2.92%

- S&P +3.25%

- Nasdaq +3.08%

The Nasdaq is now up 23.4% from its low, but still remains -16.6% from the high. The Dow is only down -7.2% from its all time high and the S&P is still down -10.18%.

For the week, the biggest gainers in the Dow 30 were:

- Disney +14.01%

- Dow, +8.62%

- Travelers, +7.93%

- Caterpillar, +6.18%

- Goldman Sachs, +5.72%

The Dow laggards included:

- J&J, -3.4%

- Visa, -2.10%

- Salesforce, -0.15%

- Verizon, +0.44%

- Coca Cola, +0.5%

The week was once again dominated by the so-called meme stocks:

- Bed Bath and Beyond, rose 58.7%

- Express rose 17.2%

- AMC rose 8.96%

Other big gainers included:

- First Solar, +15.76% after the inflation reduction act was passed

- Snap, +14.15%

- Chewy, +12.47%

- Netflix, +9.93%

- Meta, +8.01%