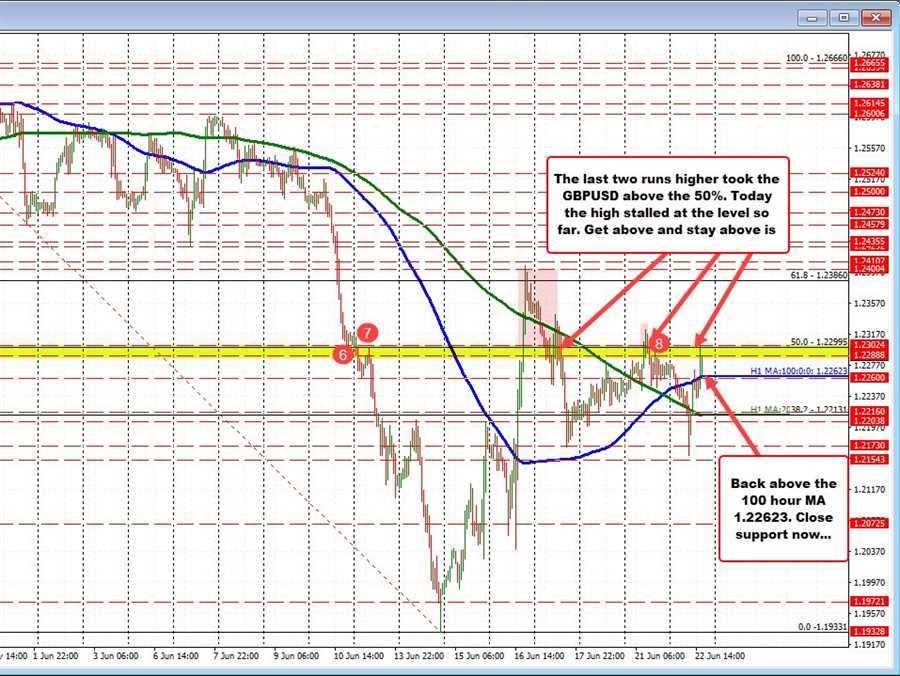

The GBPUSD – like other pairs – has seen a run lower and move back higher helped by the Fed chair comments.

The move back to the upside has taken the price back above the 200 and 100 hour moving averages at 1.2212 and 1.2262 respectively. The high price has reached up to retest the 50% retracement of the move down from the May 27 high. That level comes in at 1.22995 (call it 1.2300). Recall from yesterday, the price moved above that level only to fail and move back to the downside. Recall from last week the price moved above that level on 2 separate occasions in each break also failed.

Nevertheless get above the 50% retracement and the bias turns more bullish. Traders will look for more upside momentum with the high price from yesterday at 1.2323 as the next target to get to and through. Move above that level opens the door for further upside momentum. More importantly it establishes the 50% retracement as the new risk defining level.