The markets are breathing a little easier today on inflation despite what is supposed to the highest CPI reading since March 1982 when it is released on Thursday at 8:30 AM ET.

The catalyst today was the price of crude oil which fell below the $90 level after rising to $93.17 last week. That is the good news. The not so good big picture view is that although it is a bit of a relief, the price is still way above the low for the new year from early January at $74.27. Also the the CRB commodities index (which is lower today), is similar to oil in that it is still near 7 year high levels.

So although, there is some hope that diplomatic efforts might lead to a more peaceful ending the Russia/Ukraine situation, and perhaps there is a chance for a correction in commodities, the trends are still to the upside.

In any case, the inflation relief also helped stocks move higher with the:

- Dow up 371.65 points or 1.06%

- S&P up 37.67 points or 0.84%

- Nasdaq up 178.80 points or 1.28%

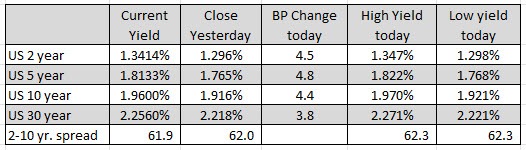

The US bond market was not impressed, however, as it the 10 year yield move back toward the 2.0% level (high reached 1.97%). That yield is the highest since August 2019. The 2 year yield is up to 1.341% which is the highest it has been since February 2020. The move higher in yields came despite a strong 3 year note auction that saw strong international demand.

In the forex today, the AUD and the NZD are ending the day as the strongest of the majors, while the JPY and CAD are the weakest.

The USDJPY move to the highest level since January 28th when it peaked at 115.68. The high today was just short of that level at 115.62. A move above with momentum would open the door toward the highs for the year at 116.35.

The EURUSD is coiling like a spring as it traded in a 22 pip trading range in the NY session. The 1.1400 level did provide support and the 100 day MA was resistance near 1.1422. Something has to give in the new trading day. Look for a break and momentum in the direction of the break.

The GBPUSD after opening the NY session near the low at 1.3515, rise up to test it’s 100 hour MA and 50% of the 2022 trading range at 1.3552. The final 8 hours of the NY session was spent banging against the dual technical levels on each of the hourly bars, without a material break above (the high could only reach 1.3555). In the new day, will that 100 hour MA/50% be broken or will the price instead move back down where the 200 hour MA and the 100 day MA are starting to converge near 1.3506?

The USDCHF has a two day range of 42 pips. That is narrow and due for a break one way of the other. The high extreme is at 0.9262. The low extreme is 0.9220. Ahead of the low is the rising 100 hour MA at 0.9226. The 100 day MA is at 0.9214. On the topside the 200 hour MA is at 0.9247 and then the highs at 0.9262 will be the next upside targets to get to and through.

The USDCAD was another pair that although higher on the day, died to a 22 pip trading range in the North American session. Those 22 pips saw the pair trade above and below the 100 hour MA at 1.2700 and the 200 hour MA at 1.2708.

The AUDUSD did make a mini-break for the upside into the close (maybe helped by “risk on”?). In doing so it is inching above the 50% midpoint of the 2022 trading range for the pair at 0.71403 (trading at 0.7146 at the end of the day). The price spent most of the NY session above its 100 hour MA at 0.71154. That gives the buyers/longs some hope. On more upside momentum, 0.7179 high from last week followed by the 61.8% at 0.71812 will be targeted.