The major European indices are closing the day mostly lower. The exception is the UK FTSE 100 which is closing up around 0.35%. The provisional closes are showing:

- German DAX, -0.65%

- France’s CAC, -0.4%

- UK’s FTSE 100, +0.45%

- Spain’s Ibex, -0.45%

- Italy’s FTSE MIB, -0.13%

For the trading week, the major indices are mostly higher as a result of earlier gains in the week:

- German DAX, +0.4%

- France’s CAC, +0.9%

- UK’s FTSE 100, +1.3%

- Spain’s Ibex, +0.44%

- Italy’s FTSE MIB, +0.8%

In other markets as European/London traders look to exit for the week:

- Spot gold plus $2.15 or 0.12% at $1793

- Spot silver up two cents or 0.10% at $22.20

- WTI crude oil near unchanged at $79.02

- Bitcoin is trading at $41,748.16

In the US stock market, the major indices are mixed with the Dow higher in the NASDAQ lower:

- Dow industrial average up 28 points or 0.08% at 36265

- S&P index -13.5 points or -0.29% at 4682.07

- NASDAQ index -118.87 points or -0.79% at 14962.18

- Russell 2000-14.35 points or -0.65% at 2192.02

In the US debt market, the yields are higher with a steeper yield curve. The 10 year yield moved above the 1.80% level for the first time since January 2020:

In the European debt market, the benchmark 10 year yields are ending mixed. The German 10 year yield got to a high yield of -0.029% as moved closer to the parity level. For the week it is up from -0.180% last Friday.

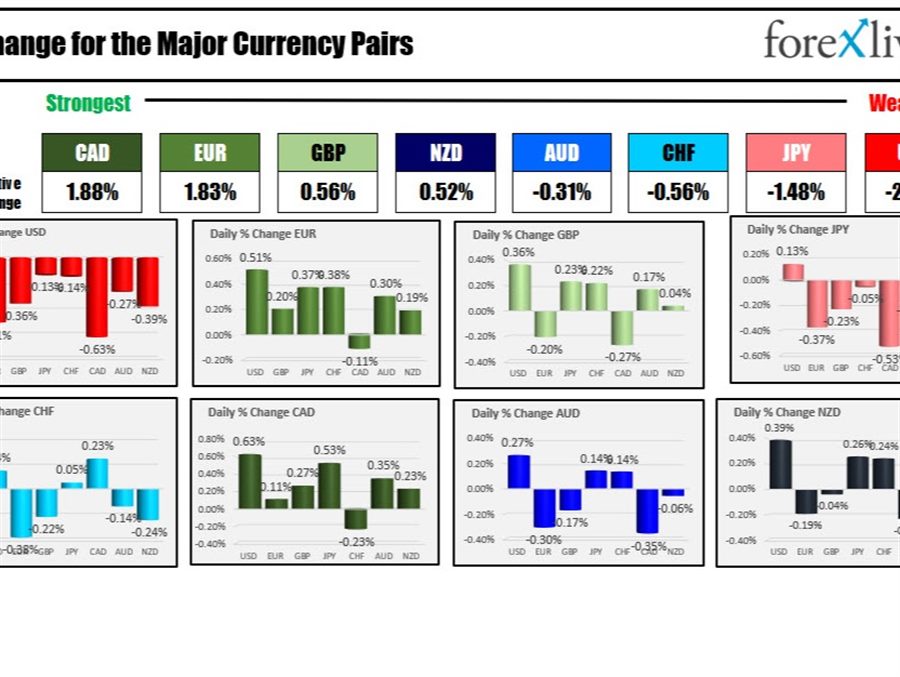

In the forex, the CAD is the strongest and the USD is the weakest as traders in Europe leave for the day.