Classic risk-positive trade wins out

The top performing G10 currencies this week were NZD, AUD and CAD, in that order. At the bottom of the list were JPY, USD and CHF.

That’s a classic risk-positive trade setup that has been underlined by the selloff in bonds and the best week for US equities since April. It’s a clear signal that the market feels it overreacted to the Fed, perhaps with a short-squeeze adding to moves.

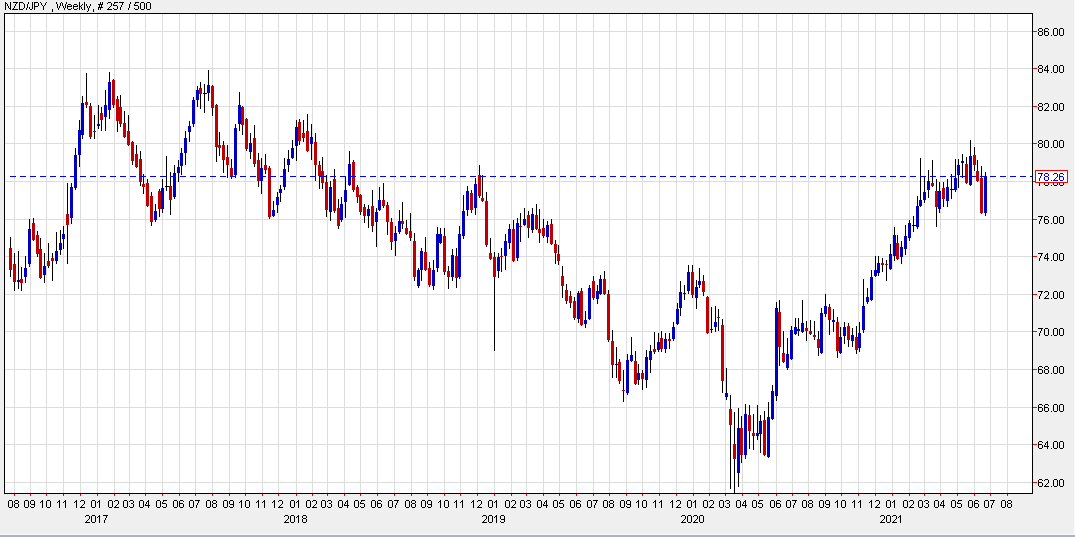

The mode now is to wait and watch on economic data, particularly jobs and inflation to get a sense of when the Fed will hike next. If NZD/JPY is any indication, we’re not out of the woods yet. The pair recovered from last week’s slump but is now right where it was before the FOMC.

The back-to-back big moves in consecutive weeks cancelled one another out and leaves the market uncertain. There’s a chance the range over the past month could persist through the summer.