NASDAQ making new all-time highs. S&P getting closer to its all-time high price of 4257.16

The US stocks have opened with modest gains and are moving higher in early trade. The NASDAQ index is trading at a new all-time high price. The S&P index is getting closer to its all-time high price at 4257.16. Yesterday gains were led by the NASDAQ index with a gain of 111.79 points or 0.79%

A snapshot of the market currently shows:

- S&P index up 3.59 points or 0.08% at 4250.03. The high price reached 4254.16 so far. That is just short of its all-time high price of 4257.16

- NASDAQ index is up 21.77 points or 0.15% at 14275.04. Yesterday the index closed at an all time record high. Anything positive today is another high (by definition)

- Dow industrial average is up 26.95 points or 0.08% at 33972.53. It’s high price reached 34009.40 so far today.

A look at other markets as stock trading gets underway shows:

- Spot gold up $6.70 or 0.3% at 1785.62. The high price reached $1787.07. The low price extended to $1777.28.

- Spot silver is up $0.25 or 0.97% $26.02

- WTI crude oil futures continue to move higher and are above $74 at $74.14. That’s up $1.28 or 1.74%

- Bitcoin is up $1670 or 5.08% at $34,590 after trading below below $30,000 yesterday

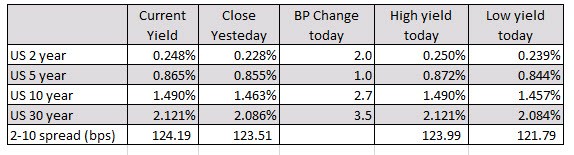

In the US debt market, yields are higher with the 10 year up 2.7 basis points and the 30 year up 3.5 basis points. The U.S. Treasury will auction off five year notes at 1 PM today

A snapshot of the forex market continues to show the NZD as the strongest of the majors and the JPY as the weakest. Those two currencies were the strongest and weakest yesterday as well.