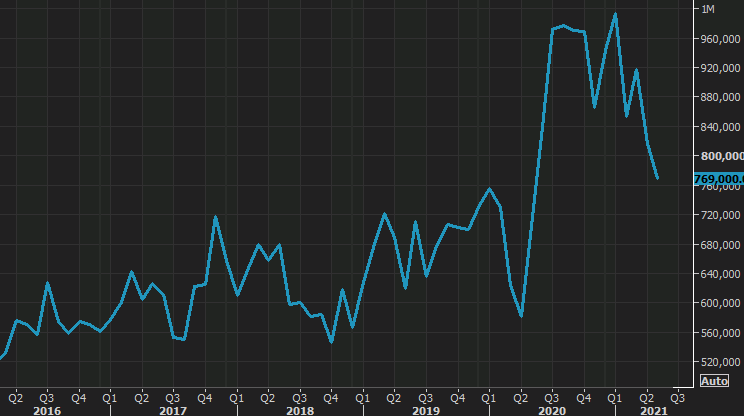

May US new home sales data

- Prior was 863K (revised to 817K)

The sticker shock of higher prices is starting to bite. It was a dip in this report a month ago that took the air out of lumber prices and we might see more of that on this data point. That said, there are numerous reports that home builders are no longer pre-selling homes or that they’re putting hefty conditions on them around costs. Instead, they’re waiting until the home is nearly built before pricing and marketing it. So this might not reflect a dip in demand, but a change in sales processes.

At the same time, the continued escalation in existing home prices (+23% y/y in yesterday’s report) is an enormous tail wind for new home building. I don’t see this weakness lasting for any length of time. Consumers will adjust to higher prices or home builders will adjust by building smaller homes at lower price points.