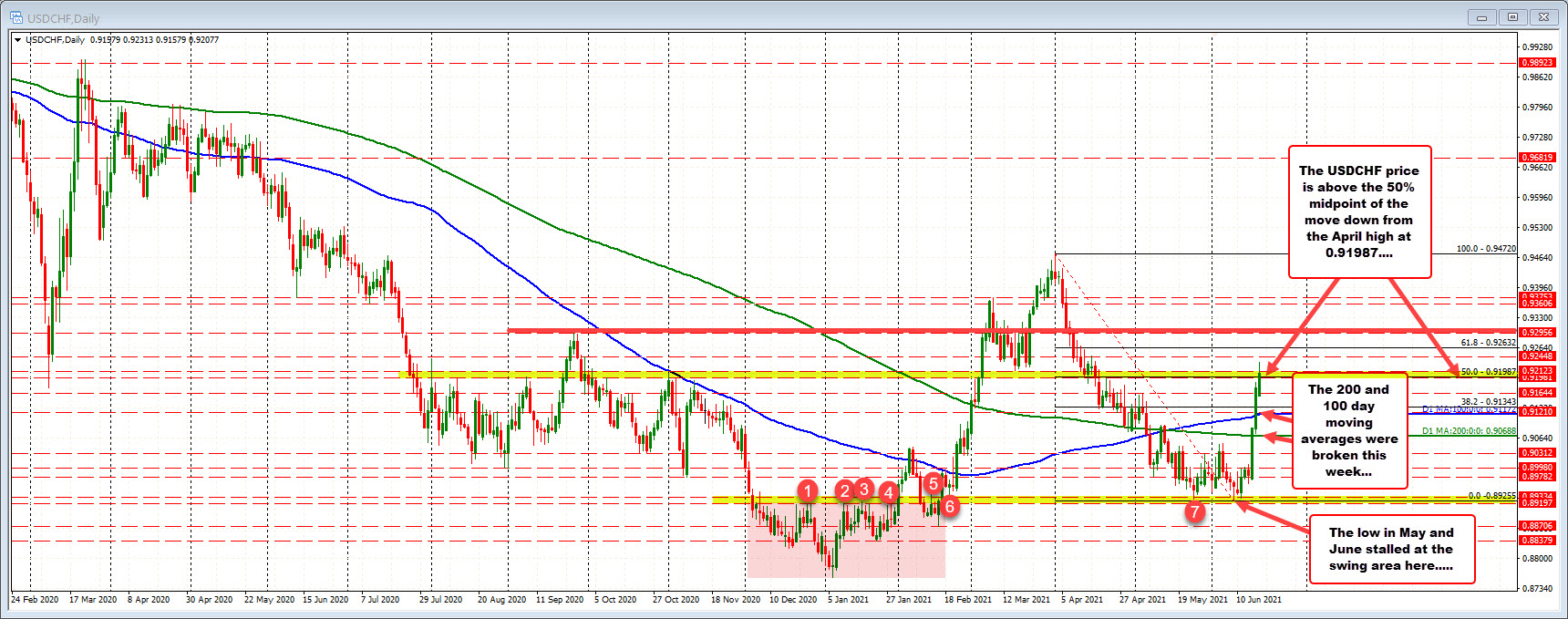

Midpoint comes in just below 0.9200

The USDCHF has extended higher in trading today with the overall dollar bullish bias. The move has extended the price above the 50% midpoint of the range since the April 1 high. That level comes in just below the 0.9200 level at 0.91987. If the price can stay above that level, the buyers would remain in firm control.

Focusing on the daily chart, the low price for both May and June reached a swing area between 0.89197 and 0.89334 (see red numbered circles). That was a nice hold and helped to setup the upside move this week that saw the price move back above its 200 day moving average at 0.90688 (green line), and its 100 day moving average at 0.91172. There is a swing area just above the 50% retracement up to 0.92123.

Targets above include the 61.8% retracement at 0.92632 and in old swing high going back to September 2020 at 0.92956.