Dow down for the fifth consecutive day

The major US indices are selling off into the close with the S&P and Dow industrial average near the lows for the day.

- The Dow closed lower for the fifth consecutive day

- S&P closes lower for the fourth straight day

- Dow has its worst week in 2021

- Dow has its worst day in more than five weeks

- Technology index fell -0.93%

- Consumer staples are down -1.67%

A snapshot of the closes shows

- S&P index -55.45 points or -1.31% at 4166.38. The low price was at 4164.40. The hi was at 4204.78

- NASDAQ index fell -130.97 points or -0.92% at 14030.38. It’s low price reached 14009.04. The hi was at 14129.25

- Dow industrial average felt -531.92 points or -1.57% at 33291.53. It’s high price reached 33622.70. The low price extended to 33271.93

- Russell 2000 index felt -49.74 points or -2.17% at 2237.72. It’s high price reached 2284.95. The low extended to 2229.58.

For the trading week, the major indices were lower led by the Dow which felt -3.45%

- Dow industrial average -3.54%

- S&P index -1.91%

- NASDAQ index -0.28%

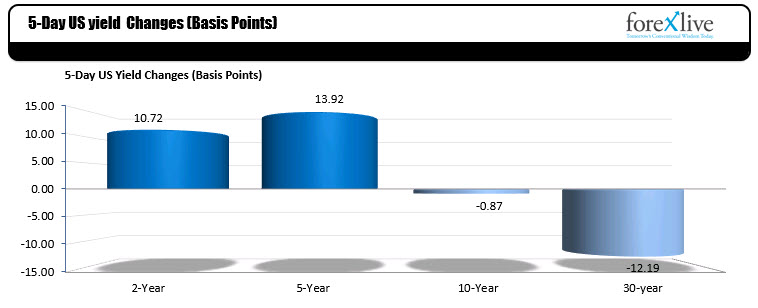

Stocks were pressure from the “get-go” as Fed’s Bullard gave a more hawkish assessment of the FOMC decision on Wednesday. As a result, in addition to stocks getting hit, the shorter end of the treasury curve saw yields rising. This week the five year yield rose 13.92 basis points, and the two year yield rose 10.72 basis point. Meanwhile the 30 year fell -12.19 basis points and the 10 yield was near unchanged.

Below are the percentage changes of the major global stock indices. The Russell 2000 was the weakest -4.1% followed by the Dow industrial average at -3.45%. The Shanghai composite index felt -2.38%. In Europe, Italy’s FTSE MIB and Spain’s Ibex were both down near -1.9%. Australia’s S&P index gained 0.91%. The Japan’s Nikkei was unchanged.

This article was originally published by Forexlive.com. Read the original article here.