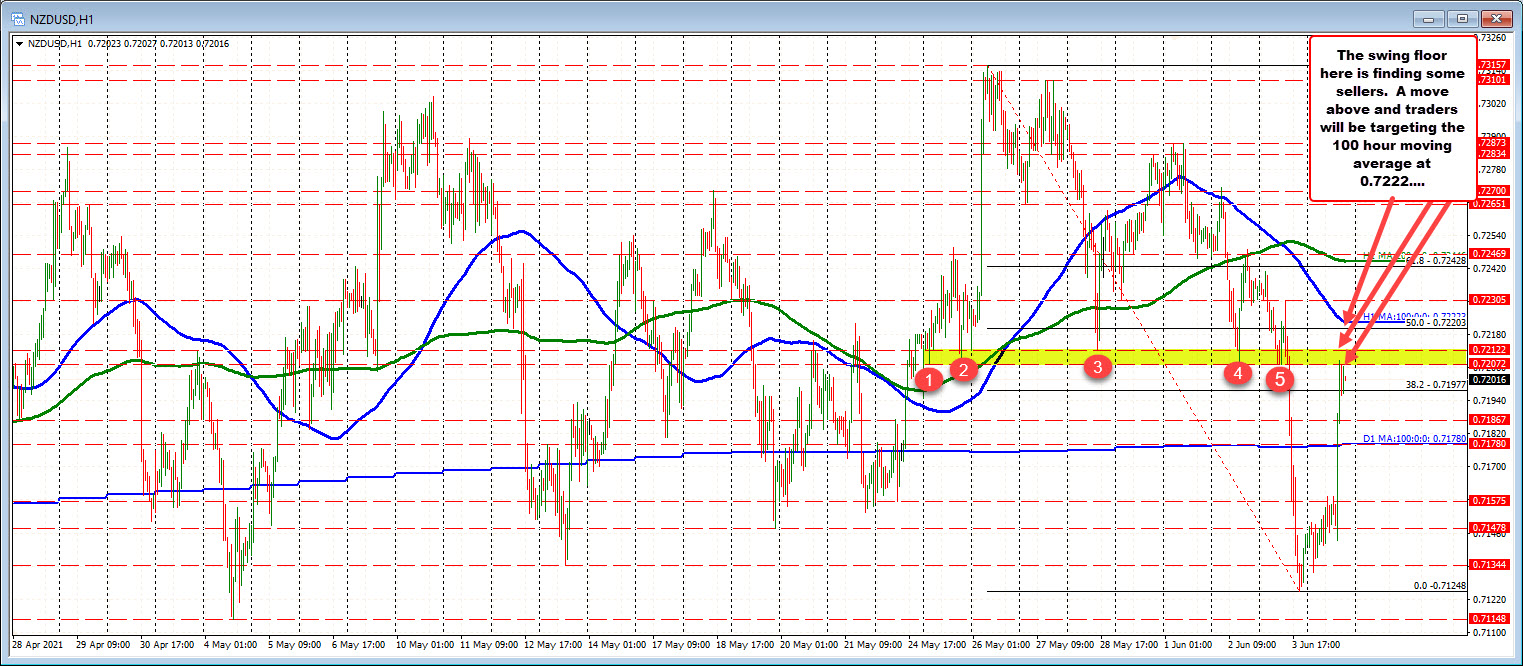

Swing area between 0.7207 and 0.72122

The NZDUSD followed the dollar lower trend and spiked to the upside.

The move higher took the price back above its 100 day moving average at 0.71780. It also moved above the 38.2% retracement of the move down from last week’s high at 0.71977. The high price moved to 0.72087. That high stalled within a swing area since May 25 between 0.7207 and 0.72122 (see red numbered circles). A move above that area would have traders targeting the 50% of the range since last week’s high at 0.72203, and the falling 100 hour moving average at 0.7222. It would take a move above both those levels to increase a bullish bias.

On the downside, a break back below the 38.2% retracement (and away from 0.7200) would be a small negative and should lead to further probing with a potential move back down toward the 100 day moving average at 0.7178. Moving below the 100 day moving average would certainly ruin some of the bullish bias seen today.