Forex news for North American trading on June 4, 2021

The US employment report showed a gain of 559K (with revisions of +27K) but that was not enough to satisfy those looking for tapering sooner rather than later. The expectations was for 675K (with the whisper levels likely higher than that given the tepid 266K – revised to 278K – last month). The unemployment rate did dipped to 5.8% from 6.1% as labor force participation rate fell to 61.6%. The shortfall from pre-pandemic levels is still 7.6 million, which is likely to keep the Fed tapering on hold, although they are still likely to start thinking about the tapering process when they meet on June 15 and 16th.

The number was of the Goldilocks variety for the US stocks (Not too hot. Not too cold). That helped to push the NASDAQ stocks higher by about 1.47%, and taper the gains in the cyclical Dow 30 stocks (up 0.52%). The S&P was stuck in the middle with the high price rising to 4233.45 before settling at 4229.89 (the S&P was up 0.88%). That puts the index within about eight points of its all-time high at 4238.04.

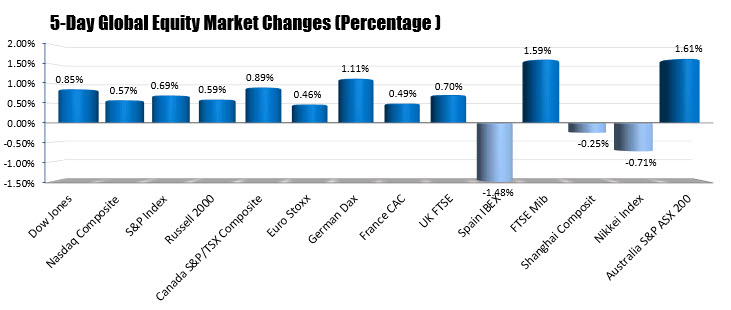

The gains today pushed the S&P and NASDAQ index into positive territory for the week. The NASDAQ gained 0.57% and the S&P rose 0.69%. Looking at the global indices, Spain’s Ibex, Japan’s Nikkei, and the Shanghai composite index were the only major indices down for the week. Australia’s ASX 2000 and Italy’s FTSE MIB, were the biggest gainers (+1.61% and +1.59% respectively). The German DAX closed at a record level after reaching an all-time high price today at 15705.89.

Also help today were US treasuries. They rose and price/fell in yields, with the 10 year US yield leading the way with a -7 basis point decline. The US 30 year yield fell -6.6 basis point.

Looking at the changes for the week, the global yields are mostly lower with the exception of Japan’s 10 year which rose 0.4 basis points. Italy’s 10 year fell -4 basis points on the week. The US 10 year – thanks to today’s decline – fell by -3.75 basis points.

With yields falling and stocks rising, the US dollar moved to the downside and was the weakest of the major currencies. The risk on flows sent the AUD and NZD. They were the strongest of the majors today.

For the trading week, the USD was mixed with the large gain versus the NZD (+0.58%) and the largest decline vs the AUD (-0.43%). The greenback also fell against the JPY (-0.29%) and the CHF (-0.11%), but gained vs the EUR (+0.2%) and GBP (+0.17%). It was near unchanged vs the CAD. The AUD was the strongest of the majors this week. While the NZD was the weakest.

In other markets today:

- Spot gold rose $20.80 or 1.11% at $1891.58. The high price extended to $1896.28. The low fell to $1856.18

- WTI crude oil futures rose $0.58 to $69.39. It’s high price stay below the $70 level at $69.76. The low price reached $68.33

- Bitcoin felt $-1665 or -4.3% at $37,046. The high price reached $39,291.24. The low price extended to $35,593.22. Elon Musk tweeted that he was not in love with Bitcoin anymore (with a broken heart emoji), and that contributed to the moved lower. The price of bitcoin has been able to stay below the 200 day moving average which is at $41,578. You have to go back to May 20 to have a close above the 200 day moving average.