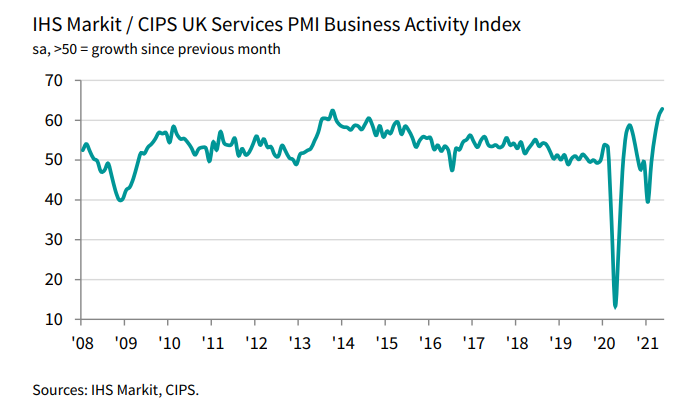

Latest data released by Markit/CIPS – 3 June 2021

- Composite PMI 62.9 vs 62.0 prelim

The reopening of the economy and looser virus restrictions also saw employment conditions improve at its strongest rate in just over six years.

The only negative in the report is that input cost inflation continues to remain elevated – the highest since July 2008 – with the steepest increase in prices charged by service providers being observed since the survey began in 1996. Markit notes that:

“UK service providers reported the strongest rise in activity

for nearly a quarter-century during May as the roll back

of pandemic restrictions unleashed pent up business and

consumer spending. The latest survey results set the scene for

an eye-popping rate of UK GDP growth in the second quarter

of 2021, led by the reopening of customer-facing parts of the

economy after winter lockdowns.“Pressure on business capacity due to a spike in demand and

staff hiring difficulties emerged as a major challenge for service

sector companies in May. Job creation was the strongest

for over six years, but backlogs of work accumulated to the

greatest extent since the summer of 2014.“The successful vaccine roll out has generated a strong

willingness to spend and fortified business optimism across

the service economy. However, inflationary trends intensified

in May as suppliers passed on higher transport bills, staff costs

and raw material prices. Imbalanced demand and supply

appears to have spread beyond the manufacturing sector,

which contributed to the steepest rise in prices charged by

service providers since the survey began in July 1996.”