The sellers could not get below the downside targets, leading to a bounce back

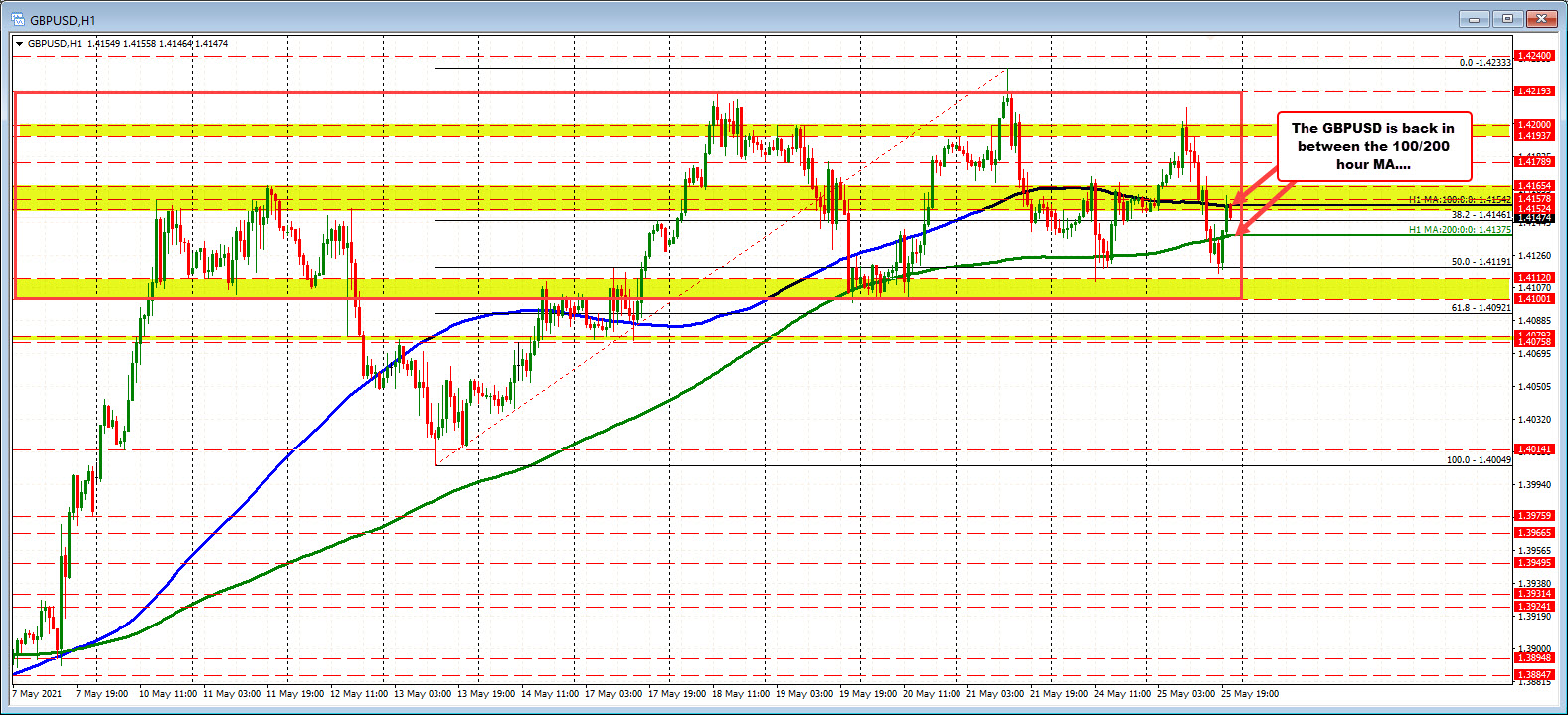

When the price moved back above the 200 hour MA, the buying continued up toward the 100 hour MA (and just above). The price is back below the 100 hour MA and above the 200 hour MA (blue and green line). I am not surprised. The sellers had their shot. The buyers has their shot. Each failed. So traders center the pair around the MAs again.

At some point, traders will figure it out, and make a shove that takes the price away from the MAs (either higher or lower). Something will give.

Ultimately, on the downside getting below the 1.4100 level and staying below should increase the bearish bias.

On the topside, getting above 1.4219, the extreme high at 1.4233 and 1.4240 (which is the February 2021 and year high) opens the upside for more momentum.