Easy to miss, but important

The latest set of RBA minutes were pretty uneventful on the face of them:

- The Board was willing to extend bind purchass if necessary

- Will decide in July on whether to roll over to November 2024 bond and whether to extend purchases

- Return to full employment a high priority for monetary policy

- Wage growth would need to be sustainably above 3% to meet the inflation target

- Public sector wages will restrain overall wage growth in the economy

The area to note is one of the last lines of the minutes. Read the full set here.

The key to rising rates is noted to be a ‘return to a tighter labor market’.

How tight do they want to go? Well Australia’s Treasurer Josh Frydenberg has already hinted at what Australia’s monetary policy will be. Here is what I wrote a couple of weeks ago.

‘The main takeaway from the RBA is that employment data is one of the key metrics to look at going forward. Australia’s Treasurer Josh Frydenberg is wanting to re-focus Australia’s monetary policy to bring down unemployment to 4%. Until that figure has been hit the RBA will not be looking at cutting interest rates.

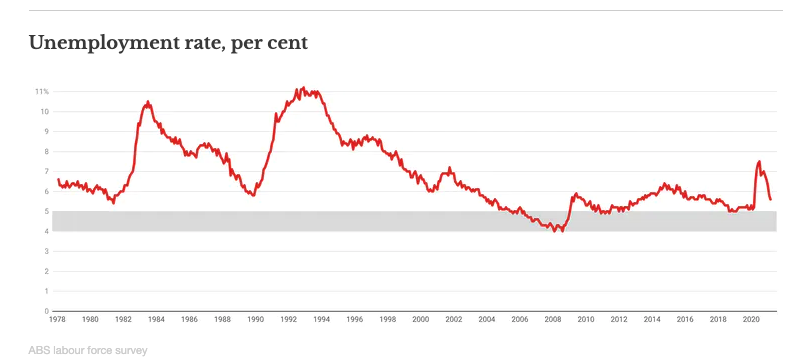

This is a significant move as the chart below shows that unemployment has not been below 4% since the early 70’s. The thinking is that inflation will not be hampered by a tighter labour market in the medium term.

So we can see that , similar to what Fed’s Clarida said, Inflation is not the RBA’s fear. Instead they anticipate a disinflationary model to continue. The aim is to get unemployment down to 1970’s levels. In the last RBA minutes there are fingerprints of Josh Frydenberg’s plan. Look at these extracts:

Further out, the stronger forecast profile for growth in output and employment was expected gradually to reduce spare capacity in the labour market. In the baseline scenario, the unemployment rate was expected to continue to decline to around its pre-pandemic level of 5 per cent by the end of 2021 and to 4½ per cent by mid 2023

And later on…

An upside scenario saw an employment rate that would decline at a faster pace and to a lower level, around 3¾ per cent, compared with the baseline’

On May 11 Joshua Frydenberg was committed to these labour figures mentioning them specifically. Here is an extract from his Q&A around the time of the budget speech

What’s the takeaway?

- The RBA is focused on employment and not on inflation, Adam pointed out that Fed’s Clarida has a similar focus. It assumes a disinflationary world where globalisation keeps inflation down.

- The RBA will not shift for awhile now. Somewhere like the Bank of England who do not have this emphasis (they have lower unemployment as well at 4.8%) will move on rates before the RBA, so a GBPAUD medium term upside bias looks reasonable in this scenario. Traders can go with the break of the trend line higher marked. Also note that the yield spread (turquoise line) is moving higher. This is the bond yield spread between UK gilts and Aussie ten year bonds and it is favouring higher prices.