The USD is higher but off highs for the day

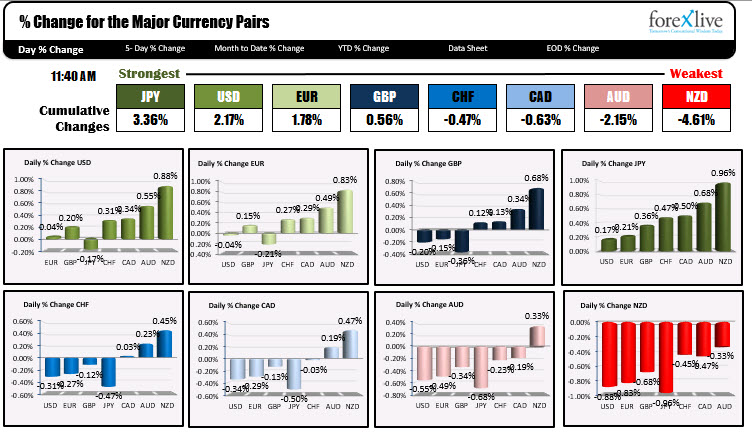

As European/London traders look to exit for the day, the JPY remains the strongest and the NZD is the weakest of the major currencies. That was the ranking when the US stocks opened for trading a few hours ago.. The USD was the strongest at the start of the North American session.

A look around the other markets shows:

- Gold has moved higher after the USD came off it’s highs. The precious metals currently up $15.64 or 0.84% at $1885.15. The high price extended to $1890.13. The low was at $1852.25.

- Silver is trading down $0.26 or -0.93% $27.91. The off it’s lows at $27.37, it still remains below its highs at $28.23 and negative on the day

- WTI crude oil futures are down $2.50 -3.73% at $63.05. The price has been volatile with the low price hitting $61.95 while the high extended to $65.35. The DOE inventory data showed a build of 1320K versus expectations of 2000K. The price is under pressure as negotiations continue with Iran for a nuclear deal. If an agreement is reached, it is presumed sanctions on Iran would be phased out.

Bitcoin has been the main story for the day. The price plunged to $30,000’s at the lows (a nice even number). The high price today reached $43,591.70. The current price is trading down $5900 a -13.64% at 37,381. It is law flows but also all of the highs and down from its all-time high of $64,895. The 200 day moving average is currently at $39,809.58. Stay below that moving average keeps appears more control.

In the US debt market, the yields are marginally lower, but a couple basis points off their lows for the day. There also a few basis point off the highs for the day. A counterbalance to sharp falls in stocks is at the yields tend to go lower and end up slowing the decline (at times). The 10 yield still remains well below the 2% level. Fed officials continue to support the idea that rates will remain low for an extended period time. The FOMC meeting minutes will be released at 2 PM ET. Traders will be eyeing to see if there is more anxiety from Fed officials than what they express in their speeches.