A look back shows what’s happening in the market

On Feb 16, US 10-year yield gapped higher through resistance at 1.20% in a quick move to 1.31%. That set off a mostly one-way rise up to 1.77% earlier today.

That move sparked a re-think in many asset classes, some Fed hand-wringing and non-stop inflation talk.

Naturally, the dollar has performed well on the rise, trailing only the loonie since then (which is also subject to rate hike talk and knock-ons from US spending). What might be less intuitive is that the Swiss franc is the laggard, and badly. It’s down 5.25% against the US dollar in that span.

What’s happened? It’s all about yield. The dollar had been partly used as a funding currency but that trade has been cleared out and it’s finding a home in CHF and JPY (second-worst performer).

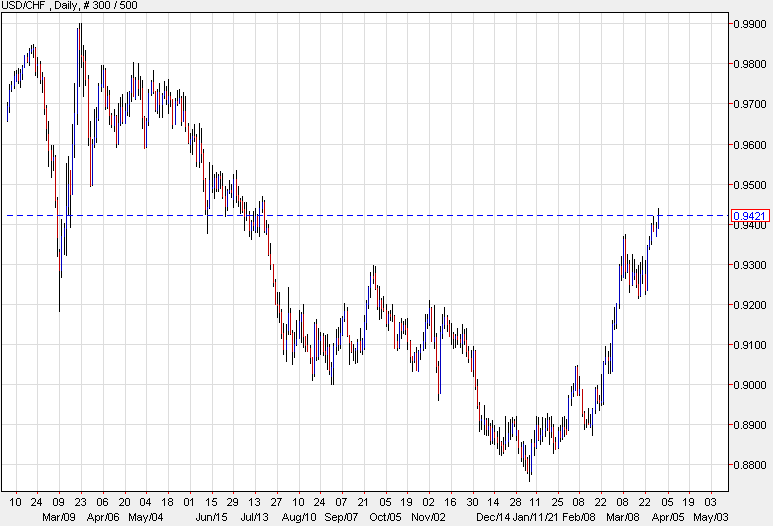

Here’s a look at USD/CHF and you can see the break higher shortly after Feb 16.

If you think there’s more room to run in US yields, this is the place to be. If you think they’re going to retrace, sell it.

I asked on twitter today whether 1.5% or 2% come first in the US 10-year. There’s a strong consensus about 2% coming first:

Be careful piling in with the consensus.