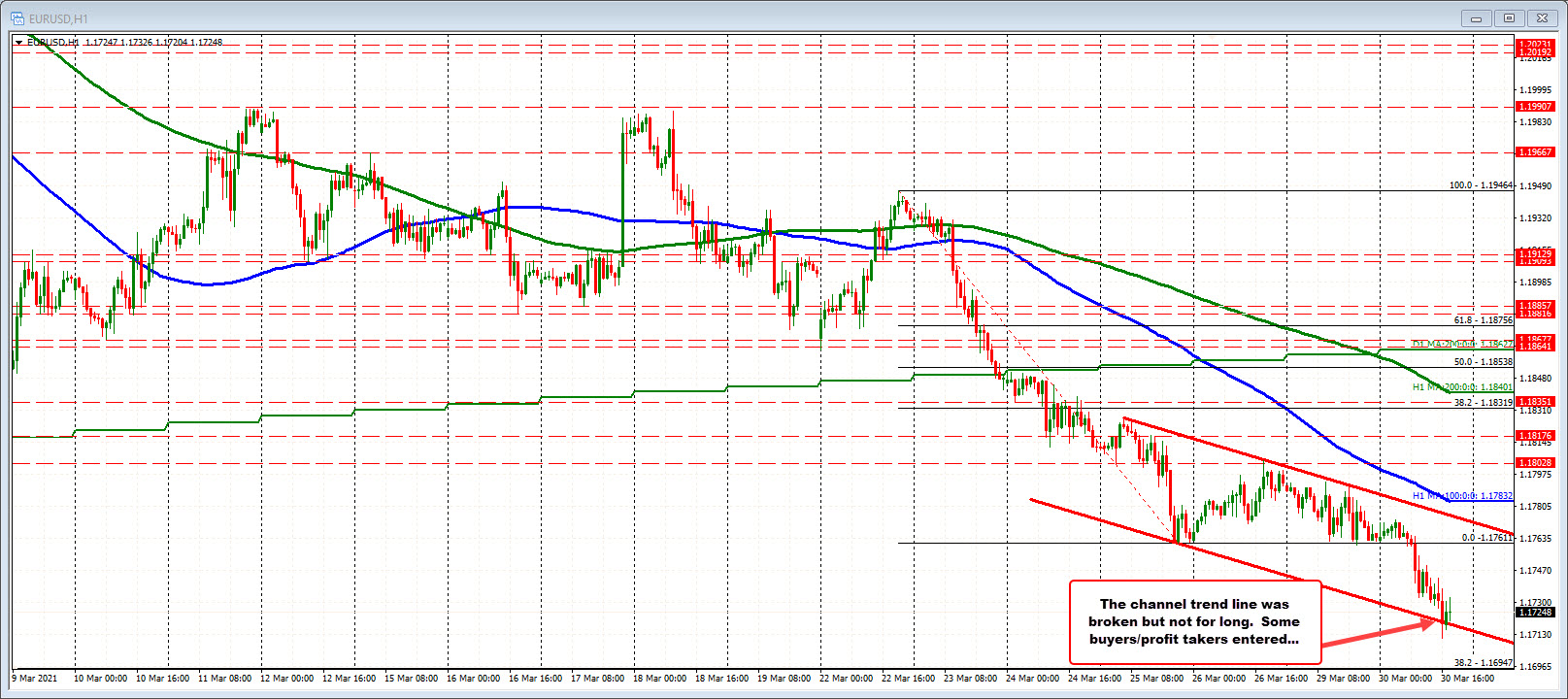

The price remains below 5-minute MA level/trend line/retracement on the intraday chart.

Drilling to the 5-minute chart the corrective move higher has moved to test a topside channel trend line, the 38.2% -50% of the trend move lower today, and the falling 100 hour MA (see all levels in the yellow area in the chart below).

All those levels stalled the corrective rally which for sellers and traders intraday, provide a close risk area to eye. So far so good for sellers/short, but can they keep the dynamics pointing to the downside?

That is not known of course. The sellers are trying to keep intraday control, but the buyers against the lower channel trend line gives those dip traders some hope as well.

Obviously the recent sellers against the trend line/38.2%/100 bar MA are recent happy traders. The recent buyers at the lower channel trend line are happy too. The traders between those levels are not at the most patient levels but both are in the game. Overall, the sellers today have more control but the battle is on near the lows.

I would eye the falling 100 hour MA as the risk and bias defining level now. The downward sloping trend line is also in play but if you look back to earlier in the day, the sellers got going when the sellers started to lean against that MA (see upper yellow area). That was the key intraday clue before moving lower in the European/London session. As a result, intraday traders will likely continue to eye that MA for bias/risk clues. Stay below and bias remains with the sellers.