Dollar is mixed as markets enter into US session, with traders digesting the slightly weaker-than-expected ADP private employment report. The re-accelerating pay growth as shown in the report might prompt some concerns among hawkish members of Fed. But the focus remains on Friday’s non-farm payroll data, the definitive input for assessing labor market health. Fed fund futures currently suggest a 76% probability of a 25bps rate cut at the December meeting, but this is not set in stone.

Sterling is outperforming peers today, buoyed partly by upward revision in UK PMI and supportive remarks from BoE Governor Andrew Bailey. Bailey reiterated a “gradual approach” to monetary easing. The indirect hint of four rate cuts next year aligned well with market expectations. His comments reflect the dual challenges facing the BoE: managing the domestic impact of the Autumn Budget and navigating international risks, particularly trade disruptions from US tariff policies under the new administration.

Meanwhile, Aussie extends its post-GDP decline, making it the weakest performer of the day. Yen also lags, as US and European benchmark yields rebound, while Kiwi follows as third worst. Loonie leads gains, with Dollar and Sterling following, while Euro and Swiss Franc sit in the middle of the pack.

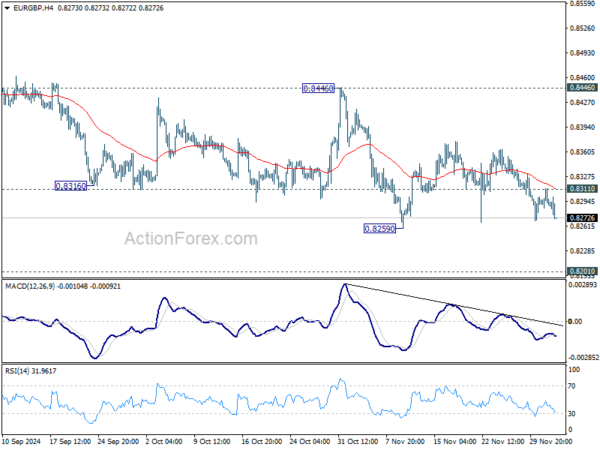

Technically. EUR/GBP might be heading to retest 0.8259 support and break through there finally to resume the larger up trend. But then, the key is whether important structural support at 0.8201 (2022 low) could provide enough support to bring sustainable rebound. Meanwhile, break of 0.8311 minor resistance will delay the near term bearish case, and bring more sideway trading.

In Europe, at the time of writing, FTSE is down -0.25%. DAX is up 0.86%. CAC is up 0.60%. UK 10-year yield is up 0.0454 at 4.297. Germany 10-year yield is up 0.035 at 2.095. Earlier in Asia, Nikkei rose 0.07%. Hong Kong HSI fell -0.02%. China Shanghai SSE fell -0.42%. Singapore Strait Times rose 0.36%. Japan 10-year JGB yield fell -0.0279 to 1.053.

US ADP employment rises 146k in Nov, pay gains accelerate slightly

US ADP report showed private employment increasing by 146k in November, missing market expectations of 165k. The growth was concentrated in service-providing sectors, which added 140k jobs, while goods-producing sectors saw a modest rise of 6k.

By establishment size, large companies led the way with 120k new jobs, while medium-sized firms added 42k. Small businesses, however, reported a loss of -17k jobs.

Pay gains saw an uptick for the first time in over two years. Job-stayers’ pay growth edged up to 4.8% yoy, while job-changers experienced a more robust 7.2% yoy increase.

ADP’s Chief Economist, Nela Richardson, highlighted the mixed industry performance, stating, “Manufacturing was the weakest we’ve seen since spring. Financial services and leisure and hospitality were also soft.” The data underscores a healthy but uneven labor market, with certain sectors and business sizes faring better than others.

BoE’s Bailey reiterates gradual approach to rate cuts

In an interview with the Financial Times, BoE Governor Andrew Bailey acknowledged that while inflation had recently dropped to target levels, there remains “a distance to travel” in managing price stability. He noted that inflation might temporarily exceed target levels again ahead.

Bailey addressed market expectations for four rate cuts next year, emphasizing that BoE’s projections are “conditioned on market rates” and highlighting the word “gradual” in their approach.

On the impact of Donald Trump’s return to the White House and the associated rise in tariffs, Bailey described the effects as “not straightforward at all.”

He explained that such policies could move traded prices but are also contingent on reactions from other countries and exchange rate adjustments, adding further uncertainty to the inflation outlook.

UK PMI services finalized at 50.8, growth stalls amid rising costs and gloomy outlook

UK services sector showed signs of slowing in November, with final PMI Services reading dropping to 50.8 from October’s 52.0, marking the weakest level in 13 months. Composite PMI similarly declined to 50.5 from 51.8, barely holding above the threshold for expansion.

Tim Moore, Economics Director at S&P Global Market Intelligence, remarked that service providers saw activity “close to stalling”. Businesses faced weaker sales pipelines, postponed projects, and heightened caution among clients, all of which curtailed growth.

Additionally, the anticipation of higher employer National Insurance contributions weighed on hiring decisions, with workforce numbers shrinking for the second consecutive month. Many firms cited margin pressures as a reason for not replacing departing staff.

Inflationary pressures intensified, with salary costs driving input price increases at the fastest pace since April. This, coupled with worries about policies outlined in the Autumn Budget, led to a “considerable reduction” in business optimism.

ECB’s Lagarde highlights Eurozone growth risks and trade vulnerabilities

Speaking at the European Parliament’s Committee on Economic and Monetary Affairs, ECB President Christine Lagarde flagged “weaker” short-term growth prospects for the Eurozone, citing slowdown in services and persistent contraction in manufacturing. Despite this, she projected a gradual recovery in consumer spending and investment as monetary tightening effects fade and real incomes improve.

Lagarde cautioned, however, that the medium-term economic outlook remains fraught with uncertainties, particularly due to elevated “geopolitical risks” and potential “trade barriers.” She emphasized that Eurozone’s deep integration into global supply chains leaves it “vulnerable to foreign shocks,” posing challenges to manufacturing and investment.

On inflation, Lagarde noted an expected temporary rise in Q4 as earlier declines in energy prices fade from annual comparisons. Beyond that, inflation is anticipated to decline toward ECB’s target next year.

Reiterating ECB’s data-driven approach, Lagarde stated, “We will review our stance again next week, following our data-dependent and meeting-by-meeting approach. We are therefore not pre-committing to a particular rate path.”

Eurozone PPI rises 0.4% mom in Oct led by rising energy costs

Eurozone PPI increased by 0.4% mom in October, aligning with market expectations. On an annual basis, PPI fell by -3.2% yoy, the anticipated -3.3% decline, reflecting mixed dynamics across sectors.

In Eurozone, Energy prices surged by 1.4% mom, driving the monthly increase, while intermediate goods prices slipped by -0.1% mom. Capital goods prices were unchanged, while durable consumer goods rose by 0.3% mom and non-durable consumer goods by 0.2% mom.

Across the EU, PPI also rose by 0.4% mom, while the annual figure showed a decline of -3.0% yoy. Among Member States, Estonia and Italy led the monthly increases with a 1.0% rise, followed by France (+0.9%) and Sweden (+0.8%). Conversely, Bulgaria experienced the sharpest decline at -2.9%, followed by Slovakia (-2.0%) and Romania (-1.5%).

Eurozone PMI composite finalized at 10-month low as stagflation concerns loom

Eurozone’s final PMI Services reading fell to 49.5 from October’s 51.6, marking a 10-month low. Composite PMI followed suit, dipping to 48.3 from 50.0, also the lowest in 10 months, indicating that the region’s private sector is contracting.

Among major economies, Ireland stood out as a bright spot with its Composite PMI hitting a 30-month high at 55.2. Conversely, Germany and France—the bloc’s economic heavyweights—reported Composite PMI levels of 47.2 and 45.9, respectively,.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, described Eurozone’s predicament as a case of “stagflation,” a challenging scenario for central bankers.

“The economy started shrinking while the PMI price components went up for the second month in a row,” he noted. Inflation pressures remain high, driven largely by the services sector, and the weaker Euro adds to concerns about rising import costs in the coming months.

ECB finds itself in a precarious position ahead of its December 12 policy meeting. While the sluggish economy could benefit from monetary easing, inflationary pressures, exacerbated by substantial wage growth in Q3, limit its room to maneuver.

De la Rubia expects ECB to avoid aggressive action, likely opting for a cautious 25bps rate cut.

Australia’s Q3 GDP expands 0.3% qoq, marking continued economic slowdown

Australia’s GDP grew by 0.3% qoq in Q3, falling short of expectations for a 0.5% qoq expansion, while annual growth reached 0.8% yoy. However, GDP per capita declined by -0.3% qoq, marking the seventh consecutive quarter of contraction.

Katherine Keenan, head of national accounts at the Australian Bureau of Statistics, remarked that “the Australian economy grew for the twelfth quarter in a row, but has continued to slow since September 2023.”

Public sector spending was the key driver of growth during the quarter, with government consumption and public investment making significant contributions.

Japan’s PMI services shows renewed growth, composite activity marginally improves

Japan’s services sector returned to growth in November, with PMI Services index finalized at 50.5, up from 49.7 in October. Composite PMI, which combines manufacturing and services activity, edged up to 50.1 from 49.6, signaling a modest overall improvement in private-sector activity.

Usamah Bhatti, Economist at S&P Global Market Intelligence, noted that the services sector experienced a “renewed upswing” as improved demand and stronger client confidence supported output and sustained new business growth. The sector’s near-term outlook appears favorable, with growth in outstanding business reaching its highest level in eight months, and optimism about the 12-month outlook remaining robust.

While the services sector drove the overall stabilization, the manufacturing sector continued to lag, with a slight contraction in production. Input cost pressures persisted across industries, contributing to higher prices for goods and services. However, businesses expressed optimism that inflationary and global uncertainties would subside, paving the way for a stronger rebound in Japan’s private sector.

China’s Caixin PMI services falls to 51.5, manufacturing boosts composite index to 52.3

China’s Caixin PMI Services dropped to 51.5 in November from 52.0, missing market expectations of 52.5, reflecting a slowdown in the sector’s expansion. However, PMI Composite rose to 52.3 from 51.9, supported by improvements in manufacturing.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted the challenges facing the economy. He noted that while the downturn appears to be “bottoming out,” the recovery requires “further consolidation.” Persistent contraction in employment underscores that the impact of economic stimulus has yet to translate into labor market gains, with businesses hesitant to expand their workforce.

Wang also stressed the importance of monitoring the “consistency and effectiveness” of additional stimulus measures. The economy continues to face “structural and cyclical pressures,” compounded by the risk of “continued accumulation of external uncertainties,” necessitating “sufficient policy buffers.”

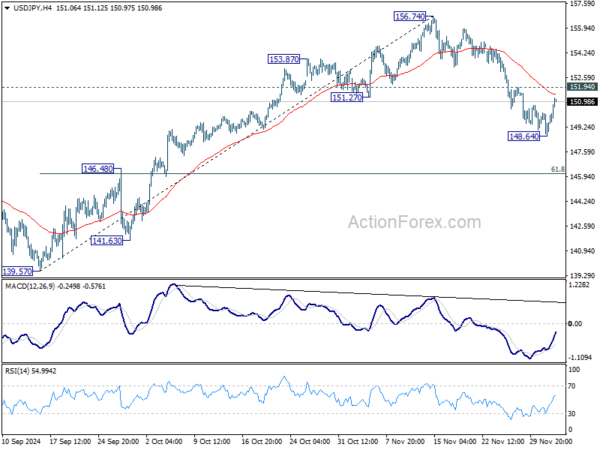

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.75; (P) 149.49; (R1) 150.34; More…

Intraday bias in USD/JPY remains neutral for the moment. On the downside, break of 148.64 temporary low will strength the case that rise from 139.57 has already completed at 156.754. Deeper fall should then be seen to 61.8% retracement of 139.57 to 156.74 at 146.12 next. Nevertheless, firm break of 151.94 resistance will revive near term bullishness and bring retest of 156.74 high.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.