Swiss Franc strengthened broadly after inflation data for November indicated a modest uptick, stabilizing after months of decline. Although the annual CPI reading missed market expectations, the stabilization reduces immediate pressure on SNB to implement a significant 50bps rate cut at its upcoming policy meeting this month.

However, uncertainty still lingers as SNB faces the challenge of balancing its decision against ECB’s rate cut on the same day. A 50bps cut from ECB could drive upward pressure on the Franc, heightening deflationary risks for Switzerland and complicating SNB’s policy considerations.

Meanwhile, Dollar and Yen, which have led currency markets this week, are retracing some gains. Traders are awaiting US JOLTs job openings data later today for potential short-term volatility. However, the focus remains on Friday’s non-farm payrolls report, a high-stakes release that could set the tone for broader market movements across stocks, bonds, and currencies.

For the week so far, Yen is now the strongest performer, trailed closely by Dollar and and then Loonie. Sterling has displaced Euro as weakest currency, with Kiwi following in third-worst position. Swiss Franc and Aussie are holding middle positions.

Australia’s Q3 GDP report in the upcoming Asia session will be a focal point for the market. Growth is expected to accelerate to 0.5% qoq. A robust reading could bolster the case for RBA to hold off on rate cuts, supporting the Aussie in the process.

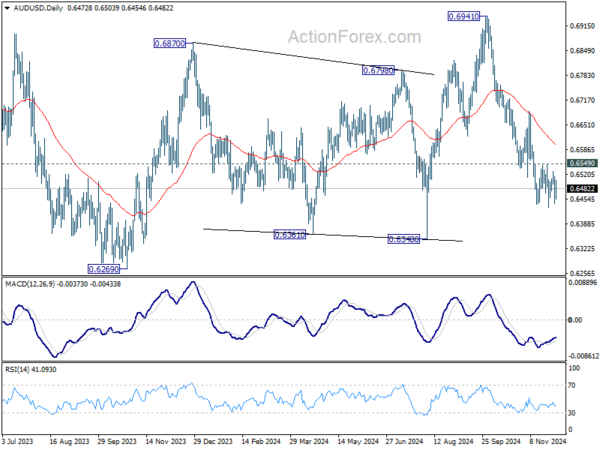

Technically, AUD/USD is staying in consolidations above 0.6433. Near term outlook remains bearish with 0.6549 resistance intact. Firm break of 0.6433 will resume the whole decline from 0.6941 to 0.6438 support next. However, firm break of 0.6549 will confirm short term bottoming, and bring stronger rebound back to 55 D EMA (now at 0.6597) and possibly above.

In Europe, at the time of writing, FTSE is up 0.89%. DAX is up 0.29%. CAC is up 0.53%. UK 10-year yield is down -0.0118 at 4.204. Germany 10-year yield is up 0.0009 at 2.037. Earlier in Asia, Nikkei rose 1.91%. Hong Kong HSI rose 1.00%. China Shanghai SSE rose 0.44%. Singapore Strait Times rose 0.93%. Japan 10-year JGB yield rose 0.0036 to 1.081.

ECB’s Cipollone: US tariffs likely to weaken both Eurozone growth and inflation

ECB Executive Board Member Piero Cipollone highlighted the potential economic implications of US tariffs on the Eurozone, emphasizing their dual impact on growth and inflation.

Cipollone noted that tariffs would weaken the Eurozone economy by reducing consumption, thereby lowering pressure on prices.

He pointed out that Chinese producers, excluded from the US market, might redirect their goods to Europe, potentially offering them at discounted prices.

On energy, Cipollone pointed out that while oil imports could become more expensive due to a stronger Dollar, US policies aimed at supporting domestic energy production could increase supply, offsetting price pressures.

“All this put together makes me think that we will have a reduction in growth but also a reduction in inflation,” Cipollone concluded.

Swiss CPI stabilizes in Nov, but remains subdued at 0.7% yoy

Switzerland’s inflation data for November showed CPI falling -0.1% mom, matching expectations and mirroring October’s pace. Core CPI, which excludes volatile items like fresh and seasonal products, energy, and fuel, was flat on a monthly basis. Price movements showed domestic products falling -0.1% mom, while imported product prices dropped -0.4% mom.

On an annual basis, CPI edged up slightly from 0.6% yoy to 0.7% yoy, stabilizing after a downward trend since May, but falling short of market expectations of 0.8% yoy. Core CPI also rose modestly from 0.8% yoy to 0.9% yoy. Domestic product prices saw a slight decline from 1.8% yoy to 1.7% yoy, while imported product prices recovered somewhat, rising from -3.1% yoy to -2.3% yoy.

USD/CHF Mid-Day Outlook

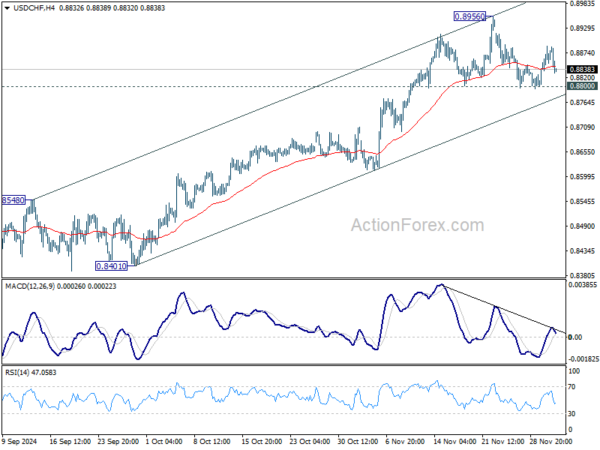

Daily Pivots: (S1) 0.8814; (P) 0.8852; (R1) 0.8903; More…

USD/CHF dips notably today but stays in established range below 0.8956. Intraday bias remains neutral at this point. With 0.8800 support intact, further rally is still in favor. On the upside, break of 0.8956 will resume the rally from 0.8374, and target 0.9223 key resistance next. However, firm break of 0.8800 will confirm short term topping and turn bias back to the downside for 55 D EMA (now at 0.8731).

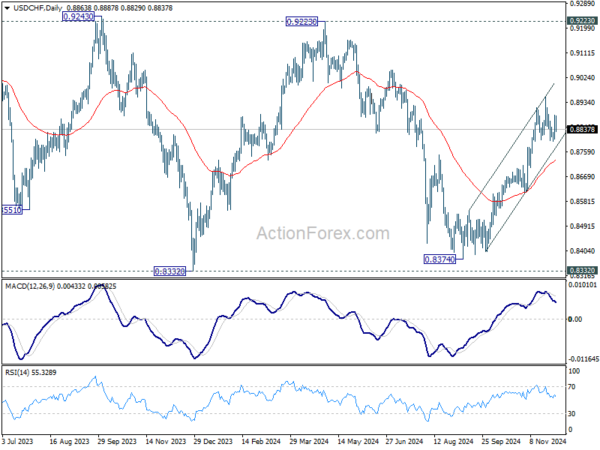

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern. Rise from 0.8374 is seen as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.