US stock futures have jumped in a relief rally following release of October US CPI data, which, while showing an uptick in headline inflation and steady core inflation, stayed within expectations. This in-line report eases fears of an inflation surprise that could disrupt Fed’s gradual easing path. Market sentiment has therefore strengthened, with Fed fund futures still pricing a 70% likelihood of a 25bps rate cut at the December FOMC meeting, indicating that the Fed’s near term rate-cut path remains intact for now.

Following the CPI release, Dollar eased across the board as risk appetite returned, although it maintains its lead as the week’s top performer. Canadian Dollar follows as the second strongest, while New Zealand Dollar rounds out the strongest three. Meanwhile, Sterling is the week’s weakest performer, overshadowed by continued caution despite comments from BoE’s top hawk. Euro and Yen also softened. Australian Dollar and Swiss Franc occupy middle ground.

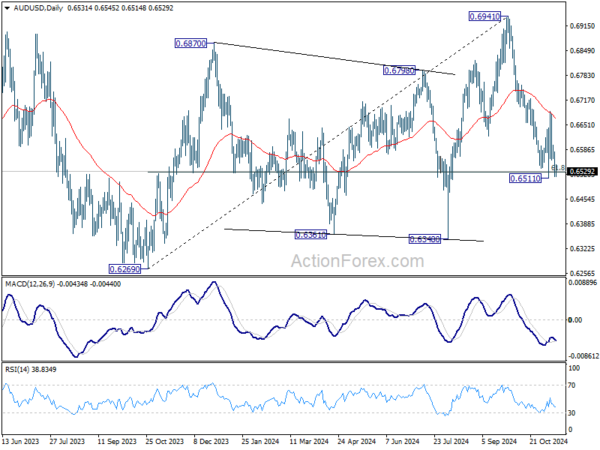

Australia’s employment data will be a major focus in the upcoming Asian session while RBA Governor Michele Bullock is scheduled to speak too. Technically, AUD/USD is so far still holding on to 61.8% retracement of 0.6269 to 0.6941 at 0.6526. But prior rejection by falling 55 D EMA is a near term bearish sign. Sustained break of 0.6526 will extend the fall from 0.6941 towards 0.6269/6348 support zone.

In Europe, at the time of writing, FTSE is down -0.06%. DAX is down -0.38%. CAC is down -0.37%. UK 10-year yield is down -0.0419 at 4.469. Germany 10-year yield is up 0.006 at 2.375. Earlier in Asia, Nikkei fell -1.66%. Hong Kong HSI fell -0.12%. China Shanghai SSE rose 0.51%. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield rose 0.0323 to 1.042.

US CPI rises to 2.6% yoy in Oct, core CPI unchanged at 3.3% yoy

US CPI rose 0.2% mom in October while core CPI (ex food and energy) rose 0.3% mom, matched expectations. The index for shelter rose 0.4 mom, accounting for over half of the monthly all items increase. Food index increased 0.2% mom. Energy index was unchanged.

Over the last 12 months, CPI accelerated from 2.4% yoy to 2.6% yoy, matched expectations. Core CPI was unchanged at 3.3% yoy. Energy index decreased -4.9 yoy. Food index increased 2.1% yoy.

BoE’s Mann advocates ‘activist’ approach as inflation not yet been vanquished

BoE MPC member Catherine Mann reiterated her hawkish stance on inflation during a panel discussion today, emphasizing the need for an “activist” approach to monetary policy. Mann expressed that she prefers to wait for more concrete evidence of underlying inflationary pressures easing before considering any policy loosening.

She highlighted the significance of monetary policy’s immediate effects on the economy, stating, “Part of my activist strategy is when I move, I will move big.”

Mann underscored that while the traditional view of long policy lags—the “olden day story,” as she referred to it—still holds some relevance, recent research indicates that rate adjustments can have prompt impacts on firms’ pricing decisions and inflation expectations.

As BoE’s most hawkish member, Mann maintained her cautious perspective on the inflation outlook. She pointed out the persistence of “pretty sticky” services inflation and cautioned about the potential for increased volatility in prices. “For those two reasons I say that inflation has not yet been vanquished,” she concluded.

ECB’s Nagel defends rate path, warns of 1% economic hit from Trump tariffs

In an interview with Die Zeit, German ECB Governing Council member Joachim Nagel reinforced ECB’s current rate path as necessary, citing persistent inflationary pressures, particularly within the services sector due to rising wages.

Nagel emphasized, “We are not exaggerating. There is still noticeable price pressure” .

Nagel also voiced concern over economic fallout from US President-elect Donald Trump’s proposed tariffs, estimating they could trim as much as 1% from Germany’s economic output if enacted.

“If the new tariffs actually materialize, we could even slip into negative territory,” he warned, a worrisome prospect as Germany already faces weak growth projections.

The German economy is anticipated to stagnate through 2024, with growth in 2025 expected to remain below 1%.

ECB’s Villeroy sees more rate cuts as US inflation risks resurface under Trump

French ECB Governing Council member Francois Villeroy de Galhau shared his outlook on inflation and global growth risks today with France Inter, suggesting a period of moderate inflation within France alongside more rate cuts from ECB. He also projected that France’s unemployment rate could temporarily increase to around 8% before stabilizing back to 7%.

Villeroy raised concerns over the inflationary impact of US President-elect Donald Trump’s proposed economic policies, specifically warning that Trump’s program “risks bringing back inflation to the United States.” He suggested this could slow global growth, although the full extent of this impact remains uncertain and could vary between the US, China, and Europe.

A particular focus of Villeroy’s remarks was on Trump’s proposed tariffs, which aim to eliminate the US trade deficit by imposing a 10% or higher tax on all imported goods.

Villeroy argued that such protectionist policies could ultimately hurt US consumers, noting, “Protectionism almost always means reduced purchasing power for consumers.”

Japan’s PPI rises 3.4% yoy in Oct, highest since mid-2023

Japan’s PPI rose from 3.1% yoy to 3.4% yoy in October, surpassing market expectations of 3.0% and marking the highest annual increase since July 2023. On a monthly basis, PPI advanced by 0.2%, reflecting sustained inflationary pressure within Japan’s production sector.

The data also revealed a less pronounced decline in Yen-based import prices, down -2.2% yoy compared to a -2.5% drop in September, signaling that import costs may be stabilizing. This relative improvement aligns with a 4.3% mom increase in Yen’s exchange rate. However, on a monthly scale, import prices saw a notable 3.0% rise after a -2.8% decrease in September.

Australia’s wage growth slows as public sector outpaces private for first time since 2020

Australia’s wage growth softened in Q3, with the Wage Price Index rising by 0.8% qoq, slightly missing the forecast of 0.9%. On an annual basis, wage growth slowed from 4.1% yoy to 3.5% yoy, falling short of the expected 3.6% yoy and marking the lowest annual increase since Q4 2022. This deceleration follows four consecutive quarters of 4% or higher wage growth, pointing to easing in wage-driven inflation pressures.

For the first time since late 2020, public sector wage growth surpassed that of the private sector. Public sector wages rose by 3.7% yoy, higher than the 3.5% yoy recorded in the same quarter last year but down from the recent high of 4.2% yoy in Q4 2023, lowest since Q3 2022.

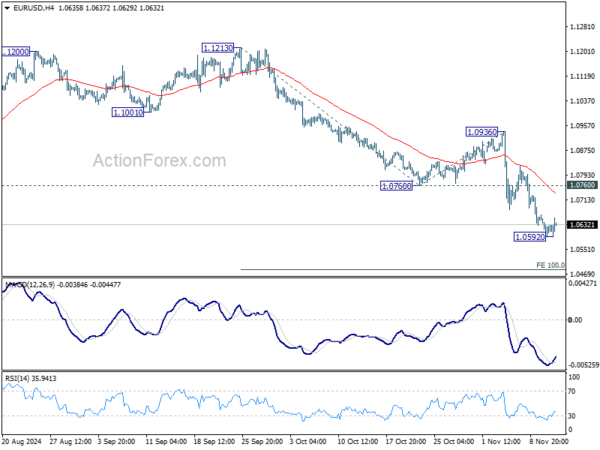

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0591; (P) 1.0627; (R1) 1.0659; More…

Intraday bias in EUR/USD is turned neutral first with current recovery. But further decline is expected as long as 1.0760 support turned resistance holds. Break of 1.0592 temporary low will resume the fall from 1.1213 to 100% projection of 1.1213 to 1.0760 from 1.0936 at 1.0483.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.