Dollar saw broad-based weakness in early US session following a much weaker-than-expected non-farm payroll report. Headline job growth came in well below forecasts, though market reaction remains tempered, as the data is widely believed to be heavily skewed by recent hurricanes and strikes. With unemployment rate holding steady and wage growth surpassing expectations, the underlying labor market still appears resilient. While this report slightly adjusted market expectations, there remains a near 95% probability of a 25 bps rate cut by Fed next week.

In terms of weekly currency performance so far, Euro remains firmly in the lead. Yen has climbed to second place, benefiting from a post-NFP decline in US Treasury yields. Swiss franc ranks third, though its performance was dampened by weaker-than-expected inflation data, solidifying the chance of another SNB rate cut in December. Aussie remains at the bottom of the chart, followed closely by the Loonie. Sterling, despite a sharp drop on the UK budget news, managed to regain some ground and now ranks as the third weakest. Dollar and Kiwi are positioned mid-range.

In Europe, at the time of writing, FTSE is up 0.90%. DAX is up 0.65%. CAC is up 0.76%. UK 10-year yield is down -0.033 at 4.401. Germany 10-year yield is down -0.017 at 2.373. Earlier in Asia, Nikkei fell -2.63%. Hong Kong HSI rose 0.93%. China Shanghai SSE fell -0.24%. Singapore Strait Times fell -0.10%. Japan 10-year JGB yield rose 0.004 to 0.945.

US NFP grows only 12k in Oct, unemployment rate steady at 4.1%

US non-farm payroll employment grew only 12k in October, well below expectation of 106k. That compares to average monthly gain of 194k over the prior 12 months.

Nevertheless, unemployment rate was unchanged at 4.1%, matched expectations. number of unemployed people was little changed at 7.0m. Participation rate ticked down from 62.7% to 62.6%.

Average hourly earnings rose 0.4% mom, above expectation of 0.3% mom. Annual growth of average hourly earnings ticked up from 3.9% yoy to 4.0% yoy.

UK PMI manufacturing finalized at 49.9, wait-and-see ahead of budget

UK’s PMI Manufacturing was finalized at 49.9 for October, down from September’s 51.5, marking the first contraction since April.

Rob Dobson, Director at S&P Global Market Intelligence, noted that the sector has entered Q4 on an “uncertain footing,” as businesses adopt a wait-and-see approach amid policy speculation leading up to the recent Budget. This cautious stance has weighed on investment and spending, with business optimism hovering just above September’s nine-month low.

However, there was positive news on inflation. Input costs dropped to a 10-month low, with inflation easing significantly—one of the largest declines in the survey’s 33-year history. Selling price inflation also moderated, giving BoE additional flexibility to support growth should demand weaken further.

Looking forward, Dobson noted that November’s PMI release will be closely watched for signs of how the Budget impacts business conditions and confidence level.

Swiss CPI down further to 0.6% yoy in Oct

Switzerland’s CPI decreased by -0.1% mom in October, missing expectations of flat growth. Core CPI, which excludes fresh and seasonal products, energy, and fuel, edged up by 0.1% mom. Prices for both domestic and imported products each declined by -0.1% month-over-month.

On an annual basis, headline CPI dropped to 0.6% yoy from 0.8% yoy, falling short of the anticipated 0.8% yoy increase. Core CPI similarly softened, slipping from 1.0% yoy to 0.8% yoy. Domestic product prices grew at a slower pace, declining from 2.0% yoy to 1.8% yoy, while imported product prices saw a deeper contraction, from -2.7% yoy to -3.1% yoy.

Japan’s PMI manufacturing finalized at 49.2, weak domestic and global demand

Japan’s PMI Manufacturing was finalized at 49.2 in October, a decline from September’s 49.7, signaling continued contraction in the sector.

Usamah Bhatti at S&P Global Market Intelligence noted that while output fell only slightly, it was at the sharpest rate since April, with new orders contracting at their fastest pace in three months. Companies cited “weakness in domestic and global demand” as weighing heavily on sales and output, particularly in the semiconductor and auto industries.

Bhatti added that “near-term outlook is clouded” as firms worked through backlogs, suggesting that incoming orders are insufficient to support ongoing production. Business confidence also remained subdued, hovering near a two-year low, with firms expressing concerns about the timeline for recovery from the current “economic malaise.”

China’s Caixin PMI manufacturing rises to 50.3, domestic demand recovery amid weak exports

China’s Caixin Manufacturing PMI improved to 50.3 in October, up from 49.3 and surpassing expectations of 49.5.

According to Wang Zhe, Senior Economist at Caixin Insight Group, October brought a mix of positive developments, including “growth in manufacturing supply and demand, increases in prices, proactive inventory replenishment by companies, and logistics delays.”

However, challenges persist as external demand remains soft; new export orders contracted for the third consecutive month. Wang added that declining employment levels and weak foreign demand continue to weigh on the sector.

EUR/USD Mid-Day Outlook

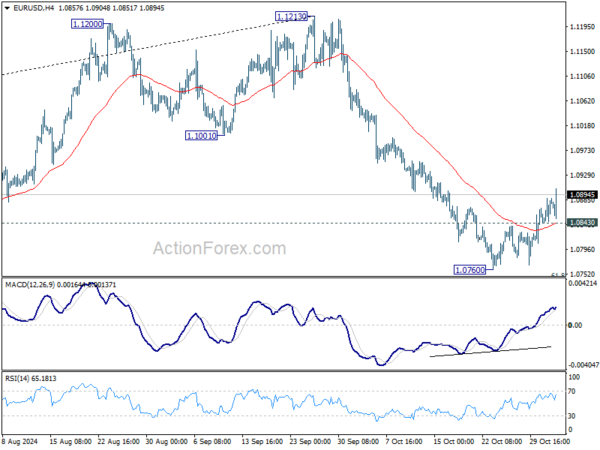

Daily Pivots: (S1) 1.0856; (P) 1.0872; (R1) 1.0900; More…

EUR/USD’s rebound from 1.0760 short term bottom continues today and intraday bias stays on the upside for 55 D EMA (now at 1.0945). Strong resistance should be seen there to limit upside. On the downside, below 1.0843 minor support will turn intraday bias back to the downside. Sustained break of 61.8% retracement of 1.0447 to 1.1213 at 1.0740 will extend the fall from 1.1213 to 1.0601 support next.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.