Risk sentiment in Asia was mixed today. Japan’s Nikkei 225 index extended its rally and broke above the 40k mark for the first time in three months. This momentum firstly follows another record close on Wall Street overnight. Secondly, contributing to the optimism are growing expectations that BoJ may hold off on implementing another rate hike by the end of the year. The latest Reuters poll indicates that a slim majority—25 out of 49 economists surveyed—expect BoJ to maintain its current policy rate at 0.25% through December. Nevertheless, tightening is going to continue, with 87% of respondents, or 39 out of 45, anticipate a rate increase to 0.50% by the end of Q1 next year.

In contrast, equities in Hong Kong and mainland China are struggling. Unconfirmed media reports suggest that China might raise an additional CNY 6 trillion (approximately USD 820 billion) through treasury bonds over the next three years to bolster its slowing economy with fiscal stimulus. The proposed funds are intended to assist local governments in resolving off-the-books debts. However, the absence of official confirmation has left investors uneasy. Investors are clearly dissatisfied with the lack of concrete information, causing hesitation in committing to positions in Chinese assets.

In the currency markets, Dollar remains the strongest performer so far this week, although its momentum is moderate. Notably, USD/JPY pair is grappling with the psychological barrier at the 150 level. Traders are cautious that breaching this threshold could trigger intensified verbal intervention from Japanese authorities, aiming to prevent excessive Yen depreciation. British Pound is currently the second strongest, with market attention focused on this week’s key UK economic data releases, starting with today’s employment and wage growth figures. Canadian Dollar ranks third in strength, ahead of Canada’s CPI release today. On the weaker side, Swiss Franc leads the decline, followed by Australian Dollar and New Zealand Dollar. Euro and Japanese Yen are occupying middle positions.

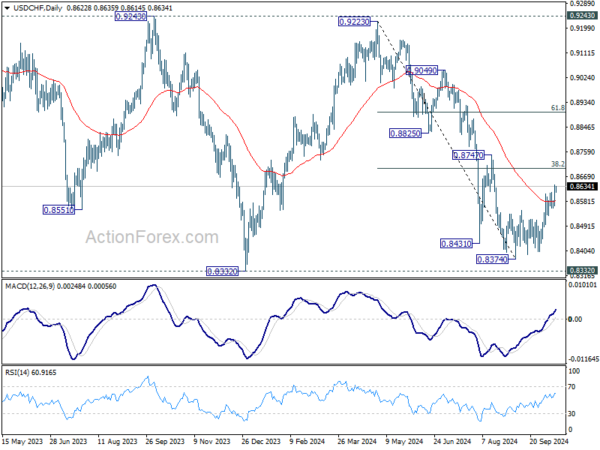

Technically, as USD/CHF’s rebound from 0.8374 short term bottom extends, focus is now on 38.2% retracement of 0.9223 to 0.8374 at 0.8698. Sustained break there will argue that fall from 0.9223 has completed after defending 0.8332 low. The term trend should have reversed in this case, targeting 61.8% retracement at 0.8899 and above.

In Asia, at the time of writing, Nikkei is up 1.26%. Hong Kong HSI is down -1.55%. China Shanghai SSE is down -0.84%. Singapore Strait Times is up 0.30%. Japan 10-year JGB yield is up 0.0167 at 0.969.

Overnight, DOW rose 0.47%. S&P 500 rose 0.77%. NASDAQ rose 0.87%. 10-year yield rose 0.0250 to 4.098.

Fed’s Waller advocates for caution in policy easing amid solid economic conditions

In a speech overnight, Fed Governor Christopher Waller provided noted that recent economic data has been “uneven,” with both positive signals and areas of concern, but emphasized that the US economy remains on “solid footing.” Employment is near the Fed’s maximum objective, and inflation is approaching the target, despite some disappointing recent inflation figures.

In light of this, Waller expressed caution about the pace of monetary easing, noting that while the September 50bps cut was necessary, the Fed should now proceed with “more caution on the pace of rate cuts.” He reaffirmed his view that the Fed would reduce the policy rate “gradually over the next year.”

Looking ahead, Waller’s baseline forecast still calls for a gradual reduction in the policy rate over the next year. However, he acknowledged uncertainty about the “final destination” for interest rates, with projections for the long-run federal funds rate varying significantly among Fed officials. The range extends from 2.4% to 3.8%, with the median estimate sitting at 2.9%.

While much of the market focus is on the size of rate cuts in the near term, Waller pointed out that the “larger message” from Fed’s economic projections is the extent of policy tightening that still needs to be reversed. If the economy continues its current stable performance, Waller expects that easing will occur gradually over time.

Cryptocurrencies surge amid optimism over US regulatory outlook post-election

Cryptocurrencies rallied overnight on growing optimism that regulatory environment for digital assets in the US may improve following the upcoming presidential election in November. This boost in sentiment was initially driven by a rise in Donald Trump’s standing in prediction markets and some polls, as he is perceived to be more pro-crypto compared. Later, the market received another push after Kamala Harris’ campaign made supportive comments, pledging to support a regulatory framework for cryptocurrencies.

Technically, however, Bitcoin is still stuck in medium term consolidation pattern from 73012 (March high). The range is pretty much set between 50% retracement of 24896 to 37812 at 49354, i.e. between 49k and 74k in short.

Further near term rise is in favor as long as 58846 support holds. Break of 66854 will target a test on 73812 high. However, there is so far no indication of sustainable momentum through to new record.

Ethereum’s outlook is worse. Current bounce might be just a leg of the consolidation pattern from 2084.52 low. Further decline will remain in favor as long as 2797.60 resistance holds. Break of 20845.71 will resume the larger down trend from 4092.55 (March high).

Looking ahead

UK employment data is the main focus in European session. Germany will publish ZEW economic sentiment while Eurozone will release industrial production.

Later in the day, Canada CPI will take center stage while US Empire State manufacturing index will also be featured.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3035; (P) 1.3054; (R1) 1.3077; More…

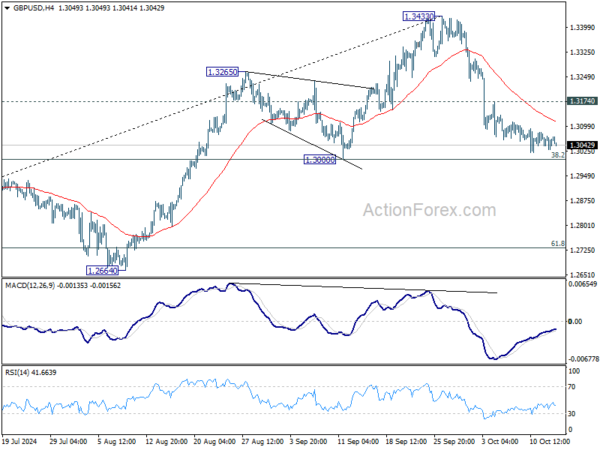

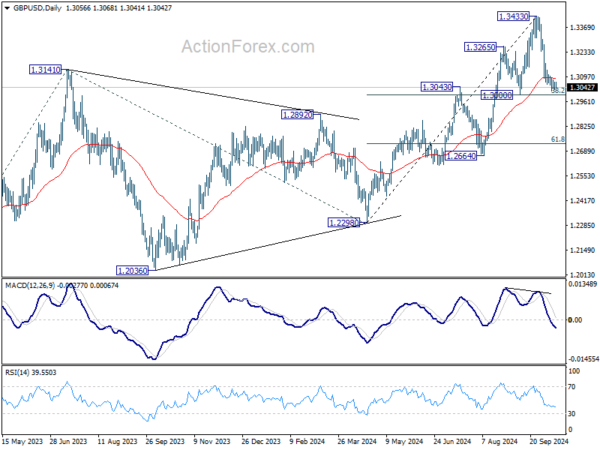

Outlook in GBP/USD remains unchanged and intraday bias stays neutral first. Strong support should be seen from 1.3000 cluster support (38.2% retracement of 1.2298 to 1.3433 at 1.2999) to complete the correction from 1.3433. On the upside, break of 1.3174 minor resistance will turn bias back to the upside for retesting 1.3433. However, sustained break of 1.3000 will carry larger bearish implications and target 61.8% retracement at 1.2732.

In the bigger picture, as long as 1.3000 support holds, the up trend from 1.0351 (2022 low) is still in progress. Next target is 61.8% projection of 1.0351 to 1.3141 from 1.2298 at 1.4022. However, considering mild bearish divergence condition in D MACD, decisive break of 1.3000 will argue that a medium term top is already in place, and bring deeper fall back to 1.2664 support next.