Dollar is gaining some traction, emerging as the strongest currency of the week so far. Several factors are underpinning this momentum. First, Fed Chair Jerome Powell has reaffirmed the expectation of two additional rate cuts this year, adhering to the script established in the latest dot plot. This stance has tempered market speculation about another aggressive 50bps cut at the upcoming November meeting.

Second, a chorus of ECB officials is aligning with market expectations for a 25bps rate cut this month. Notably, even a top hawkish member have shifted her tone to express increased concern over economic growth. This collective dovishness adds downward pressure on Euro. Third, Japan’s new Prime Minister has softened his previously hawkish stance on monetary policy. In a significant turnaround, he has indicated support for BoJ be cautious regarding any additional rate hikes. This shift has weighed heavily on Yen, making it the weakest performer among major currencies this week.

For now, fed fund futures are still seeing 36% chance of a 50bps Fed cut on November 7, and 64% chance of 25bps. The most critical data would be tomorrow’s non-farm payrolls, but a slight miss in headline job growth might not be able to alter Fed officials’ minds. Today’s ISM services will carry some weight too, and Fed would hope that services activities are not deteriorating too much.

Elsewhere, Swiss CPI data due today will also be important. New SNB Chair Martin Schlegel has warned earlier in the week that downside risks to inflation is “definitely” higher than upside risks. He even emphasized that SNB won’t rule out negative interest rate should deflation risk materializes. Swiss CPI is expected to be unchanged at 1.1% in September and any downside surprise would add to the case of another 25bps rate cut in December.

Overall in the currency markets, Loonie is the second strongest for the week at this point, following Dollar, as underpinned by rebound in oil prices. Aussie is currently the third best, but started to lose momentum as the boost from China’s stimulus measures is fading. On the other hand, Yen is the worst performer for the week, followed by Kiwi, and then Swiss Franc. Euro and Sterling are positioned in the middle.

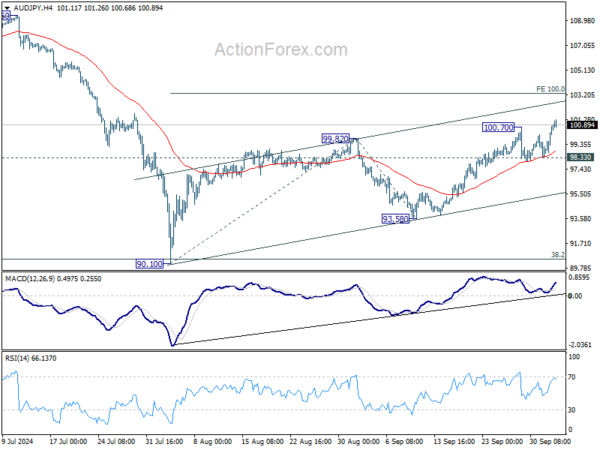

Technically, AUD/JPY’s near term rally resumed by breaking through 100.70 temporary top. Further rise is now expected as long as 98.33 support holds, towards 100% projection of 90.10 to 99.82 from 93.58 at 103.30. However, as the rebound from 90.10 is seen as the second leg of the medium term consolidation pattern from 109.36, AUD/JPY should start to lose momentum above 103.30. Strong resistance should emerge below 109.36 high to bring near term reversal.

In Asia, at the time of writing, Nikkei is up 2.24%. Hong Kong HSI is down -4.14%. China is still on holiday. Singapore Strait Times is down -0.10%. Japan 10-year JGB yield is up 0.014 at 0.834. Overnight, DOW rose 0.09%. S&P 500 rose 0.01%. NASDAQ rose 0.08%. 10-year yield rose 0.042 to 3.785.

BoJ’s Noguchi urges patience before Japan’s inflation mindset shifts

BoJ Board Member Asahi Noguchi, a known dovish, emphasized in a speech today that Japanese society still needs “considerable time” to go before fully adopting a mindset aligned with the central bank’s 2% inflation target. Noguchi highlighted the importance of BoJ maintaining its accommodative monetary policy until this shift in mindset occurs.

With inflation surpassing the 2% target for over two years and nominal wages rising, Japanese firms are increasingly willing to pass on higher costs through price hikes. However, Noguchi highlighted that real consumption remains weak, as households continue to expect low price growth—a mindset shaped by Japan’s prolonged deflationary period.

Japan’s PMI services finalized at 53.1, composite at 52.0

Japan’s services sector continued its expansion in September, although growth eased slightly. The final Services PMI was recorded at 53.1, down from 53.7 in August, marking a sustained rise in business activity for all but one of the past 25 months. Composite PMI, which includes both services and manufacturing, stood at 52.0, down from 52.9 in August, remaining above the 50-neutral threshold for the third consecutive month.

Usamah Bhatti, economist at S&P Global Market Intelligence, highlighted that the service sector’s strong performance carried into the end of Q3. The average reading for Q3 (53.5) was largely in line with Q1’s average of 53.4, signaling “sustained growth” in the service economy.

However, the manufacturing sector continued to struggle, weighing on overall private sector performance. While service sector remains a pillar of growth, aggregate new business growth slowed in September, and backlogs of work fell for the fifth consecutive month. The outlook for the wider private sector will depend on how the service economy responds to downside risks, including a stagnating economy.

Fed’s Barkin flags risk of inflation getting stuck

In the remarks overnight, Richmond Fed President Thomas Barkin expressed that he’s still “more concern about inflation” than the labor market. He added due to solid demand and renewed labor market tightness, there are challenges in completing the “last mile” of of the inflation fight.

While Barkin dismissed the notion of a “big resurgence” in inflation, he acknowledged the “very real risk” of inflation “getting stuck”.

He stated that he would be optimistic if, by Q1, inflation continued to show signs of stabilization, which would allow Fed to consider moving back to a “neutral” policy stance.

However, Barkin made it clear that “normalization comes when you’re convinced that inflation hits 2%.” He remains “open-minded” on how quickly rates could fall, leaving room for flexibility depending on future inflation data.

ECB’s hawk Schnabel turns attention from inflation to rising growth risks

ECB Executive Board member Isabel Schnabel, widely known for her hawkish stance, has shifted her tone, adding to growing signals from other officials that the central bank is preparing for a 25bps rate cut this month.

Schnabel acknowledged in a speech overnight the “headwinds to growth,” pointing to weakening labor demand and progress in disinflation. She noted that a “sustainable fall of inflation back to our 2% target in a timely manner is becoming more likely,” despite persistent inflation in services and strong wage growth.

Schnabel also highlighted that while the peak impact of monetary tightening is likely behind us and real incomes are rising, the recovery remains fragile. “Growth remains shallow,” she said, with the recovery repeatedly falling short of expectations over the past 18 months.

In separate remarks, Governing Council member Mario Centeno, a known dove, warned of the “new risk” of inflation undershooting the ECB’s target.

Centeno cautioned that this could “stifle economic growth,” leading to fewer jobs and reduced investment. A sluggish economy, he said, could create a “vicious cycle,” further driving inflation below the target and compounding economic challenges.

Looking ahead

Swiss CPI is a main focus in European session. Eurozone will release PPI and PMI services final. UK will also publish PMI services final. Later in the day, US ISM services will take center stage, while jobless claims and factory orders will also be featured.

USD/JPY Daily Outlook

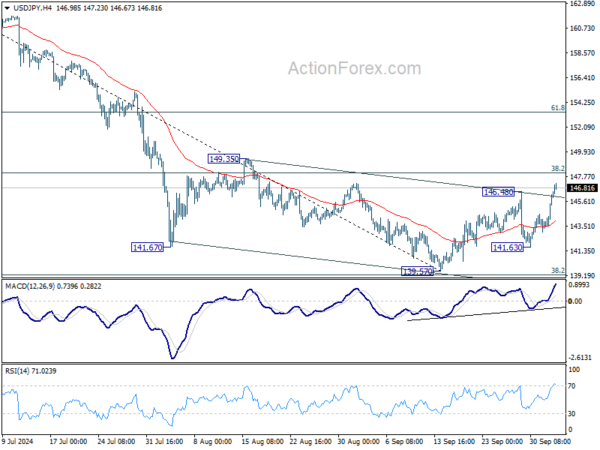

Daily Pivots: (S1) 144.41; (P) 145.47; (R1) 147.51; More…

USD/JPY’s rebound from 139.57 short term bottom resumed by breaking through 146.47 resistance. Intraday bias is back on the upside for 38.2% retracement of 161.94 to 139.57 at 148.11. Decisive break there will argue that whole fall from 161.95 has completed ahead of 139.26 fibonacci level, and bring further rally to 61.8% retracement at 153.39. For now, risk will stay on the upside as long as 141.63 support holds, in case of retreat.

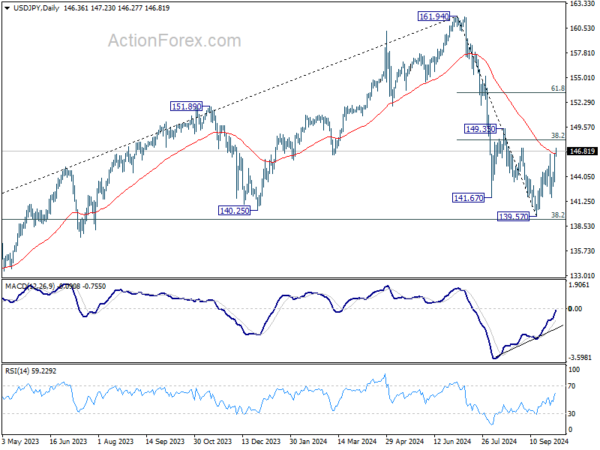

In the bigger picture, fall from 161.94 medium term top is seen as the first leg of the correction to whole up trend from 102.58 (2021 low). Strong support could be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to contain downside, at least on first attempt. Firm break of 149.35 resistance will indicate that the second leg has started. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.