It’s been a ride today between a mixed non-farm payrolls report and Fed commentary.

With the cards now all on the table, the market is shifting away from 50 basis points. Odds are down to 23% from as high as 57% in the immediate aftermath of the jobs report.

At the same time, there are 70 bps priced in for the November 7 meeting and 112 bps for year end. That highlights a very high probability of at least one 50 bps in the months ahead.

For now though, the only thing that matters to the market is the upcoming meeting and the risk aversion in stock markets is leading to a dollar bid. That’s despite Treasury yields down 4-9 bps across the curve (with the front end leading). The message there is that if the Fed doesn’t cut 50 now, it will have to cut more later.

In theory, that should hurt the US dollar but the market is more focused on the flight to safety right now, particularly the commodity currencies. Some of that may be tied to the weakening of the AI trade with NVDA down another 5.3% today and Broadcom down almost 10% after earnings.

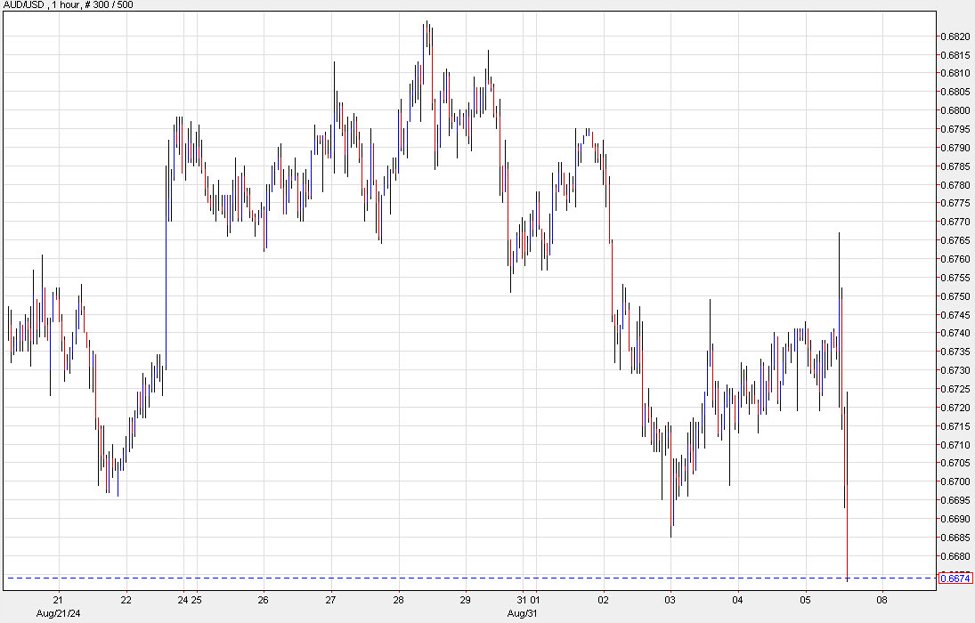

With that, the commodity currencies are particularly soft and the Aussie is down 1%.

AUD/USD 1 hour