Fundamental

Overview

The USD yesterday was sold across

the board following the soft US

CPI report. The data made the market to price back in two cuts for this

year. Later in the day though we got a bit more hawkish than expected FOMC

decision where the dot

plot showed that the Fed sees just one cut for this year despite the soft

US CPI report.

This gave the greenback a boost,

but Fed Chair Powell backpedalled

on the projections making them a bit less worrying as the central bank remains

very data dependent. So, all in all, the US Dollar might still come under

pressure as the risk sentiment should improve thanks to the soft US CPI.

The AUD, on the other hand,

has been supported by a slightly more hawkish RBA and the positive risk

sentiment due to the pickup in global growth. Moreover, the pickup in China’s

economy is generally good news for the Aussie as well as it’s Australia’s

biggest trading partner.

Today, we also got a good Australian

labour

market report which doesn’t change anything for the RBA but should still

keep the currency supported in case we go back into risk-on.

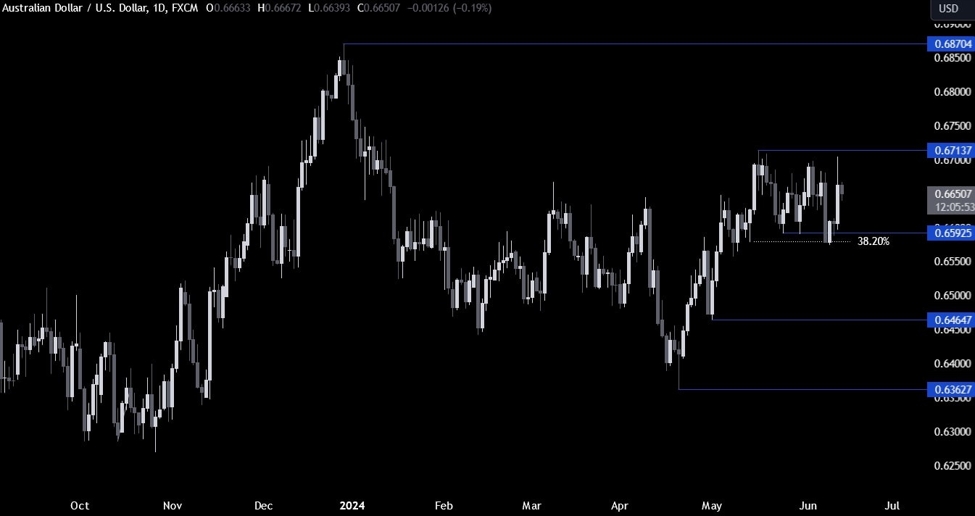

AUDUSD

Technical Analysis – Daily Timeframe

AUDUSD Daily

On the daily chart, we can

see that AUDUSD spiked into the top of the range around the 0.67 handle following

the US CPI release. The sellers stepped in with a defined risk above the resistance

to position for a drop back into the bottom of the range. The buyers will want

to see the price breaking above the resistance to gain even more conviction and

start targeting the 0.6870 level.

AUDUSD Technical Analysis – 4 hour Timeframe

AUDUSD 4 hour

On the 4 hour chart, we can

see more clearly the rangebound price action between the 0.67 resistance and

the 0.66 support. The price at the moment is right in the middle of the range,

so from a risk management perspective there’s not much to do here although if

the momentum were to change on the lower timeframe, we could see the bullish

sentiment picking up steam.

AUDUSD Technical

Analysis – 1 hour Timeframe

AUDUSD 1 hour

On the 1 hour chart, we can

see more clearly the spike on the US CPI release and the pullback on the more

hawkish than expected FOMC decision. If the price were to break above the blue

line around the 0.6667 level, the bullish momentum will likely pick up and we

might see a rally back into the top of the range. The red lines define the average

daily range for today.

Upcoming

Catalysts

Today we have the US PPI and the latest US Jobless Claims

figures. Tomorrow, we conclude the week with the University of Michigan

Consumer Sentiment survey.