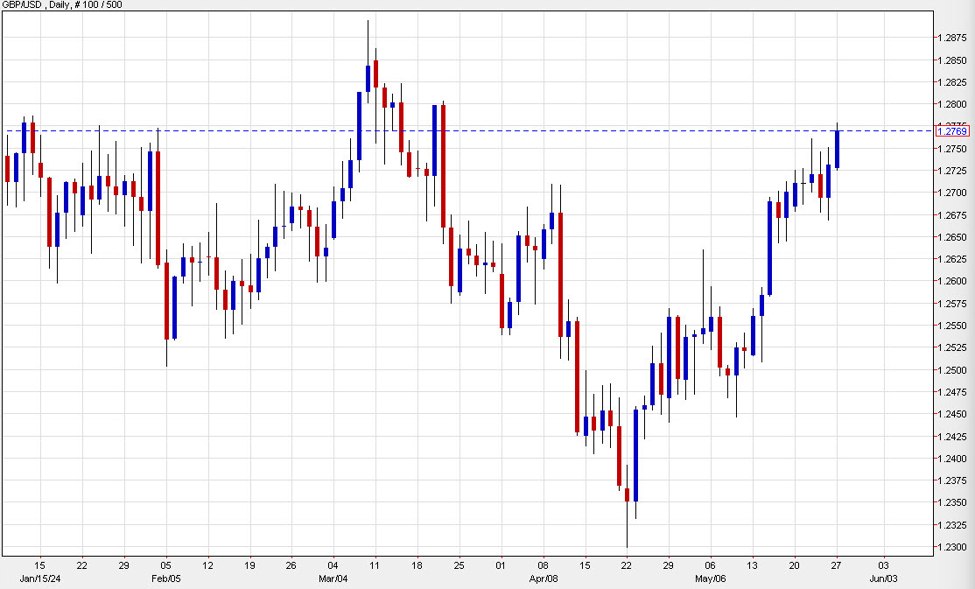

GBPUSD daily

Any time there is an election, it adds some uncertainty to a currency. Normally in G7 currencies, that volatility is small because (in the bigger picture) the stakes for elections are low. Yes, politics shape a country over generations but the market prices in those changes at a glacial pace.

In the case of the UK, the stakes are especially low and that’s because the market has long assumed a Labour win in the election. Certainly, it’s come a few months earlier than forecast but that hardly matters and the betting-market numbers tell the story: Conservatives are 13/1 to get the most seats with Labour at 2/17. Labour is 1/8 to get an overall majority.

There will be some hand-wringing about campaign promises but no one is pricing in mandatory military service or any earth-shattering changes to the economy.

As for today’s price action, the pound is up but that’s mostly about USD weakness and risk appetite. The pound is trailing the commodity currencies.