The move to the upside continues and the major indices are not on pace to all close at record levels today.

- Dow record high close coming into the day was at 39807.38. The index is up 274 points at 39832 currently.

Both the Nasdaq and S&P closed at record levels yesterday. ANything positive today would be a new record close.

- S&P is up 56.29 points or 1.07 % at 5302.60

- Nasdaq is up 223 points or 1.35% at 16733.09

For the trading year:

- Dow Industrial Average is up 5.69%.

- S&P index is up 11.15%

- NASDAQ index is up 11.44%

Yields are lower today with the 2-year down -7.8 basis points at 4.740%. The 10-year yield is down -8.9 basis points at 4.355%.

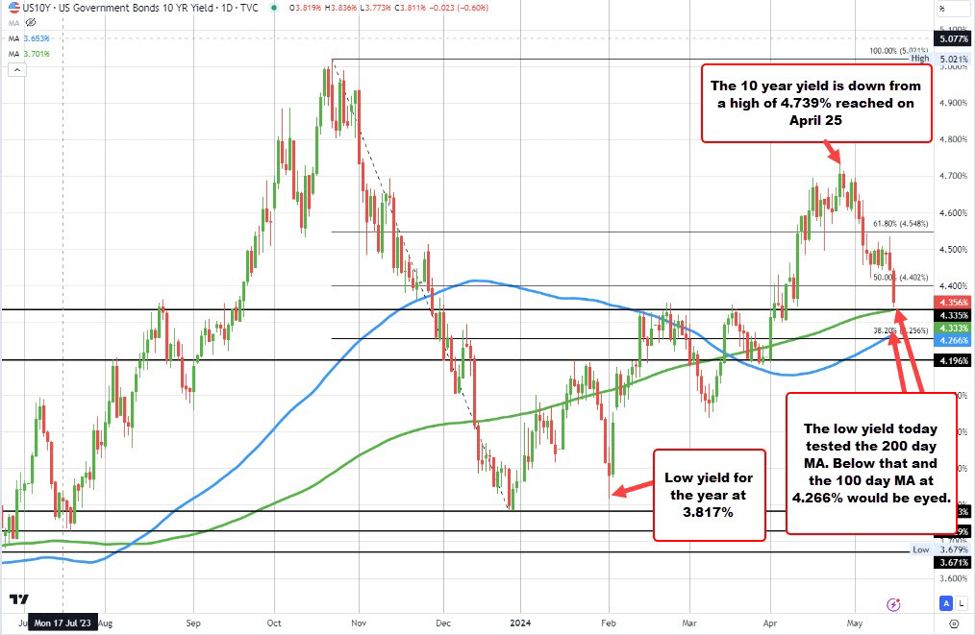

Looking at the 10-year yield below, it is trading at its lows levels going back to April 10, and at session lows today, the yield tested its key 200-day moving average of 4.333% (see green line on the chart below).

A move below that moving average level would be the first decline below the level since April 1. The low 10-year yield for 2024 was at 3.817% reached on February 1, 2024.

US 10 year yield tests 200 day moving average

The US 10 year rate is instrumental in setting the 30 year US mortgage rate. The 30 year mortgage rate in the weekly mortgage data released earlier today came in at 7.08% down from 7.18% last week. Looking at the chart below, that rate is still above the highs prior to the more recent move higher over the last few years near 7.00%. The high range from 2005 to 2008 was between 5.5% and 7.0%.

30 year mortgage rate

Meanwhile in Europe today,:

- Germans Dax closed at a record high level

- France CAC, closed at a record high level

- UK FTSE 100 closed at a record high level

- Spain’s Ibex closed at the highest level since July 2015

- Italy’s FTSE MIB closed at a record level