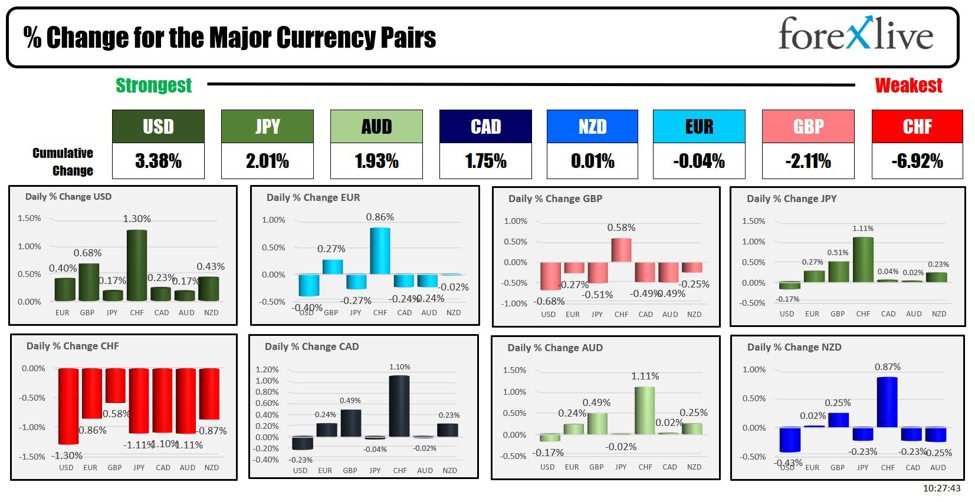

THe USD has moved to new highs vs a number of the major currencies. It is not the strongest of the major currencies:

The USD is now the strongest of the major currencies

Helping is a move higher in rates, but also some better data in the US including continued jobless claims data, existing home sales, and Philly Fed.

In the US debt market, rates are back in positive territory after moving lower earlier.

- 2-year yield 4.625%, +2.2 basis points

- 5-year yield 4.253% +1.1 basis points

- 10 year yield 4.272%, +0.2 basis points

- 30-year yield 4.445%, -1.0 basis points

Looking at some of the major currency pairs:

- EURUSD: The EURUSD price has not moved below it 100 hour moving average 1.08812 and is about they are testing the 38.2% retracement of the move-up from the February low at 1.08712. That level was also the low price from last week. It was also the high price from yesterday before the FOMC rate decision pushed the price sharply to the upside and above that level.

EURUSD retests the 38.2% of the move up from the Feb low

- GBPUSD: THe GBPUSD has extended lower in the US session and has pushed away from its 100-bar moving average on the 4-hour chart at 1.27348, and the 100-hour moving average at 1.27319. The 50% midpoint of the move-up from the February low was also broken at 1.2705 and is now close risk for sellers looking for more than the momentum. The next target comes against the low from yesterday at 1.2683 followed by the rising 200 bar moving average on the 4-hour chart at 1.2676.

GBPUSD extends to new settlors

This article was originally published by Forexlive.com. Read the original article here.